We start this morning with the return of load shedding, which began rearing its ugly head last week before some reprieve over the Easter weekend, only for Eskom to ramp it up yesterday and push the country into stage four power cuts.

While briefing the country, Eskom chief executive André de Ruyter said stage four load shedding was a “call to arms” for South Africa, adding the power utility has total unplanned outages of 15,672 megawatts, which has necessitated the need for the increase to stage four.

South Africa is in its 14th year of load shedding and it seems as if the problems Eskom faces are only getting worse with little light at the end of the tunnel.

What’s more, to add insult to injury, President Cyril Ramaphosa promised the nation that load shedding would be a thing of the past back in 2019 already.

Meanwhile, Eskom’s debt is still sitting at over R400 billion and coupled with global economic concerns related to growth and the repercussions of the flooding in KwaZulu-Natal saw the rand fall to its weakest level in months.

De Ruyter said Eskom did not have as good an Easter weekend as it had hoped with more wet coal plaguing the power utility, which has rendered it unable to produce enough power.

The Eskom chief warned there could be a total collapse of the grid if power cuts aren’t ramped up, which would take a week or longer to restore if the grid were to fail and it would bring with it detrimental effects to the economy.

MyBroadband explains what could happen if Eskom were to experience a total grid collapse.

Eskom said its best-case scenario would be for load shedding to come to an end by the end of the week and that a move to stage six load shedding was unlikely this week.

South Africa has had just under 14 days of load shedding this year, but Eskom thinks the winter could bring with it as many as 100 days of load shedding with wet and cold weather adding to the challenges the power utility has to overcome.

De Ruyter outlined six things government could do to increase the available electricity capacity.

One of the measures de Ruyter proposed, which would immediately bring more megawatts to the grid, is a simple regulatory change that would enable existing independent power producers to connect to the grid.

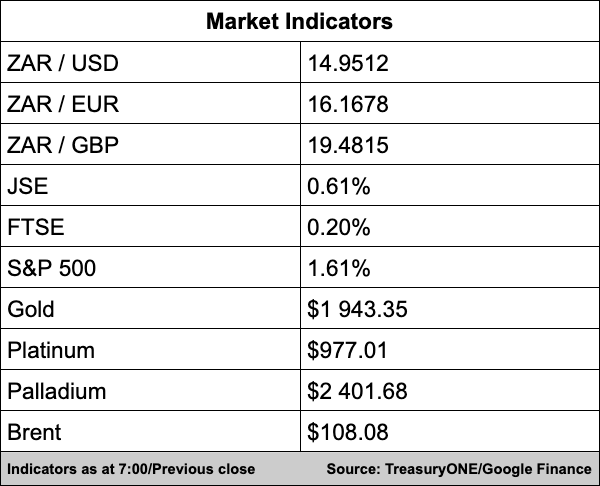

In the markets, the IMF lowering of South Africa’s GDP forecast for 2022 and 2023 to 1.9% and 1.4%, respectively, along with the impact of the flooding in KZN and the extremely fragile power grid, are weighing on the rand.

“The local currency weakened by just over 2.0% to close at R14.95 after having briefly traded at R15.00 last night. The rand has opened unchanged this morning, with the Dollar having retreated from last night’s strong closing levels against the majors,” comments TreasuryONE.

On the commodity front, gold is further down this morning at $1,945, platinum is weaker at $977, and palladium is up at $2,401.

Brent crude traded 5% lower at $107.25 after the IMF cut their global growth forecast to 3.6% from the previous 4.4%. Brent is currently trading higher at $108.60 a barrel.

Here’s what we’re reading:

SA Business

How to steal a billion from Eskom — and leave South Africa in darkness – MyBroadband

Load shedding: South Africans all coping in their own way – The Citizen

Solidarity Fund vows to protect flood relief with ‘same transparency’ as Covid-19 funds – Fin24

Global Business

Solar could generate half of world’s power by 2050, Trina CEO says – BusinessTech/Bloomberg

China and India are saving Russia from economic collapse – Business Insider

Elon Musk says his companies including SpaceX, Tesla count as philanthropy as he rebuffs billionaire hate – Business Insider

Markets

Asian Stocks Down, China Keeps Prime Loan Rate Steady – Investing.com

Rand gets hammered – MyBroadband/Bloomberg

IMF Slashes Growth Outlook on Russia Invasion, China Lockdowns – Bloomberg

Tech

Beware the over-inflated NFT – Jack Dorsey’s tweet potentially sheds 99.6% of its value – BizNews

Global Smartphone Market Had Worst Drop Since Virus Outbreak – Bloomberg

Netflix Tumbles as 200,000 Users Exit for First Drop in Decade – Bloomberg

Caption: Eskom Head Office at Megawatt Park, Image: Gallo Images/Luba Lesolle