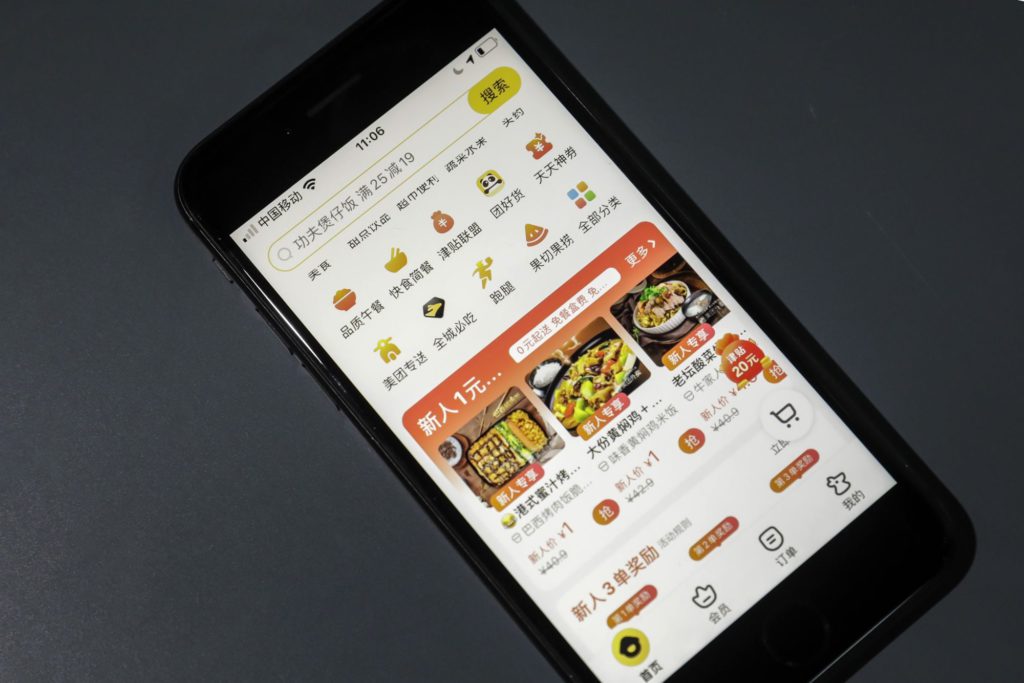

(Bloomberg) — Shares of Chinese food delivery giant Meituan surged as much as 15% in Hong Kong after its fourth-quarter results impressed analysts.

The stock snapped a two-day loss and was the best performer on the Hang Seng Tech Index on Monday. The firm reported a net loss of 5.3 billion yuan ($831 million) for the December quarter, versus the 7.2 billion yuan projected by analysts. Revenue rose 31% — the slowest in more than a year — to 49.5 billion yuan, meeting estimates.

Meituan is one of the Chinese technology giants navigating a severe regulatory crackdown from authorities in Beijing. The company, led by high-profile billionaire Wang Xing, is grappling with scrutiny in areas from the welfare of its delivery riders to the commissions it charges restaurants.

READ: Meituan Surges After Solid 4Q Results, Margin Beat: Street Wrap

“Despite obvious top-down challenges (Omicron, macro), Meituan management struck a confident tone on Friday’s calls, noting that activity levels tended to recover quickly after lockdowns ended (e.g., citing evidence in Shenzhen in recent days),” Bernstein analyst Robin Zhu wrote in a note.

Meituan and its rivals are also under pressure to do their bit to share the wealth in Xi Jinping’s “common prosperity” drive, and alleviate widespread pain as China battles several Covid outbreaks. In February, the government issued a call to aid the ailing service industry, asking food delivery platforms to cut the fees they charge restaurants — wiping $26 billion off Meituan’s value in a single day.

The company is aiming to improve its profitability by cutting back on the financial incentives that it provides to users.

Meituan “pointed to plans for a meaty cut in food-delivery user incentives this year, and focusing on mid- and high-frequency users as drivers of business growth,” Zhu wrote in the note.

Meituan’s stock had dropped 40% this year before Monday.

What Bloomberg Intelligence Says

Meituan’s 4Q boost in food-delivery margin from a persistent increase in transactions could alleviate concerns about the drag from government-initiated fee cuts — meant to provide relief to merchants amid Covid-19 flare-ups — to the unit’s 1H profitability. The company needs to raise 1H transaction volume by at least 14% to yield more cost savings, we calculate, while lifting food-delivery margin above the year-earlier level following fee adjustments.

– Catherine Lim and Tiffany Tam, analysts

Click here for the research.

The jump in Meituan’s shares contributed to a rebound in the broader Hang Seng Tech Index, which slumped 5% on Friday amid concern about the sector’s earnings and the risk of Chinese firms being kicked off American exchanges.

The tech gauge was up 3.1% at the mid-day trading break in Hong Kong. Tencent Holdings Ltd. climbed more than 4% intraday after buying back the most shares since 2011. Alibaba Group Holding Ltd. rallied more than 5%.

(Updates with analyst comment and tech index moves.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.