The JSE extended its losses for a third successive trading session and is yet to close in the green this week. The bourse lost a further 0.91% today with the All Share Index at 73,129 points

Sasol said it would no longer consider a planned gas supply pipeline stretching from northern Mozambique to South Africa with chief executive officer Fleetwood Grobler citing a global shift away from fossil fuels as part of the reasoning, reports Bloomberg.

Sasol’s share price rose 2.9% in afternoon trade but gave back some of those gains to close trade 1.21% up.

Bloomberg reports South Africa will aim to attract around $900 million of annual investment in the exploration of its mineral wealth by “removing bottlenecks, improving resource-mapping and diversifying its focus away from precious metals.”

Mining counters Glencore (1.01%), Anglo American (1.30%), and AngloGold Ashanti (1.43%) all added while Sibanye Stillwater (-0.63%) and Gold Fields (-0.25%) lost.

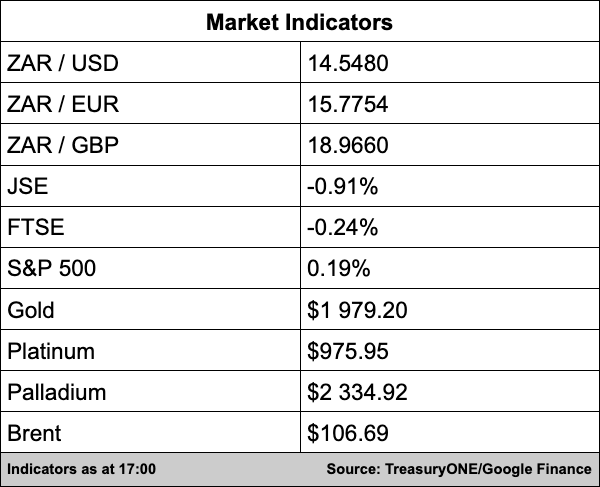

In the currency markets, the rand moved in unison with the dollar this morning as it has done for the last couple of days with the local unit threatening to break below the R14.45/$ level.

“A mixture of the Rand being overdone and something that had to give as both EM and the US dollar could only trade in the same direction for a certain time, the Rand and other EM currencies weakened a little in afternoon trade,” comments TreasuryONE.

The rand is currently trading at R14.55/$ and should this momentum continue, a short-term move to R14.70/$ cannot be ruled out.

On the commodity front, with higher inflation worldwide, gold rallied to $1,975 and is within reach of the $2,000 an ounce mark if the current momentum is to hold.

“Platinum and palladium are also in the green, with both metals trading at $975 and $2,354, respectively. Brent crude failed to sustain the break below $100 per barrel and is currently trading at $106.43 per barrel.”