The JSE extended its run of losses into a third successive session with the All Share Index losing 1.23% to close on 74,359 points

Prosus (-6.09%), Richemont (-5.72%), Naspers (-6.34%) and Amplats (-3.87%) were some of the biggest losers today.

SA’s richest man, Johan Rupert, who is chairman of and owns a controlling stake in Richemont, was the subject of a protest on Wednesday by the Economic Freedom Fighters, reports Bloomberg.

“The EFF and other left-leaning groups have long targeted Rupert, who has a net worth of $11.1 billion, calling him the face of so-called “White monopoly capital,” a local term referring to the economy being dominated by White people who make up less than 10% of the population.”

MTN rebounded from its worst day of trading in more than a year on Tuesday to see the share price add 4.48%. MTN shares took a pummelling on Tuesday and fell 7.76% after the Nigeria Communications Commission announced that all operators are required to restrict outgoing calls for subscribers who have not linked their SIM cards to their National Identity Number.

MTN complied with the directive, which affected around 20 million of its subscribers in the country.

Nigeria is MTN’s most profitable market, accounting for 40% of its core profit.

Telecom peers Vodacom and Blue Label Telecoms lost 1.69% and 0.31% respectively, while Telkom added 2.96%.

Grand Parade Investments (-0.40%) said it had placed its catering equipment group Mac Brothers into voluntary liquidation. The company had previously said the subsidiary had seen further decline and was a loss-making business.

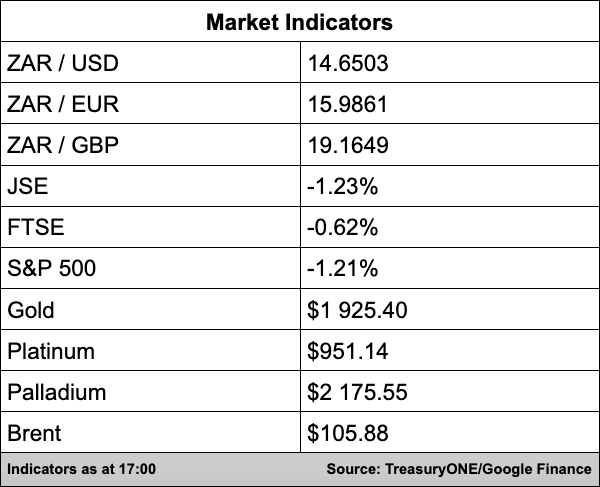

In the currency markets, the rand continued to weaken against the dollar in morning trade but the US currency ran out of steam later on, which helped the local unit to arrest some of its weakness. The rand is currently trading at R14.64/$ at the end of the local session.

“We expect some moves later on this evening with the release of the Fed minutes, as most Fed news these days carry some market-moving possibility. On the EM front, we have seen the Polish Central Bank increasing rates by 50 basis points which initially caused EM currencies to rally, but the Zloty has since faded back to pre-hike levels,” comments forex trading house TreasuryONE.

On the commodity front, it was a slow day for most with platinum the largest loser on the day, currently trading at $950, gold is flat for the day at $1,925, and palladium is at $2,210. Brent crude is also trading flat at $106 a barrel.