Cyril Ramaphosa will face his first motion of no confidence along with his cabinet this afternoon and it has been a long time coming for the president.

Political party ATM first lodged the application with the speaker in 2020 while the pandemic and a prolonged court battle over whether it should be a secret ballot or not delayed the process until now.

Ironically, ATM won’t participate in its own motion after speaker Nosiviwe Mapisa-Nqakula said she would not acquiesce to ATM’s request to have the vote postponed. On Monday, the Western Cape High Court found that ATM’s application to review the speaker’s decision to have the motion voted on by open ballot was not urgent.

Yesterday, the speaker did grant opposition leader John Steenhuisen’s request for a roll-call voting procedure. That means an MP’s name will be called out and they will reply with a Yes or No answer to the motion of no confidence.

Ramaphosa’s predecessor Jacob Zuma was no stranger to a vote of no confidence, having faced multiple attempts from opposition to remove him from the presidency. But if Zuma’s track record is anything to go by, then Ramaphosa should be safe from any real danger today. The incumbent president is also far more popular than the previous one.

Meanwhile, cooperative governance minister Nkosazana Dlamini-Zuma briefed the media yesterday where she said South Africa could exit the national state of disaster as early as next week.

Dlamini-Zuma said new draft regulations would be released to manage the response to Covid-19 once the state of disaster is removed and the public will have 48 hours to comment on them after which the government will analyse the comments and then hopefully lift the state of disaster.

She added that it could not be lifted in a “reckless and abrupt manner” with some rules likely to remain for a further 30 days once the state of disaster is ended. These would include wearing masks, limitations on gathers, and the R350 social relief of distress grant.

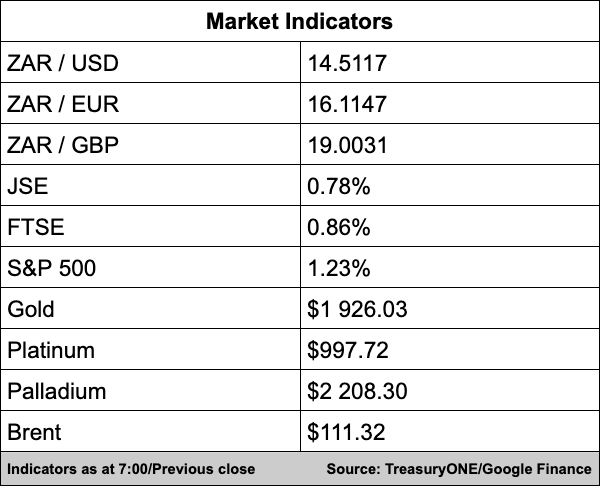

In the markets, the euro and EM currencies are on the front foot and stoking risk appetite on the back of hope that there might be a positive outcome to the ongoing peace talks between Ukraine and Russia.

“The Russian Ruble’s big gains yesterday led EM’s stronger, with the Rand closing 1.4% firmer at R14.53. A move below the R14.50 level will once again open up a move back to R14.35 as the Rand remains resilient despite the very poor unemployment numbers out yesterday,” comments TreasuryONE.

Traders will monitor the ongoing talks closely, as there is a fair amount of scepticism regarding Russia’s will to pull out of the war, which could still see some volatility in markets.

Gold is up 0.3% at $1,925, platinum is up 1.4% at $995, and palladium is up 3.4% at $2,220. The prices of Brent and WTI are marginally higher at $111.00 and $105.00 this morning as markets weigh up Covid driven demand concerns in China against supply concerns out of Russia and Kazakhstan.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

South Africa Jobless Rate at Record as Work Seekers’ Ranks Grow – Bloomberg

No record of rotting fruit at Cape Town port – but the WCape still wants it privatised – Fin24

Give SA a tax holiday on fuel, Parliament urges Mantashe, Godongwana – Fin24

Global Business

Turkey may become the new playground for Russian oligarchs – but it’s a risky strategy – CNBC

SpaceX’s plans to launch 60 Falcon rockets in 2022, twice the flights made last year – Elon Musk – Business Insider

China Evergrande to sell stake in Crystal City Project for US$575 million – Channel News Asia

Markets

Gold Up as Ukraine-Russia Peace Talks Show Some Signs of Progress – Investing.com

Asian Stocks Up, Ukraine and Russia Inch Towards De-Escalation – Investing.com

The ruble surges close to pre-invasion levels as Russia-Ukraine talks raise hopes for end to fighting – Business Insider

Tech

Apple Shares Rally Like It’s 2003 in Risk-On Day for Tech Shares – Bloomberg

Hackers Steal $590 Million in Latest Blockchain Bridge Attack – Bloomberg

Government promises to fight piracy by working with the private sector – Tech Central