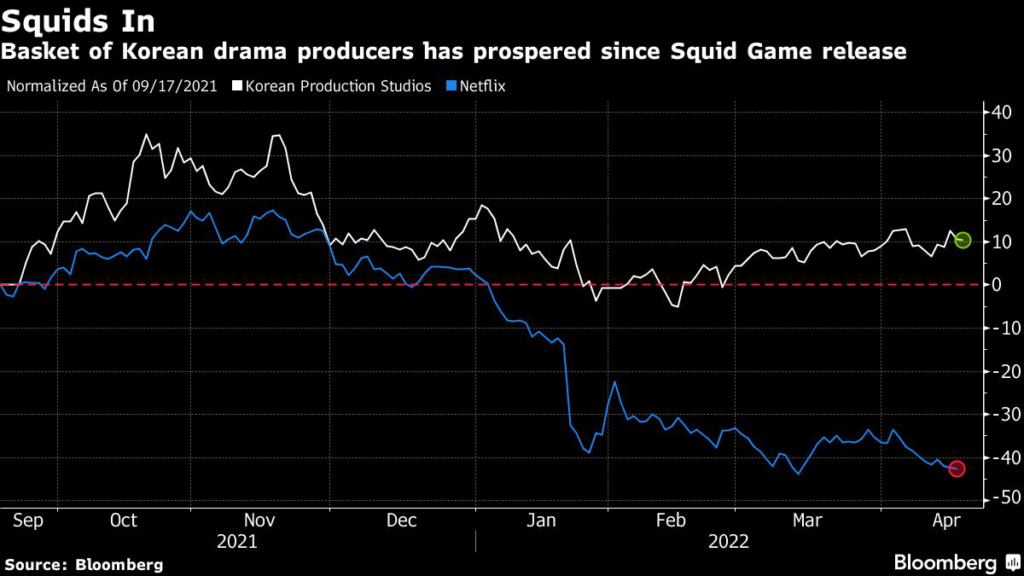

(Bloomberg) — “Squid Game” may not be boosting Netflix Inc.’s lagging stock price any more but its impact continues to bolster the shares of Korea’s production studios.

An equal-weighted basket of local drama producers remains more than 10% higher since the South Korean television phenomenon first aired in mid-September last year, versus a more than 40% slump in Netflix. Investors are betting demand for so-called K-Dramas will continue to grow on multiple platforms, after the global success of the U.S. streamer’s most popular series ever.

Walt Disney Co., Apple Inc. and Warner Media are among other big names seeking to offer Korean language titles and local originals, while domestic streaming services like TVing aim to increase their offerings to lure subscribers. Netflix announced its biggest lineup of Korean shows ever in January — more than 25 programs this year — after a six-fold global rise in viewing hours for Korean shows in 2021.

Netflix shares tumbled more than 20% in after-hours trading Tuesday, after announcing subscriber losses for the first time in a decade.

“So many people living overseas are watching Korean drama,” said Lee Kihoon, an analyst at Hana Financial Investment. “Netflix’s share price is irrelevant to drama production companies as long as Netflix continues to invest in South Korea.”

Netflix Hunts for Subscribers in Asia After ‘Squid Game’ Success

Competition to develop the next Korean blockbuster series has intensified since the resounding success of Squid Game — a show about heavily-indebted people playing a deadly childhood game to win huge prize money.

More than a dozen local production studios are listed in South Korea, many of them in the smaller Kosdaq index. Set to be flush with cash from global players like never before, Lee forecasts that almost all of them will post record-high profits this year.

Investment from streaming services will help offset lower demand from local television broadcasters who have been the main source of income for the production studios in the past.

Original Series

The leader of the pack is Samhwa Networks Co., a $200 million studio whose shares have skyrocketed almost 80% this year. It will release a remake of The Mentalist, a crime drama, which could be the first original series on HBO Max in South Korea later this year.

The company — which was loss-making in 2020 — is forecast to post annual profit of as much as 20 billion won ($16.2 million) on just 90 billion won revenue, according to Hana’s Lee.

Bigger production studios such as Studio Dragon Corp. and Jcontentree Corp. plan to create more than 30 titles this year, their biggest ever, while Next Entertainment World Co. struck a deal to produce at least one title for Disney+, which was launched in South Korea last year.

Meanwhile, Korea accounts for about 5% of Netflix’s global content investment, and that might rise to about 10%, Lee forecast.

‘Squid Game’ Shakes Up Korean Stocks as Much as Netflix Viewers

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.