(Bloomberg) — Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. urged the U.S. to allow foreign companies to participate in a $52 billion federal program aimed at boosting chip production on American soil.

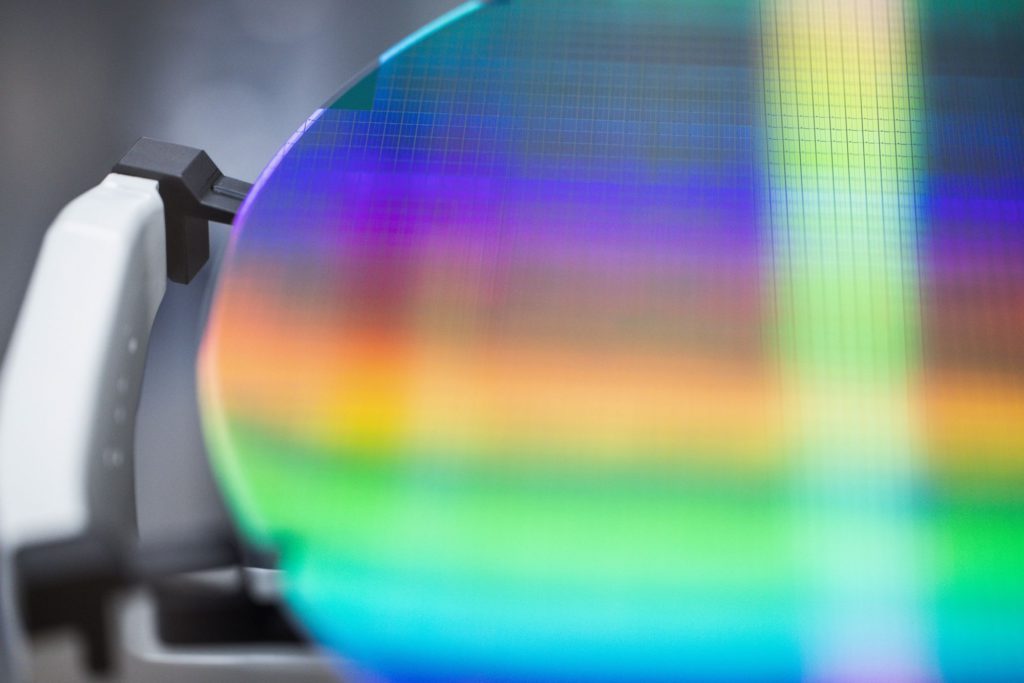

The world’s top two contract chipmakers are already both planning to spend billions of dollars to build new cutting-edge plants in the U.S. The Biden administration has made it a priority to bulk up domestic manufacturing capacity, aiming to ensure supply after chronic shortages of semiconductors over the past two years.

Intel Corp. at one point suggested that U.S. taxpayers’ money should only go to domestic companies, though Chief Executive Officer Pat Gelsinger has refrained from repeating the point in his more recent remarks. Intel’s technology is at least one generation behind that of its Taiwanese and South Korean rivals.

“Arbitrary favoritism and preferential treatment based on the location of a company’s headquarters is not an effective or efficient use of the grant and ignores the reality of public ownership for most of the leading semiconductor companies,” TSMC said in a response to the U.S. Department of Commerce’s request for information to help the agency plan and implement federal funding for the chip industry.

TSMC added that the U.S. should not try to duplicate the existing supply chain but rather focus on developing advanced technologies to increase its competitiveness. The Taiwanese company also called for reform of the immigration policy so the U.S. can attract foreign talent to help drive innovation.

Samsung echoed TSMC’s comments on incentives for foreign chip firms. It said the U.S. government should ensure all qualifying companies, irrespective of their countries of origin, can compete for U.S. funding “on an even playing field.”

TSMC is now building a $12 billion fab in Arizona with the goal of making 5-nanometer chips in 2024, while Samsung is creating a $17 billion plant in Texas with the aim of starting mass production also two years later.

Intel, meanwhile, has announced a new $20 billion chip hub in Ohio and two new plants in Arizona to help boost capacity at home.

Yet the U.S. House and Senate have been wrangling with how to combine their different versions of the legislation that includes $52 billion of funding for the semiconductor industry. A final package is unlikely to be finalized before the end of May.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.