(Bloomberg) — Arm Ltd. is shifting a chunk of its stake in Arm China to parent SoftBank Group Corp. and revising how it accounts for the troubled Chinese affiliate, a bookkeeping change that may ease the British chip designer’s path to an initial public offering, according to people familiar with the matter.

Arm Ltd. will end up holding less than 20% of Arm China and will treat it as an uncontrolled affiliate for accounting purposes, the people said, asking not to be identified because the details are private. Arm China will be treated like any other license-paying customer rather than a fully controlled subsidiary, the people said.

The change reflects the reality of the situation after Arm China’s one-time chief executive officer, Allen Wu, seized power at the business that SoftBank acquired as part of its purchase of Arm Ltd. in 2016. Arm China’s board fired Wu in 2020 for conflicts of interest, but in a dramatic clash he has refused to leave and continues to run day-to-day operations. Wu holds the company seal, needed for corporate transactions, and officials in Shenzhen have so far backed his authority.

SoftBank, Arm and Arm China didn’t immediately provide comment. The Financial Times reported earlier that Arm would transfer some of its Arm China stake to a SoftBank unit.

SoftBank once controlled all of the Chinese operation, but later ceded a majority stake to local investors, including entities affiliated with Wu. With the accounting changes now, the Japanese conglomerate will hold about 28% of Arm China and it will bear responsibility for resolving the ongoing dispute with Wu.

That should make it simpler for Arm Ltd. to proceed with its planned IPO, although it will still have to acknowledge the potential risks with the China unit. One possible concern is that Arm China’s rogue leadership could hurt the flow of revenue out of the country to the creator of the technology. Arm Ltd. will not be responsible for a full auditing of the China operation, which it had not been able to do of late.

SoftBank had originally cut a deal to sell Arm to Nvidia Corp., but the agreement was called off earlier this year in the face of opposition from regulators and customers. SoftBank is seeking a valuation of at least $60 billion for Arm in the IPO, Bloomberg News reported earlier.

Analysts had already questioned whether Arm would be able to command such a lofty price, given its profit levels and recent tumult in equity markets. Conceding that it doesn’t have control over the China business, which accounts for a substantial slice of its sales, may make that even more difficult.

“So how much is ARM worth with a quarter of its sales gone?” wrote Amir Anvarzadeh of Asymmetric Advisors. “We think without the China unit (which by the way has heisted its IPs) ARM would be worth considerably less than $40bn which Nvdia offered.”

SoftBank appointed Rene Haas as CEO of Arm after calling off the sale to Nvidia. He’s now at the helm of one of the most important firms in the $500 billion semiconductor industry.

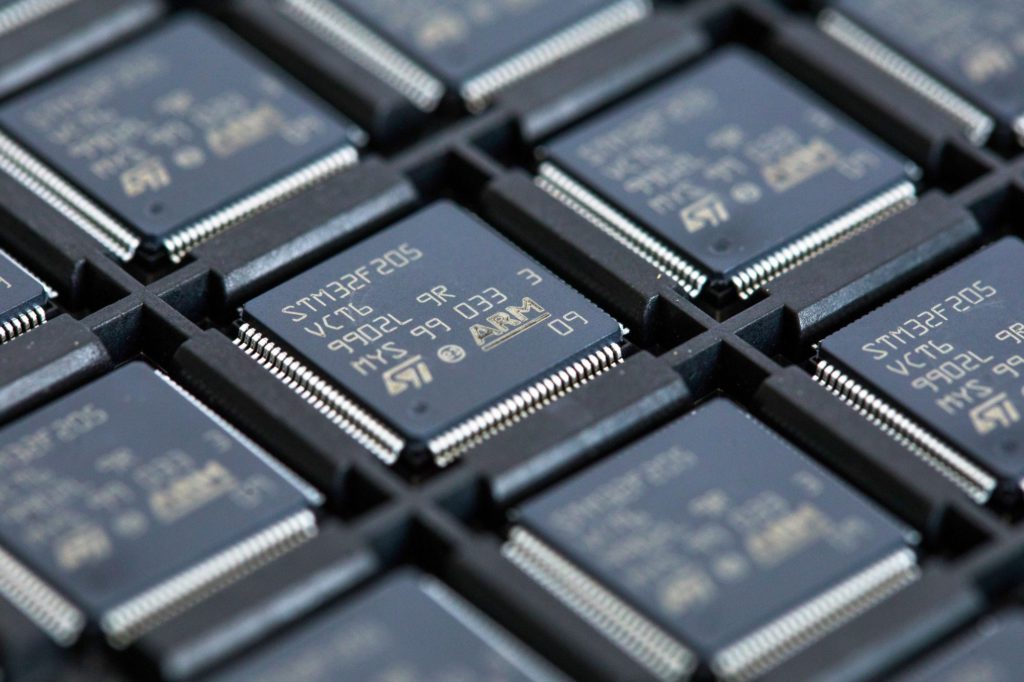

Arm’s designs and technology are ubiquitous, playing key roles in everything from the most powerful datacenter chips to Apple Inc. iPhones and right down to tiny sensors used in home appliances. Silicon demand surged during the pandemic, triggering supply shocks that have shaken various industries and emphasized the need for governments to secure the vital electronic components that power manufacturing, communications and trade.

Arm’s customers, which include Qualcomm Inc., Alphabet Inc.’s Google and Samsung Electronics Co., stoked much of the opposition to the deal with Nvidia. They were concerned that the chipmaker could restrict their access to technology they regard as crucial.

Silicon Valley’s Next Revolution Is Open Source Semiconductors

In an interview earlier this year, Haas said despite the drama surrounding Wu, the joint venture has performed well, increasing revenue and profits.

Arm’s technology is essential to China’s effort to make itself less reliant on overseas technology. That has made the firm, along with other chip technology providers, a target for the U.S. government in the trade war between the world’s two largest economies. Arm has design teams in the U.S., where Haas is based, making it subject to export controls despite its status as a U.K. company owned by a Japanese corporation.

An Arm IPO would go a long way toward freeing up capital for SoftBank, whose balance sheet has been eroded by a global selloff of technology companies. It’s unclear how or when SoftBank can resolve the dispute in China. Wu and Arm are now embroiled in lawsuits over Arm appointees that he fired as well as an attempt to assert his legal right to continue in his position.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.