Following the long weekend, the JSE spent the day in the green and by the close of the first local trading session of the week, the bourse added 0.61% with the All Share Index at 73,830 points.

The bourse opened in the green, facing mixed Asian markets and had gained 0.9% at one point in morning trade as investors tried to make sense of hawkish Fed comments that could see the US Fed tighten policy amid global growth concerns brought on by the war in Ukraine, reports Business Day.

The International Monetary Fund (IMF) said global expansion would slow to just 3.6% in 2022, down from the 4.4% forecast in January before war broke out between Russia and Ukraine, reports Bloomberg.

The IMF also projected inflation would increase even faster, after the invasion of Ukraine and renewed lockdowns in China.

Africa’s largest fishing firm, Oceana, said earnings would drop off significantly in a trading statement update released on Tuesday. The Cape Town-based group, which owns brands like Lucky Star, Ocean Lobster and Daybrook Fisheries advised shareholders that expects headline earnings to decrease between 46% and 56% for the six months ended March 31.

The fishing firm cited lower levels of inventory for the period brought on by the July 2021 unrest in KwaZulu-Natal as a reason for the drop off in earnings.

The group’s share price lost 0.44% today.

Spur Corporation (2.53%) is facing a R183 million damages claim from GPS Foods Group RSA who served Spur Corp with a summons for alleged damages related to a joint venture for a rib supply and processing facility, reports Moneyweb.

The rand fell to its lowest level since February and by midday was trading 1.5% lower against the US dollar – as Russia’s onslaught in eastern Ukraine brought with it market jitters.

“We have seen the Rand being the worst-performing EM currency today, and the upper end of the R14.40/80 range has finally been broken. With a bit of risk-off coming from renewed fighting in Ukraine, the coronavirus shutdown, a stronger US dollar globally and locally, and the announcement of stage 4 load shedding, we expect the Rand to trade slightly weaker,” comments forex trading house TreasuryONE.

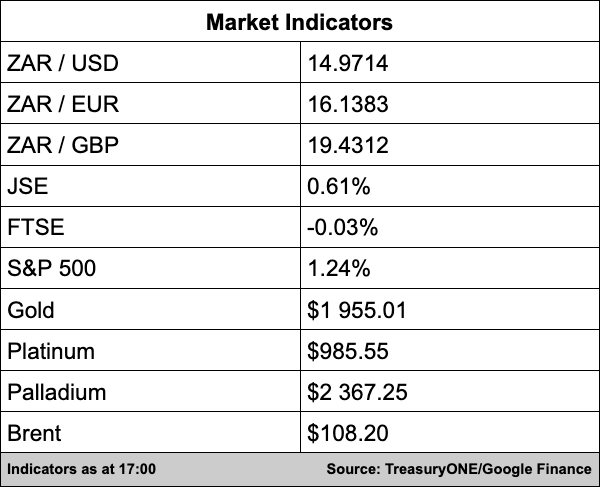

The local unit is currently trading at R14.97/$.

On the commodities front, gold has fallen away sharply and is currently trading at $1,960 per ounce. Platinum and palladium have also traded weaker today at $988 and $2,360 respectively.

Brent crude is down more than 4% today and is trading at $108.14 a barrel.