(Bloomberg) — Billionaire crypto investor Michael Novogratz says that once the Federal Reserve takes a pause, Bitcoin could start to take off again.

Novogratz, who leads Galaxy Digital Holdings, predicted the central bank under the helm of Jerome Powell will remain “very hawkish for a while” due to high inflation, and will likely raise interest rates by 50 basis points soon. But as the economy slows down and the Fed steps back, “Bitcoin goes to the moon,” he said, repeating a popular crypto catchphrase.

Novogratz was speaking at the “Bitcoin 2022” conference in Miami, which kicked off on Wednesday with the unveiling of a bull statue that commemorates the city’s partiality toward cryptocurrencies and the digital-assets industry. The event has attracted more than 25,000 attendees.

Novogratz also reiterated a call that Bitcoin will eventually reach a price of $500,000 and eventually $1 million. The largest digital currency fell about 3.3% to $44,366 as of 10:34 a.m. Eastern time.

“I go to bed and I pray that the stewards of the U.S. economy don’t screw it up,” he said, adding that he has Russian friends who have gone “bankrupt” recently. “And so I really do pray that the dollar is going to be strong and it doesn’t go to infinity because Bitcoin going to infinity means the rest of the Western world has really fallen apart,” he said, though Bitcoin can reach his price targets “with stability in the West.”

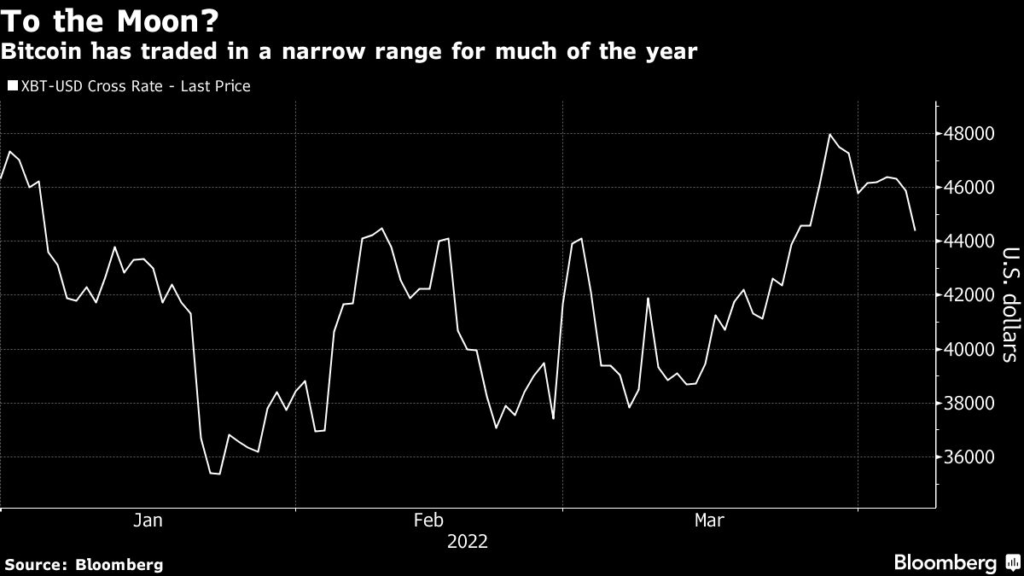

Bitcoin has recently traded in a narrow range — it hasn’t been able to meaningfully break out above $48,000 and is down so far this year. Proponents have been debating which of its narratives — including whether it’s an inflation hedge or not — is most prevalent at the moment and which story could likely end up sticking for the long run.

Novogratz said that though Bitcoin has largely traded in tandem with the tech-heavy Nasdaq 100, it could be in the process of disabusing itself from that relationship. Bitcoin’s purpose, he says, won’t be for purchasing everyday items, like shoes. But, “it’s that I’m going to take some of my wealth and preserve and store it there.” The coin, he added, is becoming a part of institutional portfolios.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.