(Bloomberg) —

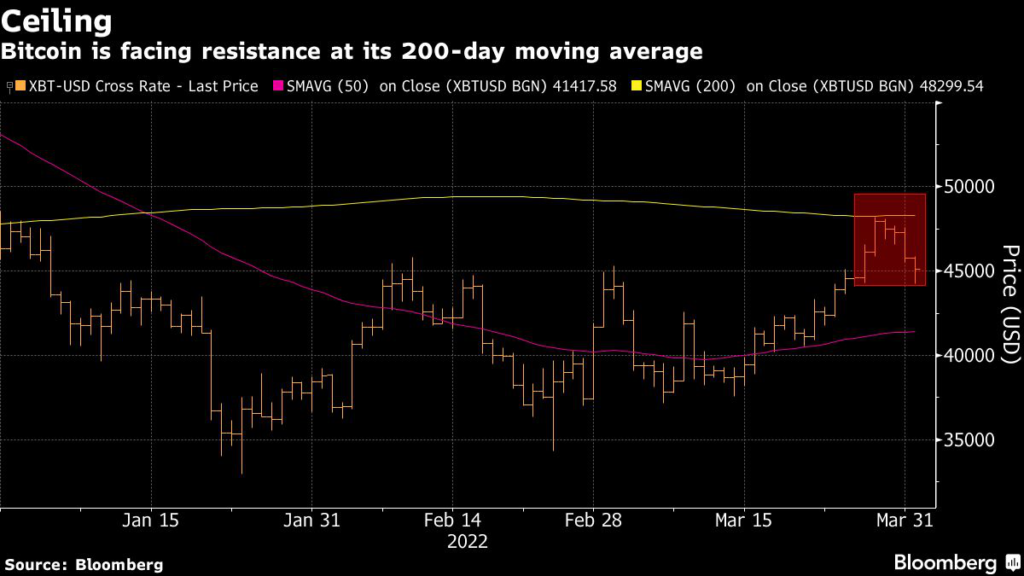

Bitcoin has lapsed back into the trading range that has persisted for much of the year.

The largest cryptocurrency by market value was little changed around $45,900 as of 10:51 a.m. in New York. It climbed about 10% during March amid an end-of-month rally.

“It’s just technical in nature,” said Matt Maley, chief market strategist at Miller Tabak + Co. “The breather that Bitcoin is taking right now is normal and healthy after such a sharp rally. Once it digests those gains, it should be able to rally further.”

“Bitcoin bulls are really going to need a good fundamental reason for Bitcoin to break sharply higher,” said Nicholas Cawley, strategist for DailyFX. “At the moment, there’s nothing on the horizon.”

Edul Patel, the chief executive officer and co-founder of digital-asset trading platform Mudrex, also cited a plan backed Thursday by a panel of the European Parliament wherein crypto transactions would be covered by EU rules requiring that financial transfers carry information about the identities of payers and payees.

“Although this does not ban interactions with unhosted wallets such as Metamask, it will place significant friction on users,” said Hayden Hughes, chief executive officer of social-trading platform Alpha Impact.

Read more: Crypto Transfer Anonymity Would End Under EU Lawmakers’ Plan

Market dynamics may also be an issue, according to JPMorgan Chase & Co., which sees stablecoins’ share of cryptocurrency market value as an indicator of potential for rallies or declines. The assets are tokens that typically are pegged to traditional currencies like the dollar.

“The share of stablecoins in total crypto market cap no longer looks excessive and as a result we believe that any further upside for crypto markets from here would likely be more limited,” JPMorgan strategists led by Nikolaos Panigirtzoglou wrote in a note. “This share currently stands below 7% which brings it back to its trend since 2020.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.