(Bloomberg) — Dip buyers have gone AWOL during the latest slide in Chinese tech stocks.

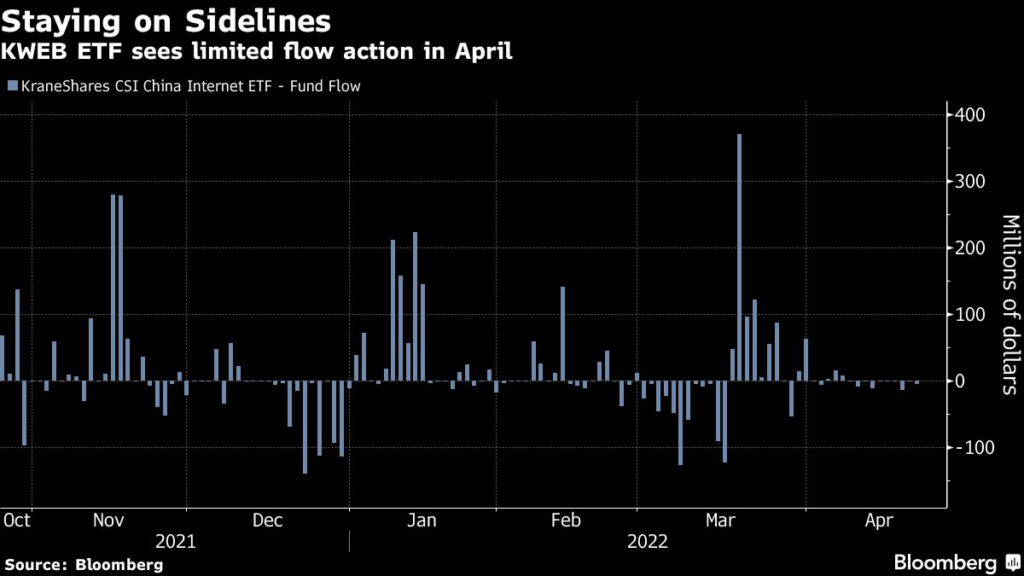

After months of seizing on virtually every decline to pile into the KraneShares CSI China Internet Fund (ticker KWEB) — a $5.4 billion U.S. exchange-traded fund that buys Hong Kong and New York-listed shares — investors have pulled $19 million so far in April. While that’s a tiny amount for the fund, it puts KWEB on course for its first monthly outflow of 2022 despite another double-digit monthly slide, its third straight.

China’s technology sector has been rocked over the past year as Beijing cracked down on industries from ecommerce to online gaming to education, pledging a new era of stricter government oversight. The potential delisting of U.S-traded Chinese tech shares has also contributed to negative sentiment. Now, despite signs of easing regulatory pressure, China’s adherence to its Covid-Zero policy and a worsening economic outlook are keeping bottom fishers at bay.

“People who have been putting capital in KWEB based on easing regulatory concerns may now be concerned with the lockdowns,” said Kevin Kelly, chief executive officer at exchange-traded fund manager Kelly ETFs. “They might not want to put capital to work.”

KWEB saw inflows of about $1.4 billion this year through the end of March, and $8.1 billion over the past 12 months, despite tumbling 22% and 68% over the spans, according to data compiled by Bloomberg.

“The risk off in China tech has wiped out all the potential dip buyers at this point,” said Art Hogan, chief market strategist at National Securities. “The space remains untouchable with the combination of both China’s zero-Covid policy and their overarching regulatory clampdown. The dip buyers have been burned.”

KWEB has seen its assets fall by nearly half compared to its $9.7 billion peak in November. The ETF is the second-biggest focus on China, after the $6 billion iShares MSCI China ETF (ticker MCHI).

KWEB consists of roughly 50 holdings including Tencent Holdings Ltd., Alibaba Group Holding Ltd., JD.com Inc. and Baidu Inc.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.