Lieutenant-General Sehlahle Fannie Masemola is the new national police commissioner after President Cyril Ramaphosa moved swiftly to replace the outgoing Khehla Sitole, whose last day as the top cop was yesterday.

Commenting on the appointment of Masemola, the president said the new police chief would have the weight of the nation’s expectations on his shoulders and that weight would be matched by government support and resources at Masemola’s disposal.

Ramaphosa ousted Sitole after five years in the role, which was marked by excessive in-fighting and disagreements with police minister Bheki Cele, a known interferer in the work of the police commissioner.

Masemola, however, is seen as a close ally of Cele’s and should have the latitude necessary to make the changes he deems fit to the police service.

But just because Masemola has a close relationship with Cele doesn’t mean he should be written off in any way says Institute for Security Studies (ISS) researcher Gareth Newham, adding that Masemola needed to stamp his authority in controlling day-to-day operations.

Ramaphosa says Masemola comes with a wealth of experience and a good track record of achievements during his time in the police service.

“General Masemola has been a deputy police commissioner with an outstanding record of achievements in policing across South Africa.

This includes helping with the de-escalation of violence in KwaZulu-Natal after our first democratic elections in 1994.”

Ramaphosa added that Masemola has also been instrumental in reducing cash-in-transit heists, playing a leading role in security coordination for all elections including 1994, and securing major international events held in South Africa.

Masemola has a long list of issues aside from just tackling crime writes Daily Maverick, which includes boosting morale, firearms smuggling, allegations of corruption at the crime intelligence unit, and dealing with mistrust among police in the Western Cape.

While other commentators have noted that Masemola is close to retiring age and may just be a placeholder for the next commissioner, Ramaphosa says in his conversations with Masemola, the lieutenant-general assured the president he was up to the new job.

Meanwhile, government will move to help consumers with the ever-increasing fuel costs by introducing a temporary fuel levy price cut from April 6 until May 31.

The fuel levy will decrease by R1.50 a litre but the levy decrease doesn’t compensate for the fuel price increase due to be implemented on the same day the levy cut takes place.

The 95 octane petrol was set to increase by R1.84 a litre and 93 octane was expected to climb by R1.76 a litre, which means motorists would still be paying the same as what they did in January for a tank of fuel, writes Daily Maverick.

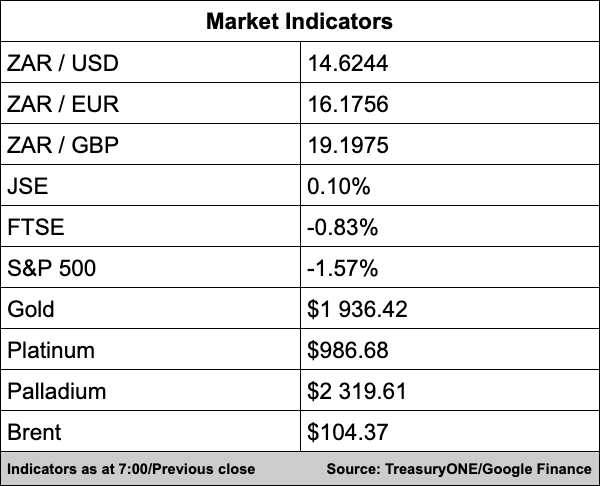

In the currency markets, after the rand dipped to the strong level of R14.41/$, the local unit closed at R14.60/$ yesterday.

“The R14.50/$ will still remain a challenging level to breach, and we expect the rand to close above this level as we enter the weekend.

We have a rating announcement from Moody’s, and we don’t expect any changes in the rating. We think that our SOEs like Eskom will be pointed out as struggles, although we have made some small steps in the right direction,” comments forex trading house TreasuryONE.

The dollar gained back some lost ground and today is a big day with US non-farm payrolls out later.

The expectation is for 490,000 jobs to be added.

“The release can always cause some volatility and if the number comes out not as expected, we can see that volatility come through. We have also seen that risk appetite towards the rand is waning a bit as our terms of trade get eroded with the stronger currency,” says TreasuryONE.

There were big moves in oil yesterday as we await the announcement of US president Biden on the release of strategic oil reserves from the US to help the market.

There was also an OPEC meeting where they agreed to increase production for May, comments TreasuryONE.

“All this is good, but the oil market will still be in deficit with any Russian oil. So, we do not expect oil to rally too hard to downside further and with Brent crude at $103 a barrel, any dips below $100 will be well supported in the short term.”

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

Vodacom South Africa MD to step down – Tech Central

Brace yourselves: Eskom 9.61% tariff hike to kick in on Friday – EWN

Flysafair: Flight diversion was false alarm – Fin24

Global Business

Biden orders unprecedented use of oil stockpile to combat US fuel prices – Fin24/AFP

African Development Bank to stimulate African crops with $1B boost – Ventureburn

The Sanctions Imposed So Far on Russia From the U.S., EU and U.K. – Bloomberg

Markets

Dollar Up, Resumes Rally Against Yen Ahead of U.S.

Jobs Report – Investing.com

Asian markets fall further and oil extends steep losses – AFP

Where Is Bitcoin Heading?

Look at the Options Market – Bloomberg

Tech

South Africa to stay on analogue TV until 2037 – Tech Central

Using AI in agriculture could boost global food security – but we need to anticipate the risks – Cape Business News

Hubble telescope spots Earendel, the most distant star on record – Daily Maverick/Reuters