(Bloomberg) — Treasury Secretary Janet Yellen is counting on the support of corporate America for a recently agreed global tax deal to help win passage in the U.S. Congress — a crucial step for its worldwide success.

The problem with that plan: Big business is nowhere near backing the plan. Executives at eight major U.S.-based multinational corporations interviewed by Bloomberg said that far too much remains unknown about the deal, whose fine print is still being negotiated.

Corporate leaders agree that international tax rules need reform and that the groundbreaking global deal Yellen secured last year could deliver important benefits to them by helping to reduce disputes and prevent trade wars. But they also called the plan overly complex and expressed little confidence it would be implemented fairly and uniformly around the world.

The executives represent firms across more than eight industries with a combined $600 billion of annual revenue — each likely exceeding the thresholds for the proposed new global tax rules. They spoke on condition of anonymity to offer candid comments on the accord.

Most of the executives said some version of deal can eventually be finalized, but not on its current, ambitious timeline, which aims for implementation by the end of 2023. Some say it may never fly at all.

Not Guaranteed

Many Republicans are opposed to the accord, and the November midterm elections could give them control of one or both chambers of Congress, adding urgency for Yellen. In a February interview, she stuck to her view that enough Republicans will eventually support the deal because U.S. companies will ask them to.

But the interviews with U.S. company executives indicate such support is far from assured.

“I think there’s a willingness to make it to that finish line,” said Alexandra Minkovich, a partner in the North American tax practice at law firm Baker McKenzie, whose comments echoed those from many executives. “But the mere fact that it’s a political process means the ultimate outcome can’t be guaranteed.”

Two senior administration officials, also speaking on condition of anonymity, said they are acutely aware that companies still lack the information necessary to make a final judgment on whether to support the accord. Still, they remain confident that once the deal’s details are ironed out and made public, corporations will prefer that outcome to a world without the agreement and a continued deterioration of the global tax landscape.

In the meantime, the Treasury is continuing to solicit feedback from businesses and lawmakers and incorporating that feedback as it works to resolve all the deal’s open issues, the officials said.

Long Slog

Negotiators already have made remarkable progress toward a transformational agreement in a very short period.

The Organization for Economic Cooperation and Development had tried for eight years to find a plan that would address rampant cross-border profit shifting that was costing governments an estimated $100 billion to $240 billion in tax revenue each year. But talks at the OECD had stalled, until Yellen and a team at the Treasury revived them in early 2021.

