(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

China’s home sales slump deepened in March, keeping pressure on cash-strapped developers even as policy makers vow to support the property market.

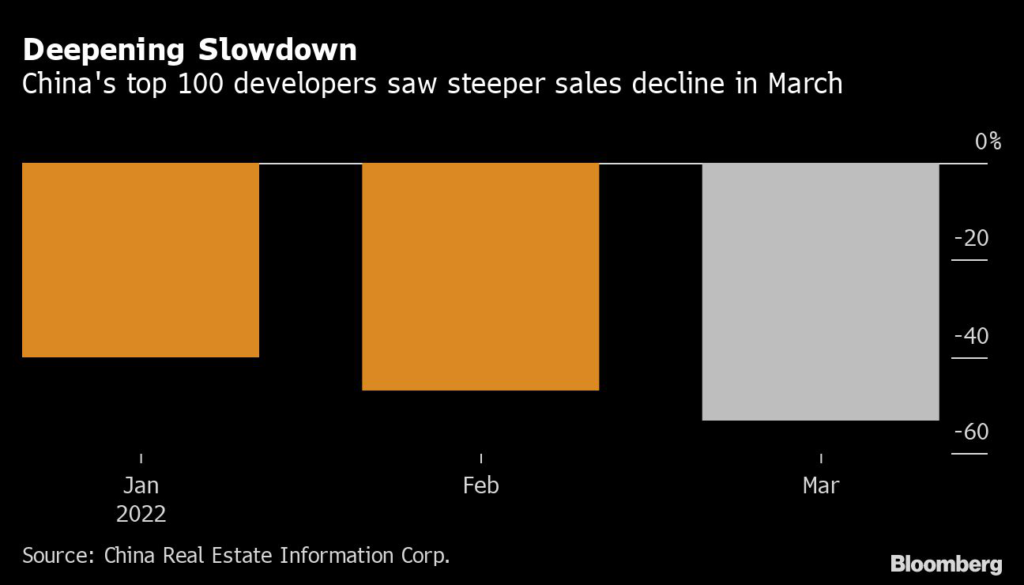

The 100 biggest companies in China’s debt-ridden property industry saw a 53% drop in sales from a year earlier, according to preliminary data from China Real Estate Information Corp. That’s the steepest decline this year.

The enduring downturn contrasts with a two-week rebound in developers’ stocks and dollar bonds after Chinese officials reiterated a pledge to prevent a disorderly collapse in the property market. Regulators have eased their clampdown on leverage in the industry by urging banks to boost lending to builders and cut mortgage down payments for homebuyers.

In an early promising sign, March sales grew 27% from February, according to CRIC, driven by state-backed and strong private developers. The roll-back of policy curbs may kickstart a “slow and gradual” recovery in developers’ sales, Bloomberg Intelligence analyst Kristy Hung wrote in a Friday note.

Still, in the first quarter, almost 40 developers saw sales drop by more than half from a year earlier, according to CRIC analysts. Buyer confidence remained subdued and real estate companies turned inactive in marketing new projects, they said. Covid outbreaks and lockdowns in cities including Shanghai added to the gloom.

A sales revival is crucial to alleviate the cash crunch for developers as offshore bond markets remain prohibitively expensive. Funding difficulties and sizable refinancing needs for the rest of 2022 will further strain liquidity and increase defaults, Moody’s Investors Service analysts led by Daniel Zhou wrote in a note Thursday.

A slew of battered developers including Kaisa Group Holdings Ltd. and Sunac China Holdings Ltd. failed to report unaudited earnings by a March 31 deadline, adding to pressure on credit ratings and forcing suspensions in trading of their stocks.

The real estate sector is bracing for another challenging month of bond and trust obligations in April, after March saw further signals of investor concern about builders’ repayment capabilities.

Stressed developers face at least $3.1 billion of payments on dollar and onshore public bonds this month, according to data compiled by Bloomberg. The sector also has 53.6 billion yuan ($8.4 billion) of trust payments due, according to data tracker Use Trust.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.