Traders cheered the recovering Asian markets during morning trade with Tencent, which can often give the JSE direction through Naspers and Prosus’ stake in the Chinese tech giant, which is up 0.21% for the day.

The bourse firmed during morning trade “along with its global peers as the focus remained on inflation and the response of central banks,” reports Business Day.

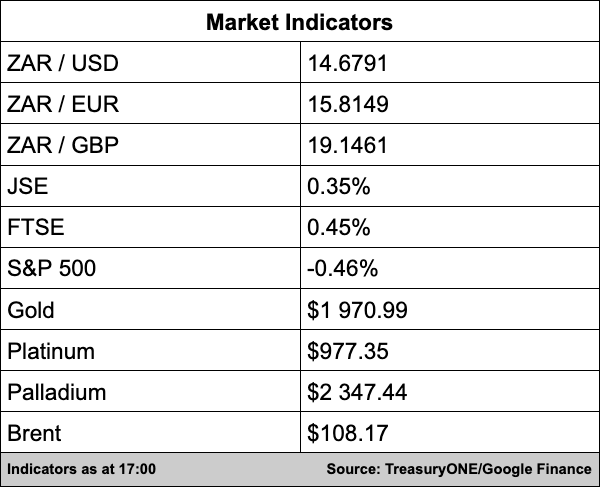

The JSE’s All Share Index was up 0.6% mid-morning on Thursday, with Richemont gaining almost 4%. The rand was almost a per cent weaker at R14.61/$.

The bourse almost lost its footing before close but broke a three-day losing streak after spending seven of the past eight sessions in a downward slide to enter the Easter weekend by adding 0.35% and the All Share Index at 73,383 points.

Thungela Resources, the country’s largest exporter of coal burned in power stations, slumped as much as 9.3% at one point but firmed in afternoon trade to close 4.68% down. The downward slide comes against the news that Transnet “is sending out force majeure notices to coal miners in South Africa as shipments of the fuel slow, potentially affecting exports at a time global prices are running high,” reports Bloomberg.

Thungela expects the rail bottlenecks to affect transport for at least another six months.

Miner Exxaro Resources (0.20%) also received the force majeure and said it had consulted with legal advisors over the notice.

On the international front, it has been a rollercoaster ride for Twitter with Elon Musk first announcing he had acquired a large stake in the social media company, then Twitter offered Musk a seat on the board, which Musk reportedly accepted before he said he would not be joining the Twitter board.

Today, Musk made a $41.4 billion offer to buy Twitter in its entirety and take the company private. Twitter’s share price surged 12% in pre-market on Thursday. At the time of writing, the share price was up just under 2% on the New York Stock Exchange.

In the currency markets, the rand started to show some cracks yesterday in the face of the US dollar’s strength and the trend continued into today’s trade. The local unit traded weaker and drifted towards R14.70/$ with the rand currently trading at R14.68. If the trend continues the local currency could test the upper band of the range at R14.80/$ soon.

Commodities were a mixed bag today with “red and green splattered across the board,” comments TreasuryONE. Gold is trading lower at $1,970, platinum and palladium are at $979 and $2,342 respectively while Brent crude continued its upward march and is currently trading at $108 per barrel.