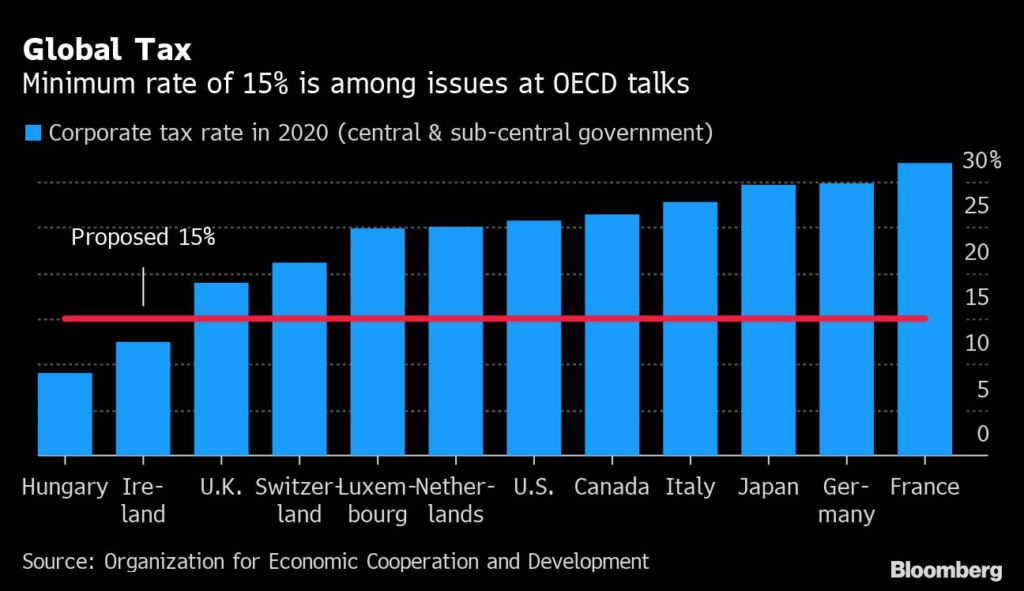

What emerged by mid-year was a two-part deal that would introduce a 15% global minimum tax and reallocate some taxing rights from nations where profits are booked to those where revenue is generated — giving so-called market countries a fairer slice of the taxes imposed on the largest multinational corporations.

Importantly, the deal would also ban so-called digital services taxes that target cross-border electronic commerce.

For multinational companies, it promised a trade-off: higher taxes in exchange for a more predictable tax landscape, with relief from the rapidly rising number of tax disputes and potential trade wars. Several executives recognized the attraction — certainty, they said, is invaluable to a business leader.

Last October, government heads from about 135 countries endorsed the agreement. It was a stunning achievement, but the new plan was nowhere near complete. “Technical” talks, the OECD said, would continue.

The executives who spoke with Bloomberg made clear they see these unresolved details as important enough to make or break the overall deal.

One company engaged in substantial digital commerce — and thus hit harder by digital services taxes — was generally enthusiastic for the deal. Trade groups including the Information Technology Industry Council and the Computer and Communications Industry Association, praised the agreement and Amazon.com Inc. issued a statement welcoming the “consensus-based solution for international tax harmonization.”

But for the rest, not enough is known yet about the formula for reallocating taxing rights. Without that, they said, the firms can’t begin to estimate how their overall tax exposure will change.

Many are also deeply worried about the complexity of the reallocation, as it will require them to report on the ultimate destination of their products. A plan intended to offer certainty, they said, may simply deliver a compliance nightmare.

Executives whose companies aren’t engaged in significant digital commerce expressed resentment about being dragged into a framework where taxes are reallocated in exchange for giving big tech companies relief from digital services taxes — something which wouldn’t benefit them.

The full reallocation plan won’t be available until at least June, leaving firms in the dark for now. That will also leave Congress — where legislating will grind to a halt in August through the midterm elections — little time to consider how and whether to write the plan into U.S. law before a potential change in partisan control.

Forgone Benefits

Meanwhile, new details on the minimum-tax rules released by the OECD in December have alarmed many U.S. firms and lawmakers. They worry the new system will prevent companies from benefiting from some tax incentives the U.S. offers, like credits for research and development.

The Treasury is working with Congress to adjust its proposal for bringing U.S. tax law into line with the global minimum rules in a way that offers U.S. firms more protection, but the process appears bogged down. Legislation incorporating the global corporate minimum tax was originally embedded in President Joe Biden’s longer-term economic agenda package, currently stalled in the Senate.

At the same time, European Union officials are having more trouble than expected adopting a directive for the minimum tax inside the 27-member trading bloc.

These hiccups introduce a troubling scenario, since all the big partners to the deal need to remain confident in the schedule for implementation. No one wants their own companies exposed to a new set of rules well ahead of others, so one set of delays can cascade across the globe.

Enforcement Worries

U.S. executives also repeatedly expressed a lack of confidence over whether the minimum tax would be codified and enforced in a uniform way, when and whether digital services taxes would be eliminated, and whether the deal would come with a credible and robust dispute resolution mechanism — a feature many executives said was critical.

Most of the executives believe some version of the plan will eventually be implemented, maybe years from now. But that didn’t mean they would urge Congress to adopt it — making Yellen’s prediction look shaky.

Peter Barnes, a tax specialist at the law firm Caplin & Drysdale, said he expects the lobbying picture to remain mixed as the agreement’s details are ironed out.

“I don’t think it will be uniform, and when the business community cannot say with one voice, ‘We want this,’ then it’s very hard for Congress to act.”

(Updates with context on legislation in second paragraph after ‘Forgone Benefits’ subheadline.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.