Optimism over French President Emmanuel Macron’s re-election victory quickly gave way on Monday as traders ditched risker assets and renewed concerns over the global economy and the impact of rising interest rates began to take hold.

By mid-morning the JSE had lost over 3% while Asian shares hadn’t fared much better, suffering the worst trading session in over a month with concerns over possible Covid-19 lockdowns in Beijing.

Macron is also likely to keep up the pressure for a European-wide ban on Russian oil imports, which will have a bearing on the market.

The local bourse closed the afternoon 3.48% down, extending its losses into a fourth consecutive session with the All Share Index dipping below the 70,000 point mark to see it at 69,751 points. The top 40 lost 3.81%.

Investment holding company PSG Group (-0.55%) said it would hold onto its dividend for 2022 given the firm’s intention of delisting from the JSE, which is a process expected to be concluded by August.

The firm’s net asset value has increased by nearly 40% and strong financial performances from subsidiaries PSG Konsult (-0.52%) and private school group Curro saw the group’s sum-of-the-parts value rise by more than a third to R26 billion for the year ended-February.

Sasol slumped 6.11% after declaring a force majeure on the export of certain chemicals following the heavy rainfall and flooding in KwaZulu-Natal. Sasol cautioned that its quarterly volume outlook may also be affected by the floods but it would have to access the extent of the damage to infrastructure and the recovery time needed.

Sasol said in a production update for the nine months to the end of March that its financial performance was based on a favourable macroeconomic environment.

Retailer, The Foschini Group (1.76%) said in a trading update for the year to end-March, headline earnings per share for the period are expected to be 692.6 cents per share for the period, which is far higher than the 197.9 cents per share that were reported for the previous period.

The retailer also said around 36 of its stores and a cloth warehouse were damaged by the floods in KZN. The group owns @home, American Swiss, Markham, and Fabiani among others.

Retail peers Woolworths (-0.55%), Truworths (-0.88%), and Mr Price (-1.58%) all lost.

SA Corporate Real Estate (-0.88%) said it would have a second listing on the Johannesburg-based A2X stock exchange while retaining its listing on the JSE. SA Corporate share will be available for trade from May 3 on A2X.

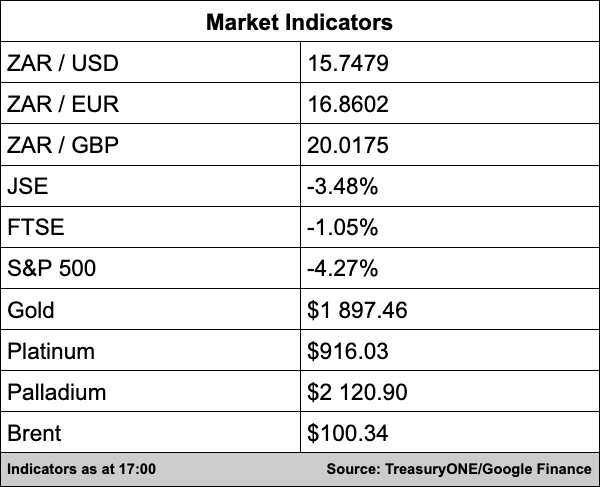

In the currency markets, the rand was pushing the R15.80/$ level at one point before settling at R15.75/$. The local unit is due for a course correction after losing around R1.00 last week to the greenback.

“The rand faces headwinds from a couple of different fronts with a stronger US dollar, general risk-off sentiment in currency and equity markets, and commodity prices coming under pressure with China heading for lockdowns after surging covid numbers,” comments TreasuryONE.

On the commodity front, the situation in China is upsetting the commodity markets. Gold and platinum are trading almost 2% down at $1,895 and $916, respectively. Palladium is the most volatile commodity with the metal down 11% on the day.

Brent crude continues to lose ground and is moving back towards the $100 mark and is currently trading at $100.68 a barrel.