The JSE traded weaker on Friday morning and never recovered the ground it lost as it closed the week in a three-day losing streak to see the All Share Index lose 1.48% to see it at 72,265 while the Top 40 is down 1.55%.

The bourse was not the only exchange to trade down today with its global peers joining as traders tried to digest hawkish comments from US Federal Reserve officials.

Fed Reserve chair Jerome Powell said on Thursday that a 50 basis point rate hike was on the cards for May something the market has almost fully priced in now.

The world’s largest brewer, Anheuser-Busch InBev (-2.52%) resolved to sell its stake in its Russian interest as a result of the country’s invasion of Russia, resulting in a R17 billion writedown. The brewer is looking to its Turkish brewer partner, Anadolu Efes to acquire its 50% stake in the pair’s joint Russian venture.

Sappi (-3.40%) said its employees had returned to work in its KwaZulu-Natal operations following the recent flooding in the province. In a SENS news update, Sappi said: “There is no material damage to any of the plants and the immediate focus is on reinstating logistical supply chains for raw materials and finished goods.”

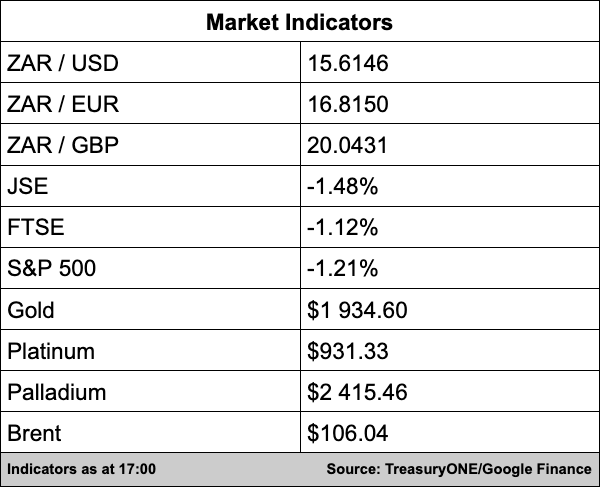

In the currency markets, the rand took a further beating today and traded 3% down by midday. The local unit is on track for its worst week since before the pandemic in 2020, reports Bloomberg.

The rand has retreated from R14.62/$ a week ago with renewed load shedding and floods in KZN placing greater pressure on the South African economy. It tested the R15.70/$ level at one point today but has since retreated to R15.61/$.

“The rand has gone from the strongest to the weakest emerging market currency in a matter of a week, with several factors contributing to the cause. Since Tuesday, the Russian Ruble has been on the front foot and could have a lot to do with the sell-off seen in our local bonds as markets start to rotate back into eastern European EM’s,” comments TreasuryONE.

On the commodity front, platinum came under pressure and lost over 3.5%, palladium is also down but above the $2,400 while gold is currently trading at $1,942. Brent crude has given back most of the gains it started the week with and is currently trading at $106.50 a barrel.