(Bloomberg) — Bitcoin’s tendency to move in tandem with technology stocks means the biggest cryptocurrency may slump to $30,000 by June, according to Arthur Hayes, the co-founder of crypto trading platform BitMEX.

Hayes, in a blog post on Monday, also said the same dynamic could drive Ether to $2,500.

The tokens traded at around $42,300 and $3,180, respectively, at 12:43 p.m. in Hong Kong. Hayes said he’s buying “crash” puts expiring in June on both coins, while pointing out that’s he’s overall in a “long crypto position.”

Expectations for a series of interest rate increases by the Federal Reserve in coming months have weighed on crypto and tech stocks recently, with the Nasdaq 100 Index losing 3.6% last week and Bitcoin briefly dipping below $42,000 on Monday.

The Fed may need to hike interest rates above 4%, Goldman Sachs Group Inc. Chief Economist Jan Hatzius said Friday.

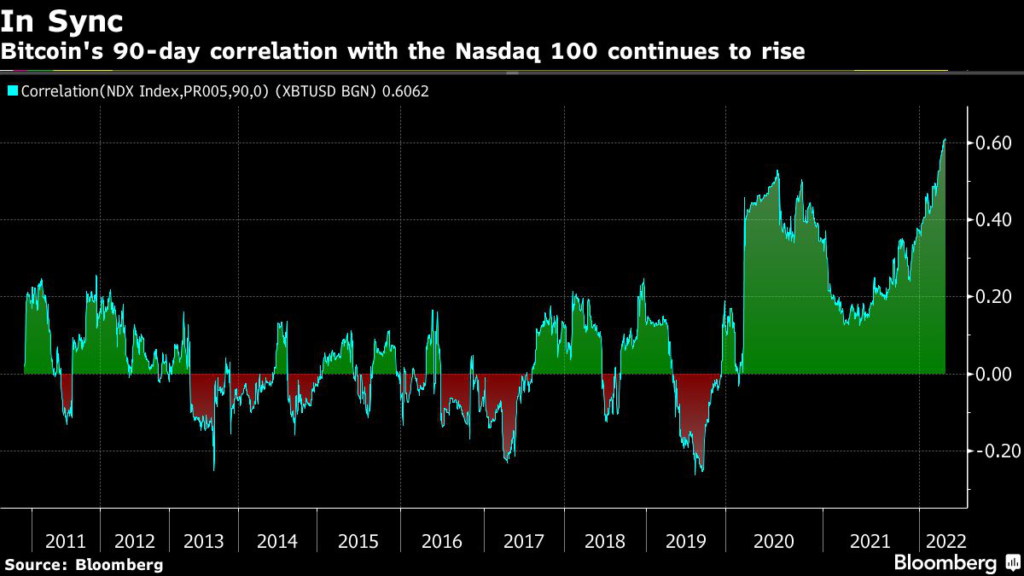

Bitcoin’s 90-day correlation with the Nasdaq 100 is at a record, undermining the token’s appeal as an instrument for diversification.

The combination of weakening global growth and less accommodative central banks will weigh on tech stocks, and by extension, crypto, Hayes said. He acknowledged that his predictions for Bitcoin and Ether are mainly based on a “gut feeling.”

Crypto markets “will lead equities lower as we head into the downturn, and lead equities higher as we work our way out of it,” he wrote.

“Bitcoin and Ether will bottom well before the Fed acts and U-turns its policy from tight to loose.”

Hayes, who is awaiting sentencing after he and fellow BitMEX co-founder Benjamin Delo admitted in February they failed to establish an anti-money-laundering program at the cryptocurrency exchange, has been sounding a cautious note on digital assets of late.

“As we move into year end and 1Q 2022, I don’t see how we can take out Bitcoin at $69,000 or Ether at $5,000,” he wrote Dec.

10, following a sharp drop in both tokens over the previous month. “I can imagine, though, a muddle-through, sideways, boring market with small bouts of downside volatility followed by a tepid recovery.”

That prediction proved prescient, with Bitcoin spending most of this year mired in its tightest trading range since mid-2020.

While crypto moved mostly sideways, bulls have pointed to accumulation by longer-term holders as a sign that digital assets were poised to break out of the rut.

Bitcoin Breakout Is Making Proponents Wary of Another Fakeout

“There are many crypto market pundits who believe the worst is over,” Hayes wrote in his latest post.

“I believe they ignore the inconvenient truth” that crypto prices are currently an indicator for the S&P 500 and Nasdaq 100, “and do not trade on the fundamentals of being peer-to-peer, decentralized, censorship-resistant digital networks designed for the transfer of money.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.