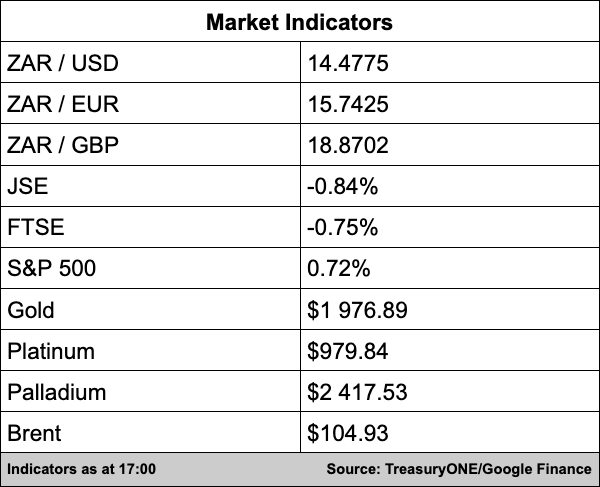

US inflation came out at 8.5% year-on-year, slightly higher than the 8.4% that was expected while the month-on-month increase was in line with expectations at 1.2%. The rand did not react much to the news and was trading at around R14.55/$ at the time of the announcement this afternoon.

Since the release of the data, riskier assets have been on the front foot with emerging markets following the trend. The rand broke below the R14.50/$ mark and will look to test the R14.40/$ level.

“This level could provide the rand with some resistance for further strength at first, but we will need to see how the markets continue to anticipate the Fed’s next move,” comments TreasuryONE.

The local unit is currently trading at R14.48/$.

Gold has also been on the front foot since the release of the inflation data with the yellow metal jumping up to $1,972. Platinum is slightly up for the day after trading as low as $966 at one point while palladium is down 1% with supply constraints and lower demand still being weighed up against each other.

Brent crude is currently trading 6% higher at $104 a barrel.

In Asian markets, Tencent stocks surged as much as 5% in morning trade on the Hong Kong stock exchange, joining the rest of China’s gaming industry in a rally after regulators approved the first new batch of gaming titles in more than eight months, reports Bloomberg.

China’s easing of gaming approvals will likely help ease market anxiety that’s plagued the sector.

“But investors are also confronted with other headwinds, including a surge in Treasury yields before U.S. inflation data due later, and a dimming growth outlook for China as lockdowns continue,” reports Bloomberg.

Local JSE heavyweights Naspers and Prosus, which have a stake in Tencent, didn’t react favourably to the news as both declined by 4.05% and 3.06% respectively.

The bourse was also dragged down for a second consecutive trading session, losing 0.84% with the All Share Index at 73,802 points.