The rand traded in a fairly narrow range for most of the day before rapidly losing ground against the dollar, comments forex trading house TreasuryONE.

“Hawkish commentary by both Kansas Fed President Esther George and Federal Reserve Governor Lael Brainard gave the dollar fresh momentum. This is the first time in some while we saw the rand acting adversely to a stronger dollar, with the local currency losing nearly 10 cents in a couple of minutes to trade above R14.60.

“The hawkish sentiment by two of the FOMC’s decision-makers has the market pricing in a more aggressive hiking cycle in the near term, with a possible 50bps hike in April.”

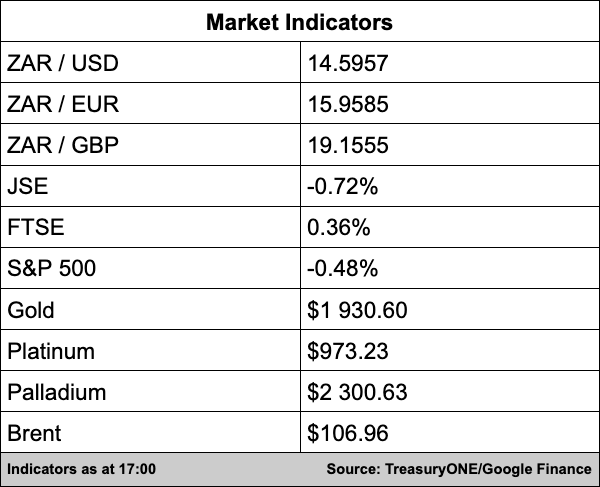

The local unit is currently trading at R14.59/$.

Also, have a look at currency strategist Andre Cilliers talking about the recent market moves.

On the commodity front, it was stable trade for most of the day until the comments made by Fed officials. Gold traded strongly at $1,944 but has since lost most of its gains, palladium is up 1% at around $2,300 while platinum slid to $973. Brent is also trading lower this afternoon and is currently at $107 a barrel.

South Africa’s largest coal exporter, Thungela continued its share rally today after reports the European Union is planning to end coal imports from Russia. Thungela surged 9.97% to record a fifth straight day of gains and register a new record high. Thungela has advanced more than 90% since Russia invaded Ukraine at the end of February, reports Bloomberg.

Meanwhile, Alphamin (1.14%) reported a rise in core profit of almost a third to a record $98 million (R1.43 billion) for the first quarter ending March with the mining giant continuing to reap the rewards of soaring metal prices.

Newspaper and packaging group Caxton (1.14%) is buying two businesses from the Swiss-based packaging company Amcor, in a deal worth a reported R90 million. The deal will include Amcor’s Cape Town-based bag-in-box pouching business, which manufactures bag-in-box bladders for boxed wine.

Heavyweights Naspers and Prosus lost 0.98% and 1.88% respectively.

The JSE ended in the red for a second day running with the bourse losing 0.72% and the All Share Index at 75,287 points.

On the international front, Twitter said it would be adding Elon Musk to the board after the Tesla and Space X chief executive purchased over 9% worth of stock in the social media company. Musk is now the single largest shareholder in the company.