We begin this Friday morning with something for your weekend table talk, SA-born tech billionaire Elon Musk says he has secured the funding needed to purchase the social media company Twitter in its entirety.

On Thursday, the Tesla and Space X CEO filed documents with US regulators indicating he had secured $46.5 billion worth of debt and equities to make the purchase and will take the offer directly to Twitter’s board.

Musk has agreed to put up $33.5 billion personally, which will include $21 billion of equity and a further $12.5 billion of margin loans against his shares in Tesla.

Banks like Morgan Stanley have agreed to provide a further $13 billion in debt secured against Twitter itself.

The world’s wealthiest man had launched an unsolicited offer to buy Twitter on April 14, but he received no response from the board, who launched a “poison pill” that would make it more difficult for Musk to get a controlling stake in the company.

Musk previously bought a 9.2% stake in the company, making him the second-largest shareholder and largest individual shareholder.

Analysts say there is only one way for Twitter to truly dodge a Musk takeover and that is to have a white knight saviour swoop in at the last minute and make a bid that the company would prefer over Musk’s one.

Musk has indicated he would make big changes to the company and that it needs to be taken private to enable growth and champion free speech.

He has plans to run the company without moderators, something that analysts say won’t work with many rival social media companies catering to unfettered “right-wing” commentary popping up over the years with little success.

Analysts have been wary of a Musk takeover citing his shoot from the hip management style and his self-serving attitude to running a business as has been evidenced by the recent scandals plaguing Tesla.

These have included allegations of racism, a lack of unions, and the treatment of workers at the electric car manufacturer.

Musk reportedly mocked a Tesla whistle-blower and has a particular aversion to banning people from Twitter and curtailing free speech, prompting many to believe that if given the change he would allow Donald Trump to rejoin the platform.

Former US president, Trump has been banned from the platform following his actions before the January 6 Capitol Building riot last year.

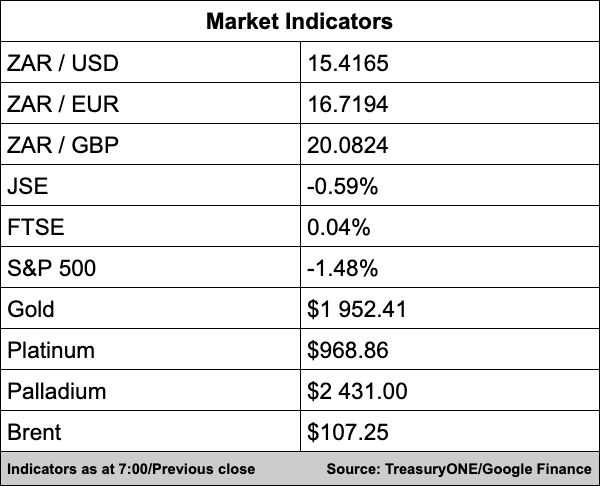

In the currency markets, the rand closed 2.4% weaker at R15.39/$ yesterday and has lost a total of 5.4% this week, changing course from being one of the best performing emerging market currencies to one of the worst.

“Hawkish commentary from Fed Chairman Jerome Powell has seen US Treasury yields rise once more and the dollar on the front foot.

The rand has opened a touch weaker this morning and is currently at R15.41/$ on the back of the stronger dollar; however, the local currency is getting stretched up here, and we could be due a correction in the short term,” comments TreasuryONE.

Gold and Platinum are currently trading flat at $1,951 and $968, respectively, while Platinum is up 0.4% at $2,430.

The price of Brent is currently stable at $107.20 as demand concerns over rising rates and global growth are offset by supply constraints.

Here’s what we’re reading:

SA Business

How Postbank nearly caused a social grant meltdown – Fin24

Load shedding is here to stay for (at least) another year, while the government dithers on policy – Daily Maverick

‘Government has failed on its infrastructure delivery promises’ – The Citizen

Global Business

JPMorgan employees describe the ‘fear of God’ and ‘panic’ as the company tracks their office attendance – Business Insider

In a twist – Elon Musk wants a regulatory agency for AI – BizNews

Disney to lose special tax status for opposing Florida’s ‘don’t say gay’ bill – The Guardian

Markets

Oil Down, Set for Nearly 4% Drop as Fuel Demand Concerns Persist – Investing.com

Gold Up, but Set for First Weekly Loss in Three Over Strong U.S.

Yields – Investing.com

Morgan Stanley raises oil forecast to $130 a barrel – BusinessTech/Bloomberg

Tech

CNN streaming service to shut a month after launch – BBC

Have we seen peak Netflix? – BBC

Google’s mega subsea cable brought ashore in Nigeria, en route to South Africa – Tech Central SA