We start this morning with the big global business story of the week, SA-born tech billionaire Elon Musk purchased a large stake in Twitter and snagged a seat on the board, which means the sometimes-erratic Musk could be in a prime position to shake things up at the social media giant.

At the start of the week, we heard the news that Musk had purchased 9.2% worth of shares in Twitter, which would make him the largest single shareholder at the company.

Twitter stock surged 25% on the New York Stock Exchange and by the closing bell on Tuesday his stock was worth roughly $3.73 billion.

But new fillings show that Musk has carefully carved out this position for himself, systematically buying Twitter stock almost every day since January.

What the new fillings revealed was the initial reporting that Musk would be a passive shareholder in the company wasn’t correct.

“On Monday, Musk’s ownership stake had been disclosed via a 13G filing, which indicates a passive stake, or when a shareholder doesn’t try to exert influence.

The new 13D filing, instead, confirms that the Tesla chief will be an active investor who looks to hold sway over Twitter’s business and operations,” reports Business Insider.

A day after the deal was announced, Twitter moved to add Musk to the board of directors with CEO Parag Agrawal saying he was excited about having Musk on the board and called the Tesla and SpaceX chief executive a “passionate believer and intense critic of the service, which is exactly what we need on Twitter.”

Wired magazine summed up Musk’s appointment in a great headline, “Elon Musk is on Twitter’s board.

What could go wrong?”

Musk has already indicated he won’t be an idle board member and will surely look to play an active role in the direction the company takes after he sent out a poll on his Twitter account asking his some 80 million followers whether the service needed an edit button.

Twitter has since said they were already testing whether to implement an edit function.

“Turns out he likes to take advice from his Twitter followers – as was the case in his highly publicised Twitter poll last year when he asked his followers if he should sell 10% of his Tesla stock.

Although he then sold $14.1 billion in shares in two transactions to pay an outstanding tax bill,” comments tech writer Toby Shapshak in his weekly newsletter.

Shapshak writes that Musk has been a fierce critic of the social media company over the years for a lack of free speech among other issues but has also praised the service during other times.

The only consistency when it comes to Elon Musk’s use of Twitter is his inconsistency and contradictive opinions.

Time will tell what Musk’s big plans for Twitter are and whether this whole transaction is yet another Muskian showmanship ploy.

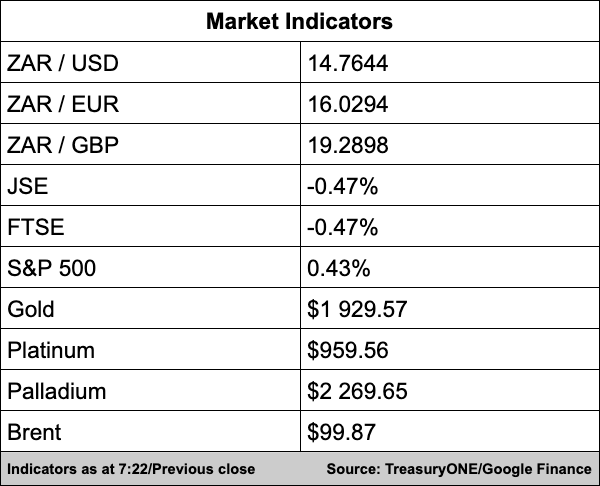

In the markets, metals prices closed slightly stronger last night but a stronger dollar has seen some pullback in gold and platinum during morning trade.

Gold is currently at $1,929 and platinum at $958, while palladium is trading 1.5% stronger at $2,270. Brent crude is down 3% for the week with the US releasing strategic reserves. Brent is currently below the $100 level and is at $99.75 a barrel.

In the currency markets, the dollar is trading on the front foot this morning while emerging market currencies are generally trading weaker in the Far East.

The rand is currently trading flat at R14.77/$ with traders keeping an eye on a break above R14.80/$, which would bring the R15.00/$ level back into play, comments TreasuryONE.

Here’s a roundup of the world’s top and most interesting headlines:

SA Business

How much money South Africa’s cellphone networks make – MyBroadband

SA’s vital foods price volatility hurts the poor – The Citizen

More than R12 trillion needed to support SA’s transition to net zero – report – Fin24

Global Business

Elon Musk made extra $156 million from his Twitter investment by failing to disclose his stake earlier – Business Insider

Microsoft’s CEO Warns of the Impact of All Those Late-Night Emails – Bloomberg

Renault Chief to Meet Nissan in Japan as Woes Cloud Alliance – Bloomberg

Markets

Oil Down, Set for 3% Weekly Drop Over 210-Million-Barrel Emergency Release – Investing.com

Dollar Up, Potentially Tighter U.S.

Monetary Policy Continues to Provide Support – Investing.com

Asian markets struggle to track Wall St on hawkish Fed – AFP

Tech

Meta working on virtual coins for its apps that employees have nicknamed ‘Zuck Bucks’, report says – Business Insider

Apple, Facing Outcry, Says App Developers Are Thriving on iPhone – Bloomberg

China Targets Big Tech’s Algorithms as Crackdown Persists – Bloomberg