(Bloomberg) — Ukraine expects Russia to widen its offensive in the east of the country this week, President Volodymyr Zelenskiy said, echoing a U.S. warning which also predicted “a more protracted and a very bloody phase” of the conflict.

Russian troops will likely maintain a push to take the port city of Mariupol as well as other targets, Urkaine’s military staff said. Moscow is pursuing the goal to seize the whole Donbas region, which has been partially occupied by self-proclaimed separatist republics.

The mayor of Mariupol said more than 10,000 civilians had died in the city since the invasion, and Poland’s prime minister predicted Europe would soon see its biggest tank battle since World War II.

(See RSAN on the Bloomberg Terminal for the Russian Sanctions Dashboard.)

Key Developments

- Global Oil Market Swings From Chaos to Calm as War Shock Ebbs

- Biden, Modi Talk About Managing Ukraine Fallout Amid Tensions

- Russia’s Export Windfall Catapults Key Trade Barometer to Record

- Europe Moves to Arm Ukraine as Sanctions Fail to Sway Putin

- Ukraine Seeks Russia Assets, Oil Fleet Seizure as Reparations

All times CET:

Inflation in Ukraine Surged Last Month (9:30 a.m.)

Ukraine saw a rapid increase in prices for food staples, drugs and fuel last month, as Russia’s invasion disrupted supply chains and complicated access to imports, according to the country’s central bank.

Fuel costs rose by 30% from the previous year due to soaring prices in global markets and Russia’s targeting of Ukraine’s oil-storage facilities, even though the government scrapped sales and excise taxes on fuel to help ease the burden on consumers. Annual inflation accelerated to 13.7% from 10.7% in February.

Asos Warns of Earnings Impact (8:30 a.m.)

British online fashion retailer Asos said its full-year earnings goal is at risk due to the fallout from Russia’s war in Ukraine and accelerating inflation. U.S. consultant Accenture completed an exit from its Russian business following a transfer to several of its local leaders.

Finnish 5G Gear Maker Nokia to Exit Russia (8 a.m.)

Nokia will exit the Russian market after having suspended deliveries, stopped new business and initiated a move of its limited R&D activities out of Russia in the past weeks, the Espoo, Finland-based telecommunications networks maker said.

Russia accounted for less than 2% of net sales in 2021 for Nokia, whose rival Ericsson on Monday said it had suspended business with customers in Russia “indefinitely” and put about 600 staff on paid leave.

Oil Rebounds After Fall That Erased War Gains (7:31 a.m.)

Oil rebounded after a tumble that saw crude erase most of the gains sparked by Russia’s invasion of Ukraine. China’s virus outbreaks and mobility curbs are imperiling demand as it locks down Shanghai and other areas in pursuit of a Covid Zero strategy that has made it a global outlier in handling the pandemic.

The next major test for markets looms later Tuesday, when the U.S. is expected to unveil an inflation print for March of more than 8%. The Ukraine war is disrupting flows of essential commodities, and China’s lockdowns are straining supply chains.

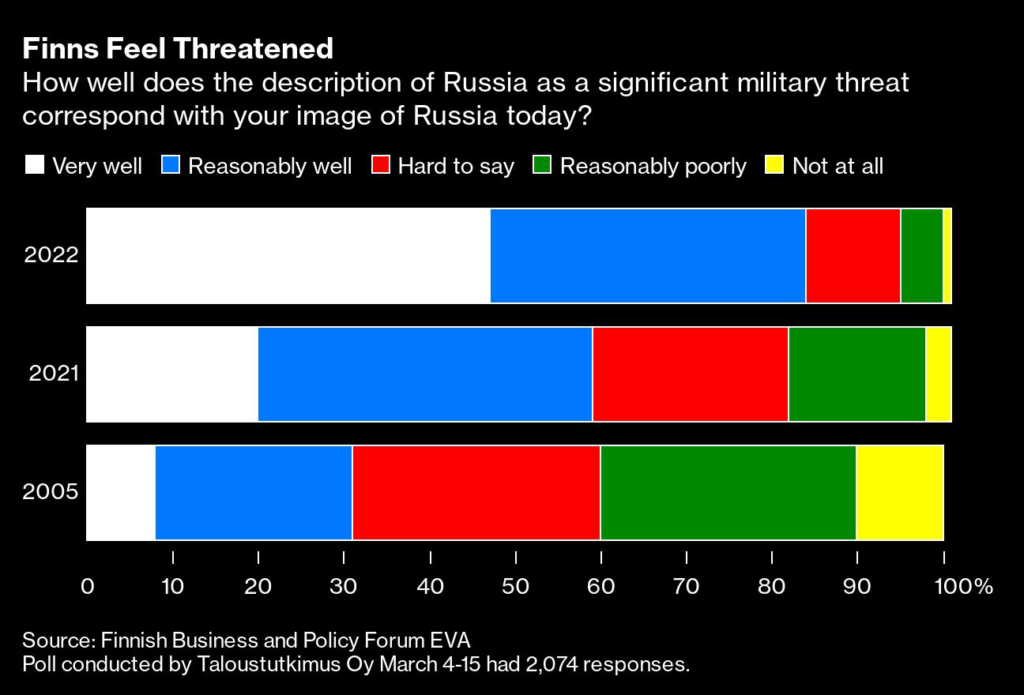

Russia Significant Military Threat, Say Finns (5:23 a.m.)

Some 84% of Finns believe Russia poses a significant military threat, according to a survey by Finnish Business and Policy Forum EVA, with the government set to kick off a process that may culminate in an application to join NATO.

In 2005, fewer than one in three in the Nordic country with a 1,300-kilometer (800-mile) border with Russia considered Moscow a major threat. The change helps explain why Finns now back NATO membership, with the government seen leaning toward an application within weeks.

War Damage Amounts to $270 Billion, Minister Says (3:10 a.m.)

Ukraine’s infrastructure war damage is an estimated $270 billion, Finance Minister Serhiy Marchenko told the Financial Times. Some 7,000 residential buildings have been damaged or ruined, about 30% of Ukrainian companies have ceased operations and electricity consumption has dropped 35%, the minister said.

Despite that, Ukraine plans to continue servicing its debt and expects to avoid borrowing restructuring, he said. Last month, the country paid $292 million on a dollar-denominated Eurobond maturing in September.

“A lot of politicians advise us to talk about restructuring but that is not our policy,” he said, adding Ukraine expects to access financing and continue to issue external debt.

Japan Sanctions Putin’s Daughters (2:42 a.m.)

Japan’s government announced asset freezes on 398 individuals, including the two adult daughters of Putin as part of its latest round of sanctions over the war in Ukraine. Russian Foreign Minister Sergei Lavrov’s wife and daughter were also added to list.

Asset freezes were also expanded to 28 entities including the country’s biggest bank Sberbank.

Biden, Modi Discuss Managing Ukraine Fallout (2:37 a.m.)

U.S. President Joe Biden and his Indian counterpart Narendra Modi held a candid discussion Monday about how to counter the fallout from Russia’s invasion of Ukraine, a senior U.S. administration official said.

“The president has made clear that he does not believe it’s in India’s interest to accelerate or increase imports of Russian energy and other commodities,” White House Press Secretary Jen Psaki told reporters.

Modi, via a translator, said he’d been appealing for peace and called the killings in the Ukrainian city of Bucha “very worrying.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.