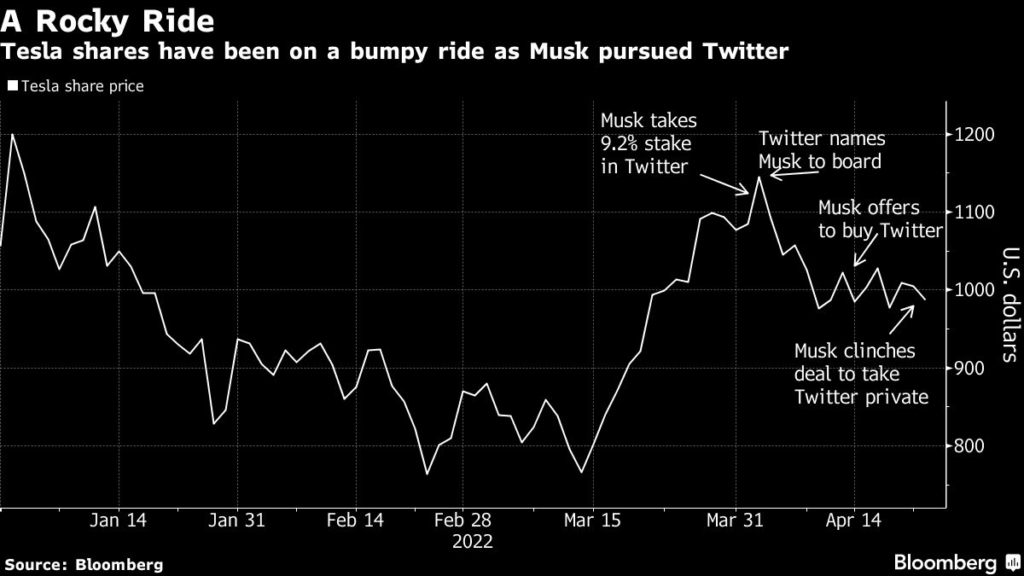

(Bloomberg) — Tesla Inc. shares fell Monday afternoon following news that Chief Executive Elon Musk is buying social media company Twitter Inc. in a $44 billion deal.

Shares of the electric-vehicle company ended 0.7% lower after Twitter said it agreed to be acquired by Musk for $54.20 per share in cash. The shares were among the five biggest weights on the S&P 500 Index, which rose 0.6%.

While the weakness in Tesla shares could reflect investors’ worrying “a bit about focus,” the reaction is unwarranted, according to Roth Capital Partners analyst Craig Irwin. “Tesla is in his blood, so I’m not worried about Musk taking on another project,” he said.

While Tesla’s stock is down 7% this year, it has significantly outperformed most mega-cap technology companies, the broader market and auto behemoths such as General Motors Co. and Ford Motor Co. Twitter’s shares were up more than 6% after being halted by the New York Stock exchange.

Twitter will become the latest company for Musk to focus on in addition to Tesla. They include Space Exploration Technologies Corp. or SpaceX, The Boring Co. and Neuralink Corp.

The resilience of Tesla’s shares this year reflects the company’s deft management of the supply-chain shortages and soaring raw material costs. Its first-quarter results last week further highlighted those advantages, with Tesla reporting strong profits and saying that it was on track to expand production to more than 1.5 million vehicles this year, despite supply challenges.

Still, China’s worsening Covid outbreak is threatening to further complicate shortages, with additional lockdowns and production halts at Tesla’s Shanghai plant potentially upsetting the company’s plans for the year.

As Musk pursued Twitter in a highly public fashion — tweeting his opinions about the platform to his millions of followers and conducting polls — Tesla investors were left guessing about the impact of a deal. Some worried that the Tesla CEO might be required to sell off some of his stake in the EV maker to pay for Twitter. However, Wedbush analyst Daniel Ives on Monday said he does not believe the “Twitter bid will result in a major sale of Musk’s Tesla shares.”

(Updates stock move in second paragraph, adds Roth comments in third paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.