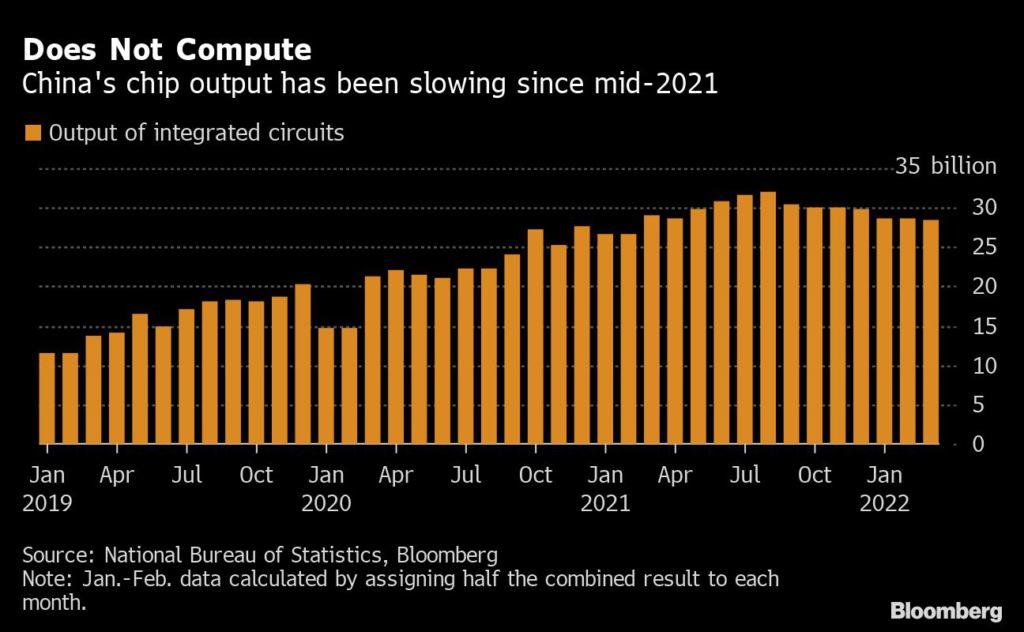

(Bloomberg) — China’s quarterly production of semiconductors shrunk for the first time since early 2019 as consumer electronics demand softened and Covid-triggered lockdowns in regions including Shanghai disrupted output.

Output of integrated circuits dropped 4.2% in the first three months of the year as chipmakers reported a steeper decline in March, according to data from the National Bureau of Statistics. It was the worst quarterly performance since the first quarter of 2019 when the country’s chip output slumped 8.7%.

China has put Shanghai, a key chipmaking hub, into a month-long lockdown as Xi Jinping’s administration tries to stop the spread of Covid infections. The nation’s biggest chip manufacturers, from the Semiconductor Manufacturing International Corp. to Hua Hong Semiconductor, have struggled to source some components due to traffic controls imposed by local authorities. Chip production dropped 5.1% in the month of March.

A number of executives from Chinese auto and hardware companies expressed concerns over supply chain disruptions last week as more regions announced stricter prevention measures following reports of local Covid cases. Those include the tech manufacturing hub of Kunshan and Zhengzhou, home to the world’s largest iPhone factory.

Tech factories across the country could be forced into production halt after May if suppliers in Shanghai remain closed, Huawei Technologies Co. Executive Director Richard Yu wrote in a WeChat post last week.

“The economic loss will be immense,” said Yu, who oversees the Chinese company’s smartphone and smart car businesses.

The Ministry of Industry and Information Technology has sent officials to help chip companies in Shanghai resume production despite the lingering Covid infections in China’s biggest city.

For years, Beijing treated home-grown chip industry as a strategic industry and a key component of its race for tech supremacy. Its chip output enjoyed double-digit growth for years amid the trade war with the United States although China still imported more than $432 billion worth of chipsets in 2021, according to China Semiconductor Industry Association.

Sluggish demand from consumer electronics sector also bodes poorly for some Chinese chip firms. Demand for smartphones, PCs and TVs has been hurt by China’s lockdown measures, according to Mark Liu, chairman of Taiwan Semiconductor Manufacturing Co.

Jefferies analyst Edison Lee wrote in a note this month that “demand from smartphone and some consumer electronics is very weak.”

“Smartphone is a meaningful part of semi demand, but how long does it take for that weakness to transmit to foundries remain uncertain,” Lee said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.