(Bloomberg) — MicroStrategy Inc. used a loan against its Bitcoin holdings for the first time to purchase $190.5 million more of the cryptocurrency.

The software maker controlled by Bitcoin advocate and CEO Michael Saylor now owns about 129,218 of the digital tokens valued at around $6 billion. The Tysons Corner, Virgina-based company acquired 4,167 Bitcoins between Feb. 15 and April 4 during its most recent buying spree, according to a regulatory filing. Bitcoin fell less than 1% to $46,004.

Last week, the firm announced that it had taken out a $205 million three-year term loan from a unit of Silvergate Bank. The loan is backed by collateral roughly equal to four times its size or $820 million.

“We view Bitcoin as pristine collateral for the digital age and believe this transaction allows us to continue pursuing our Bitcoin acquisition strategy in a manner accretive to our shareholders,” Saylor said in response to an email Tuesday.

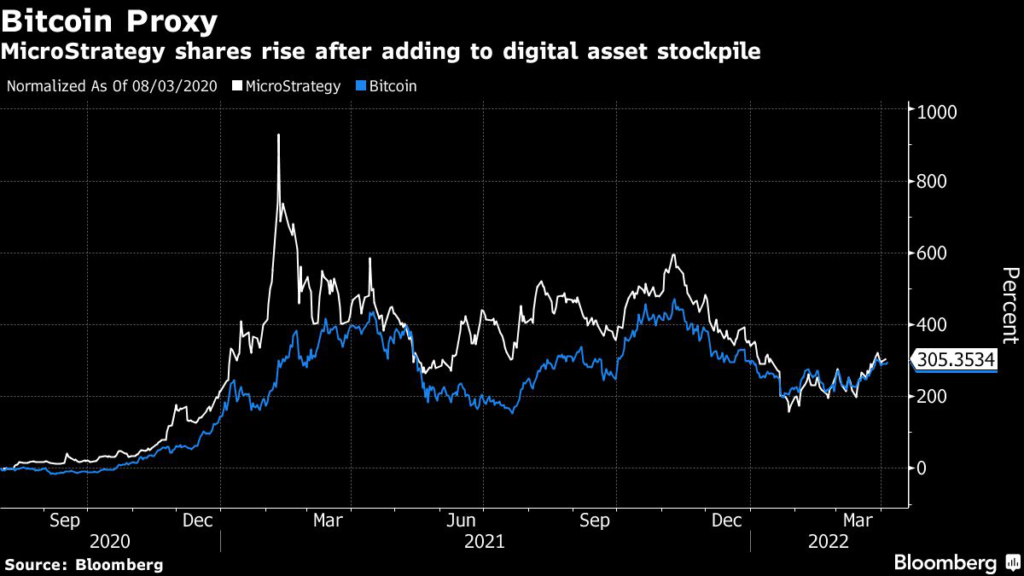

MicroStrategy’s aggregate purchase price for its holdings is about $3.97 billion and the average purchase price of around $30,700 per Bitcoin, the filing shows. The company started acquiring Bitcoin for its balance sheet in August 2020, with Saylor citing the Federal Reserve’s relaxing of its inflation policy for helping to convince him to get out of cash.

MicroStrategy has already sold two sets of convertible bonds and issued corporate debt to buy Bitcoin.

Shares of MicroStrategy fell about 4.3% Tuesday. The stock has jumped about 300% since the company started buying Bitcoin, giving it a market value of around $5.7 billion.

(Updates first paragraph to say that the loan was used to make the purchase.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.