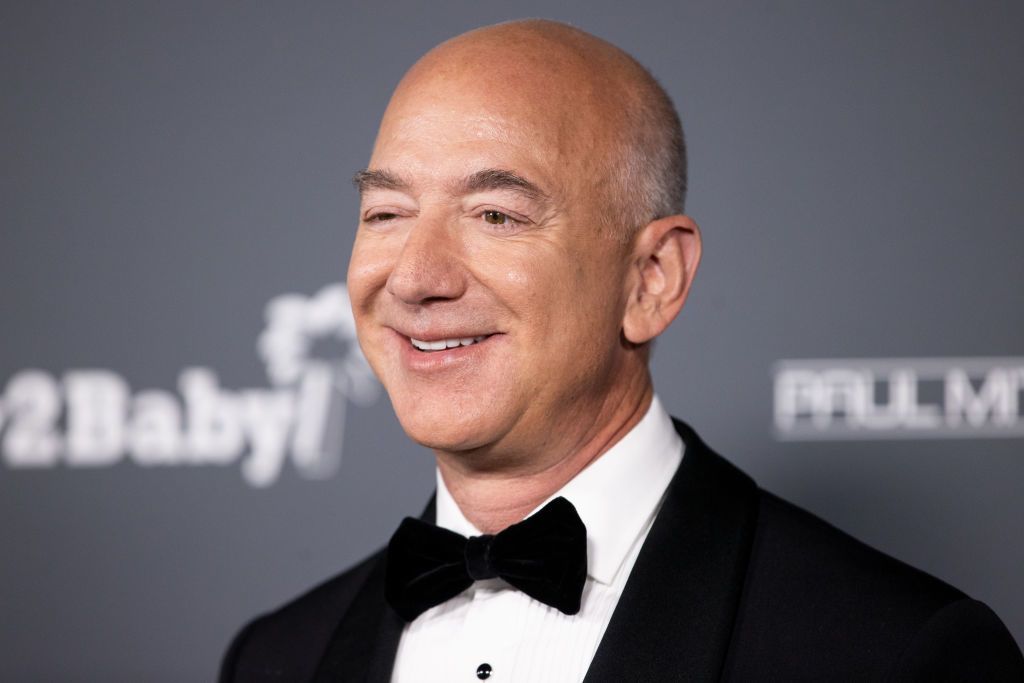

(Bloomberg) — Jeff Bezos and Mukesh Ambani, billionaires who have been battling for years in India, are headed for a ferocious new clash over rights to the country’s cricket matches.

This week, the Indian cricket league unveiled guidelines to auction off media rights and they seem designed to raise bids — and tensions. For the first time, the rights to broadcast matches on television and to stream them online will be sold separately, opening the door to Amazon.com Inc. and its Prime video service. Ambani’s Reliance Industries Ltd. is also determined to win, according to people familiar with the matter, as the companies fight for e-commerce supremacy in one of the world’s fastest-growing markets.

What’s more, the cricket competition will take place live online over the course of two days, which means proxies for the two men will have to make minute-by-minute bids and counterbids in real-time. Imagine a Sotheby’s-style auction with Bezos and Ambani, worth about $275 billion and $100 billion respectively, bidding for a prize that only one can ultimately possess.

“Winning the auction is about prestige and vanity, so Reliance, Amazon and others can be expected to flex their muscles,” said Aditi Shrivastava, co-founder and chief executive officer at digital entertainment startup, Pocket Aces. “It’s a big deal and bidders will surely fight tooth and nail to win the rights.”

The event, which starts on June 12, could see bets of $7 billion or more, according to the people, who didn’t want to be quoted discussing sensitive information. At stake are the rights to show dozens of Indian Premier League matches between 2023 and 2027, with separate auctions to decide the winners for livestreaming and broadcasting in different regions. For comparison, Amazon is paying about $1 billion a year for the rights to show the National Football League online, but that’s for Thursday night games rather than the prime weekend games.

The cricket auction is generating intense interest in India, where the sport is wildly popular. Live streaming matches is an effective way of reaching the country’s 1.4 billion people, who are increasingly watching sports on their mobile devices.

“If successful, you’ve captured an attentive audience for six straight weeks every year for five years,” Shrivastava added. “It’s the biggest viewership event of the year in India.”

Though Amazon and Reliance are the most ambitious, they join a horde of competitors, including the Walt Disney Co.-owned Star India and its Disney Hotstar streaming service. Also in the mix is a newly-created media behemoth that combines Sony Pictures and India’s Zee Entertainment Enterprises, multiple people said.

The auction promises to be an epic showdown between the Seattle-based retail Goliath on one side and India’s most valuable company on the other. Winning streaming rights would represent a prestigious get for Amazon or Reliance. They are both eager to control a large share of digital opportunities in India.

The bidding adds more friction between the two companies, which are locked in a power struggle over the assets of Future Group, a debt-laden Indian retail chain. Neither side has budged an inch, leading to three dozen legal cases between Amazon and Future Group — with Reliance hovering in the background.

Ultimately, the prize is also about bragging rights in India’s e-commerce market. Armed with inexpensive smartphones and availing themselves to one of the world’s lowest data tariffs, nearly 800 million Indians have internet access to watch Bollywood movies and live stream sports on their personal devices. The Indian Premier League, or IPL, is one of the world’s most watched sporting tournaments, comprising 10 teams and over 70 matches.

Separating broadcast rights and digital streaming opens the door to new bidders. Amazon, with its Prime video service, can face off in the e-auction against Reliance’s Jio telecom subsidiary, which has nearly half a billion subscribers in India. Unlike in the past, no consolidated bidding will be allowed.

Representatives for Amazon and Reliance did not respond to emails for comment. Disney Hotstar, which currently holds digital streaming rights for the matches, would not confirm its participation in the auction. Others, including Meta Platforms Inc.’s Facebook and Alphabet Inc.’s YouTube, are still considering whether to place bids, multiple people said.

The Board of Control for Cricket in India, the sport’s governing body, has released detailed terms and conditions in its “Invitation to Tender.” According to the board, the document will be available to purchase in the coming weeks to those who pay a non-refundable fee of 2.5 million rupees plus taxes.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.