(Bloomberg) — A Philippine fintech venture, whose flagship GCash payment platform clocked almost $73 billion in gross transactions last year, will consider an initial public offering only after expanding its services.

Globe Fintech Innovations Inc., a unit of wireless carrier Globe Telecom Inc., is seeking to include crypto currency and stock trading in its bouquet of services besides loans, investment and insurance it introduced in the past two years, Ernest Cu, the CEO of the parent said in an interview. The arm, also known as Mynt, already allows money transfers and online betting on cockfights.

“We want to diversify our revenue,” Cu said in Manila. “We just don’t want to be in payments, phone loads and bank transfers. Right now we are still building our business. When we are done and ready we’ll be doing the IPO.”

The boom in online services during the coronavirus pandemic has bolstered the prospects of Mynt, which brought in Chinese giant Ant Group Co. as partner in 2017. Users of GCash more than doubled to 55 million in 2021, while gross annual transactions on the platform surged almost 12-fold to 3.8 trillion pesos, from pre-Covid 2019. The new services will “easily” help GCash’s transactions value grow at least 10% a year, Cu said.

The growing customer base and wider acceptance of digital payments could make the new businesses profitable in four to five years, unlike GCash, which took 17 years since it started, Cu said. The platform handles 19 million transactions a day, according to the company.

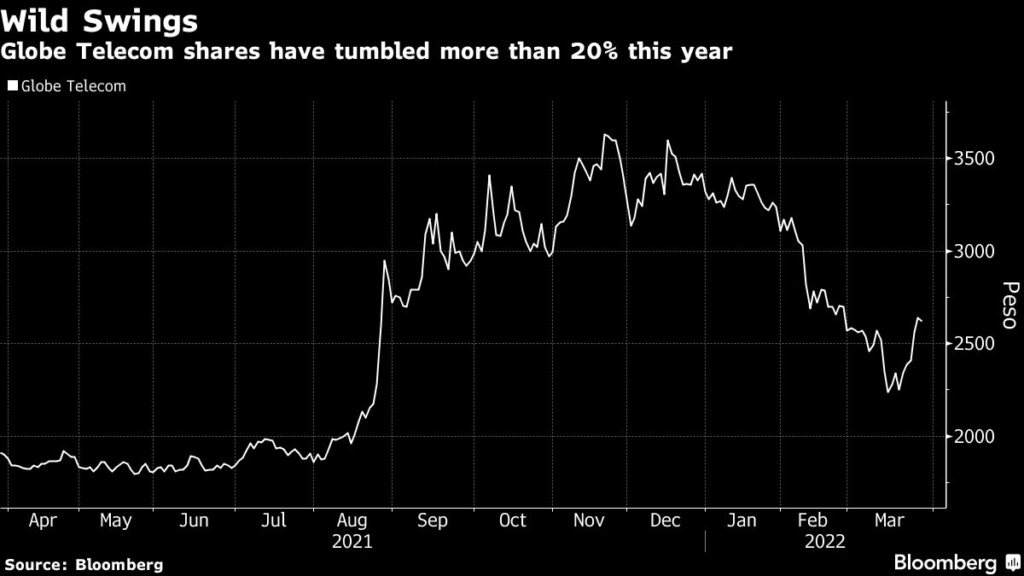

A $300 million funding round led by Warburg Pincus, Insight Partners and Bow Wave Capital in November valued Mynt at more than $2 billion, compared with the parent’s market capitalization of $6.7 billion.

Future Growth

Cu, who became CEO in April 2009 and helped Globe Telecom topple Smart Communications Inc. from its perch as No. 1 in the Philippine mobile phone market eight years later, is betting on services such as GCash for future growth because he expects telecommunications and broadband to soon hit a plateau.

“Globe is changing the way it looks,” Cu said. “It’s no longer a one trick pony that’s only in telecom. We now have a fintech business and a telecommunications business. Eventually, we will have a health business, an e-commerce business. So it’s turning into a group of digital companies that feed on each other.”

Singapore Telecommunications Ltd. owns about 47% of Globe Telecom’s common shares, while Philippine conglomerate Ayala Corp. owns about 31%, according to data compiled by Bloomberg.

Cu is also pushing into data centers, a segment he views as promising. Domestic demand and customers wanting to hedge geopolitical risks would make the Philippines even more attractive for the industry, he said.

Data centers, which accounted for less than 5% of Globe Telecom’s revenue in 2021, could reach a few hundred million dollars to about 10% of revenue in five years, Cu said. The company scaled up the business this month with a $350 million venture with ST Telemedia Global Data Centres and Ayala.

“We won’t put that kind of money if it won’t move the needle,” Cu said.

While Globe Telecom’s capital expenditures has already peaked, Cu said the company wants to “shore up” its capital base and reduce its debt-to-equity ratio with a plan to increase the company’s authorized capital stock. The proposal will be presented to shareholders on April 26.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.