(Bloomberg) — For years, Fridays at Beef ‘O’ Brady’s, a sprawling restaurant chain in the Southeast, meant one thing: the steak-and-shrimp special.

But in January, Chief Executive Officer Chris Elliott saw signs that consumers were feeling the squeeze of soaring inflation. So he took the $12.99 surf-and-turf dish off the specials list, replaced it with a fish-and-chips platter and slapped a $9.99 price tag on it. Even with the change, though, customer traffic has been flagging in recent weeks.

“People are looking for deals; they’re getting hammered everywhere — at the gas station, at the grocery store,” said Elliott, who acknowledges that restaurants, including his own, have also been raising prices.

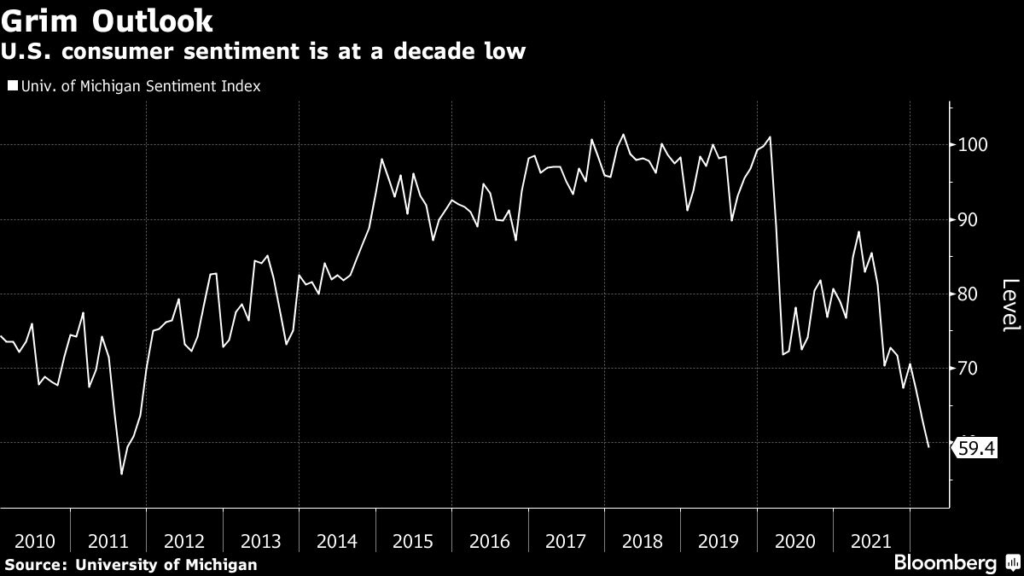

One year into the inflation spiral that has rocked the U.S. economy, lower-income consumers are starting to shift spending patterns. They’re cutting back on more expensive items, ramping up on cheaper ones and forcing restaurants, grocery stores and retailers to rejigger their sales strategies. This marks a major break from 2021, when consumers, still flush with pandemic stimulus and newly won pay raises, kept spending at a frenetic pace even as annual inflation surged to a four-decade high.

“Consumers are becoming more sensitive to price,” said Krishnakumar Davey, president of strategic analytics at IRI Worldwide, a provider of market research and data. “March is the turning point.”

The dropoff in spending, executives and analysts say, is most pronounced in lower-income families as inflation overtakes those wage gains. Food prices rose 7.9% in February from a year earlier, the largest gain since July 1981. Updated U.S. inflation figures for March will be released on Tuesday. While job gains and a jump in savings mean the pandemic-era shopping boom may not be completely over, it’s clearly slowing.

Bank of America data show that households making less than $50,000 annually increased card spending by only 4% in March — about a third of the rise for those who earn more than $125,000 a year.

More than a third of U.S. households brought in less than $50,000 in 2020, excluding government stimulus payments, according to a Census Bureau report in September. That would total about 49 million households. Those in the lowest-income quintile spend 18% of their income on food and energy, compared with 11% in the highest one-fifth group, according to Bloomberg Economics.

This underscores the urgency of the Federal Reserve’s mission to restore price stability. Governor Lael Brainard highlighted the dynamic last week, noting that some families feeling crunched can shift to buying private-label goods. But for those already purchasing cheaper options, it won’t be as simple. Those shoppers “would have to either absorb the increase in cost or consume less,” she said.

Those in the food business are trying to adjust. Denny’s Corp. is promoting a $6.99 all-you-can eat breakfast of pancakes, eggs and hash browns to entice customers who are “feeling the pinch at the gas pump,” Chief Brand Officer John Dillon said. But that same endless breakfast meal costs $8.99 in states where wages and commodity costs are running higher. And bacon? That’ll be an extra 99 cents.

Soaring prices at restaurants and retailers are a big reason why the average U.S. household will have to spend an extra $5,200 this year, or about $433 a month, for the same consumption basket, according to Bloomberg economists Andrew Husby and Anna Wong.

That doesn’t necessarily mean total consumer spending is poised to fall. In fact, economists are predicting an inflation-adjusted 3.1% gain after last year’s 7.9% jump, according to the median estimate compiled by Bloomberg. That’s still strong, and ahead of the average annual growth of 2.5% the U.S. posted from 2016 to 2019.

Indeed, there’s still plenty of cash to be spent. U.S. households are flush with an extra $2.5 trillion in savings built up over the pandemic, and inflation pressures will absorb only about a quarter of it, Husby and Wong said.

Even at the lower end, “consumers in the bottom 50% of incomes and wealth have never had more excess net worth or liquid assets,” Tavis McCourt and other analysts at Raymond James Financial Inc. said in a report. And with the job market booming, “we suspect it will take longer for consumers to show significant stress/slowing demand than one would normally expect,” they said.

Even so, shoppers are now looking harder for ways to save on groceries. Foot traffic at dollar stores, especially those of Dollar General Corp., has generally held up better than at traditional retailers, according to data compiled by Placer.ai, which uses mobile-phone data to determine traffic.

Big-Box Shift

Momentum is also shifting among big-box retailers. Target Corp. trounced Walmart Inc. in sales growth during the pandemic, and the company’s more upscale clientele positions it well for the future. But sales gains at Walmart have been stronger in recent months, according to Bloomberg Second Measure, which analyzes U.S. consumer transactions to measure revenue. That suggests shoppers are increasingly drawn to Walmart’s mantra of everyday low prices.

As recently as the fall, IRI, the market researcher, was predicting food inflation of 6% this year, with most of the increases coming in the first half. Now, it’s predicting a jump of between 8% and 11%. The sharp increase appears to be spurring a sales turnaround for private-label brands. Spending on generic-brand food recently ticked up after slipping during the pandemic, IRI’s Davey said.

With many unable to pay more, companies’ profits are likely to fall. Friendly’s Restaurants is giving away more discounts than in the past, and is also advertising big portions. CEO Craig Erlich said he hopes Friendly’s won’t have to raise prices this year. He’s simply not sure customers can keep up.

“That’s why we’re being mindful about not increasing prices significantly like we’ve seen out there,” he said. “It’s really a tough balance we face.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.