(Bloomberg) — The U.K.’s planned privatization of Channel Four Television Corp. is unlikely to be quick sale, and faces political and competition hurdles amid a pullback in investor demand for television assets.

The government is considering changes which would make Channel 4 — whose privatization was disclosed to management on Monday — more appealing to investors. The company could be allowed to raise capital and increase its borrowing under a new owner, as well as produce and keep the rights to its own shows, something it’s not currently permitted to do, according to a person familiar with the sale process.

The sale of Channel 4 raises questions about its price and the regulations around its business model. Privatizations are often also drawn-out affairs, with the U.K. government still selling down shares of NatWest Group Plc, which it acquired during the financial crisis.

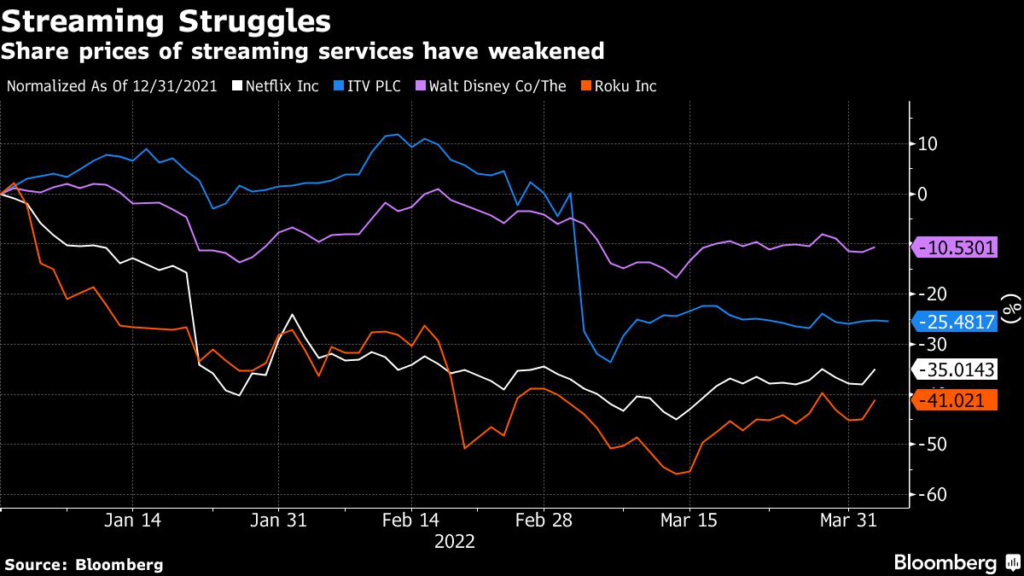

Traditional TV businesses and streaming services have recently seen valuations go into reverse as investors weigh heavy investment, proliferating rival platforms and uncertain growth prospects. The U.K.’s largest free-to-air broadcaster, ITV Plc, has lost a third of its market value in the past 12 months, and even winners from the shift to streaming have plummeted recently, with Netflix Inc. shares down 28% in the same period.

A valuation of 1 billion pounds ($1.3 billion) has been widely discussed for Channel 4, a target that’s “going to be demanding” for the state-owned, self-funding broadcaster, analyst Claire Enders said. The founder of Enders Analysis cited a range between 750 million pounds and 1.2 billion pounds, depending on several variables.

The price depends on the extent to which a buyer will be forced to continue with Channel 4’s “remit” — state-mandated responsibilities that include innovation and attracting younger, diverse audiences. A new owner would have to continue a commitment to prime time news and contribute to the U.K.’s cultural ecosystem, the person added, who asked not to be named speaking about ongoing discussions.

Unlike nearly all of its rivals, Channel 4 is barred from keeping intellectual property from the shows it commissions, though such rights are fueling mega media mergers like 2021’s $130 billion tie-up between Discovery Inc. and AT&T Inc.’s Warner Media, or Rupert Murdoch’s $71 billion sale of 20th Century Fox to The Walt Disney Co.

Streaming Suitors

Possible suitors could include ITV as well as New York-based Paramount Group, which bought Britain’s Channel 5 in 2014. Other bids could be considered at Discovery Inc. and Comcast Corp., owner of Europe’s largest pay-TV operator Sky.

Before any offers can be made, the sale needs approval in the House of Commons and the upper House of Lords, where it faces resistance. The opposition Labour, Liberal Democrat and Scottish National parties immediately hit out at the privatization on Monday night, as well as senior members of the ruling Conservative Party like Damian Green, who served as deputy to former Prime Minister Theresa May.

That could mean it’s challenging to finish the process before the next general election, which is expected as soon as next year.

Then, once any deal is proposed, it could face a competition probe, Enders said.

Channel 4’s management has also opposed the government’s approach. It said in a statement Monday that it had presented ministers with “a real alternative to privatization” which had been dismissed, and added it was “disappointing” that the government hadn’t formally recognized “significant public interest concerns”.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.