Yet another fuel price increase kicks in today with petrol going up by as much as 36 cents a litre, and our only reprieve is the scrapping of a R1.50 fuel levy from the price.

Last week, finance minister Enoch Godongwana announced a temporary emergency intervention to help cushion the blow of soaring costs brought on by the Russian invasion of Ukraine.

The minister said the fuel levy would be lowered by R1.50 for the next two months but fuel prices are still rising sharply even with government intervention.

93-octane will go up by 28 cents a litre while 95 increases by 36 cents a litre.

Illuminating paraffin goes up by R2.66 while both grades of diesel will also increase with 0.05% going up by R1.52 per litre and 0.005% going up by R1.69 a litre.

The increases bring the fuel prices up to record levels even when you take the fuel levy cut into account.

Petrol totals R21.96 a litre for 95-octane while 93 is at R21.63 a litre.

The Automobile Association welcomed government intervention and commended it for taking the issue of rising costs seriously but pointed out that while there are no quick fixes, the interventions thus far haven’t taken the pain away entirely.

“The intervention to cut the GFL is significant as it shows the government is taking the issue of rising fuel costs seriously, which is to be welcomed.

It also has indicated that it is looking at several proposals to deal with rising fuel costs in the future,” said the AA.

The body said whatever interventions were being discussed by government, they needed to be implemented immediately as prices are likely to remain volatile as the war in Ukraine continues to rage unresolved and places strain on global fuel supplies.

To this point, Godongwana has said once the temporary measures lapse at the end of May, government will consider a full review of the basic fuel price as well as other measures.

Some of them include:

- A reduction in the basic fuel price by three cents a litre

- The termination of the demand side management levy of 10 cents a litre on 95 unleaded petrol sold inland.

- The introduction of a price cap on 93 octane petrol, following from the previous department of mineral resources proposal and consultation.

This will allow retailers to sell at a price below the regulated price.

The price of fuel has also been aided by a stronger rand-dollar exchange through March, which had a lower contribution to the basic fuel price than in previous periods.

The two main contributors to South African fuel prices are the dollar exchange rate and international petroleum prices.

During the period under review, Brent crude oil increased from $96.47 a barrel to $109.37 a barrel.

The price of Brent is under strain due to supply issues, which include sanctions on Russia and OPEC and non-OPEC members limiting fuel supply despite higher global demand.

In the markets, the dollar strengthened sharply against most currencies yesterday after hawkish comments from two Fed FOMC members.

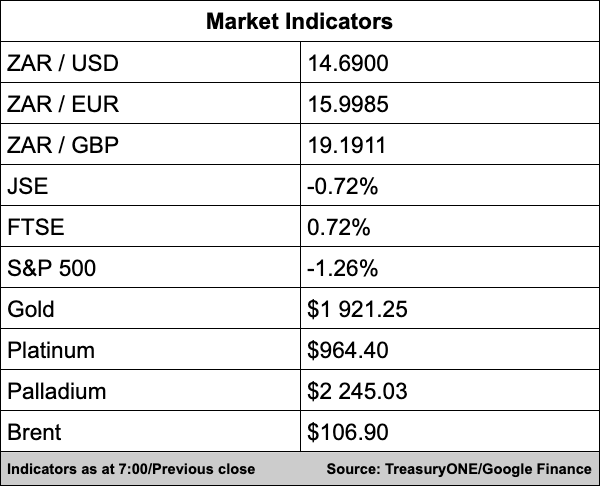

Markets are betting on a 50 bp hike in April for the US along with a faster balance sheet reduction. The rand fell by over ten cents yesterday and this morning the local unit is trading at R14.70/$.

On the commodity front, gold and platinum are trading flat at $1,923 and $968 respectively, while palladium is stronger at $2,247.

Oil slipped to a lower close with the stronger dollar, pandemic concerns and new sanctions on Russia affecting the price. Brent crude is currently trading at $107 a barrel in the Far East.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

Here are the new Covid rules for workers and businesses in South Africa – including mandatory vaccinations – Business Tech

MTN taps JPMorgan to separate fintech unit – Fin24/Bloomberg

BMF and PIC to demand meetings with Absa board to explain CEO’s appointment – The Citizen

Global Business

Musk Gets Twitter Board Seat After Stake-Purchase Surprise – Bloomberg

US, EU to Hit Russian Investments With New Round of Sanctions – Daily Maverick/Bloomberg

Ukraine war: Chanel restricts sales of goods to Russians abroad – BBC

Markets

Dollar and Treasury Yields Dent Safe-Haven Appeal – Investing.com

Asian markets track Wall St retreat on hawkish Fed bets – AFP

Oil Pares Declines as EU Avoids Sanctions on Russian Crude – Daily Maverick/Bloomberg

Tech

Twitter to Test Edit Feature, Says Work Began Before Poll – Bloomberg

Canada to Force Google, Facebook to Pay News Publishers – Bloomberg

The team that built an AI to dominate poker is now picking stocks – The Next Web