(Bloomberg) — Chinese tech stocks fell, as investors responded to hawkish comments from the Federal Reserve and awaited more clarity on how Beijing’s new rules will help keep local firms listed on U.S.

exchanges.

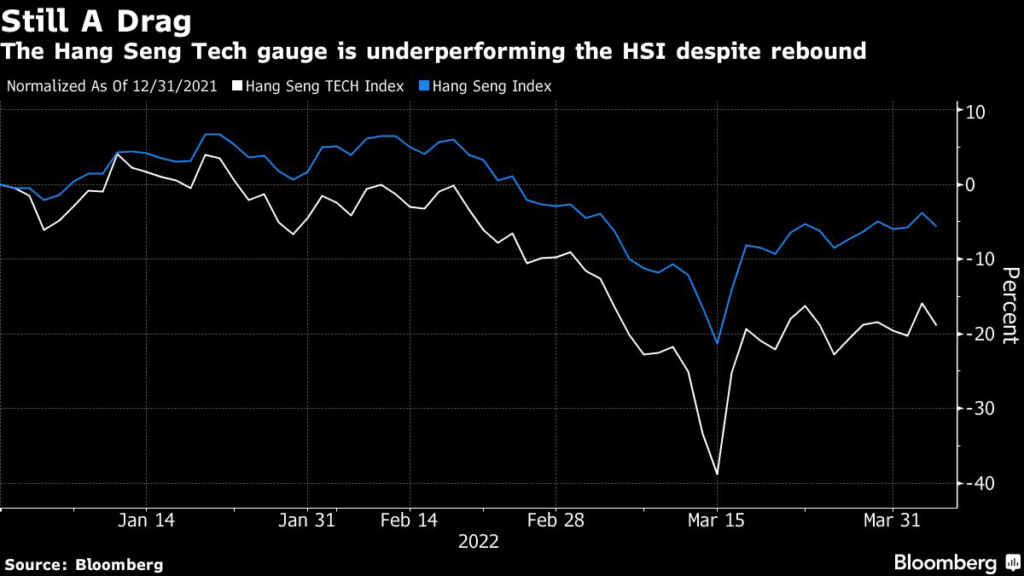

The Hang Seng Tech Index slid 3.8% as trading in Hong Kong resumed after a holiday, with Alibaba Group Holding Ltd. and JD.com Inc. among the biggest decliners. The broader Hang Seng Index dropped 1.9%.

Tech shares led broad losses in Asian equities on Wednesday after Fed Governor Lael Brainard said the central bank will raise interest rates steadily while starting balance sheet reduction as soon as next month.

The Nasdaq Golden Dragon Index fell 4.6% overnight, after a two-day 12% rally, while the tech-heavy Nasdaq 100 index dropped 2.2%.

Wednesday’s losses cut short a rebound earlier this week as Chinese regulators sought to defuse U.S.

delisting risks with a radical rule change proposal over the weekend. While Chinese shares listed in the U.S. and Hong Kong initially staged strong rallies following the news, investors say that there are still some hidden risks.

Of particular concern is whether Beijing’s plan to modify a rule restricting offshore-listed firms from sharing sensitive financial data with foreign regulators will be enough to satisfy U.S.

requirements, Tai Hui, chief Asia market strategist at JPMorgan Asset Management, said in a briefing on Wednesday.

In China, where local markets opened for the first time this week, the CSI 300 Index closed 0.3% lower.

Among worries included Shanghai’s growing Covid outbreak, the nation’s worst to date, with harsh restriction measures hurting the outlook for growth.

“Risks remain for the broader Chinese economy as Covid lockdowns prompt analysts to cut GDP and earnings forecasts, with the results season unable to ease worries,” wrote Marvin Chen, a Bloomberg Intelligence analyst.

Economists have been rushing to cut China’s growth forecasts as lockdowns and various curbs cover vast swathes of the nation.

A Wednesday report by Caixin Media and IHS Markit showed China’s composite purchasing managers’ index for March slumped to 43.9, the lowest in more than two years and falling deeper into contraction.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.