(Bloomberg) — Infosys Ltd. gave a sales forecast that trailed analyst estimates, signaling slowing demand for software and IT services as companies exit work-from-home arrangements in a post-pandemic world.

Revenue this fiscal year ending in March 2023 will increase 13% to 15% in constant currency terms, lagging the 17% growth analyst had projected on average. The stock slid more than 6% in New York.

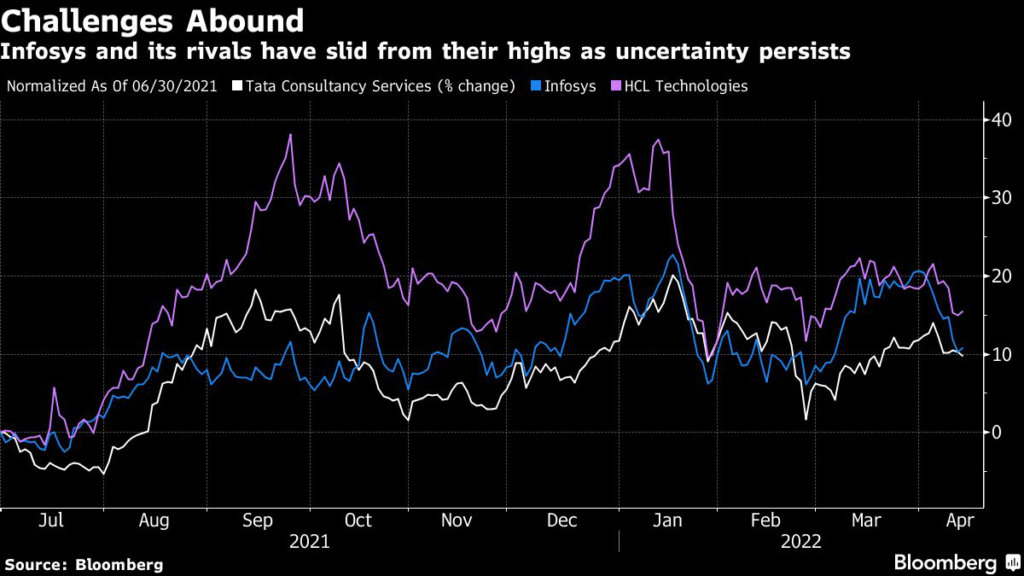

Infosys, a bellwether of India’s showpiece $227 billion IT sector, and rivals including Tata Consultancy Services Ltd. are facing a potentially cooling market as customer organizations’ employees return to workplaces, lessening the demand for software and services that were needed to set up remote connections. Meanwhile, uncertainty surrounding the war in Ukraine could weigh on new orders from Europe. The IT providers are also facing margin pressure as a shortage of tech talent boosts the costs to hire and retain employees.

Infosys had less than 100 people working in Russia and the company was transitioning work outside, Chief Executive Officer Salil Parekh said at a post-earnings conference call.

Profit for the fourth quarter through March rose about 12% to 56.9 billion rupees ($747 million). Analysts had expected a profit of 60 billion rupees.

Bigger rival TCS on Monday reported a 7.4% increase in fourth-quarter profit to 99.3 billion rupees, as rising employee costs partly offset higher demand.

India’s outsourcers are seeking to maintain the momentum they gathered during the pandemic as enterprises across the world scaled up their online presence, boosting demand for services ranging from cybersecurity to cloud and payments.

“In all of our discussions, clients are more and more ready to spend — much more focused on the cloud area, very much on the data analytics business, on IoT and lot of discussion on automation,” said Parekh.

(Updates with share action in second paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.