In case you missed it, we begin this morning with the big overnight news that Twitter has agreed to sell to billionaire Elon Musk for a reported $44 billion and take the 16-year-old social network private in the process.

The deal was unanimously agreed upon by Twitter’s board and is expected to be concluded later this year. Investors will receive $54.20 for each Twitter share they own with Musk securing $25.5 billion of debt and margin loan financing and will provide about $21 billion in equity to fund the deal.

The deal includes a provision where Musk, the world’s wealthiest individual, would have to pay the company a fee if he decides to walk away from the deal or it collapses while Twitter is not allowed to solicit offers from other buyers.

Musk has yet to outline his plans for the social media company, but he is a well-known free speech advocate, and is thought to want to overhaul Twitter to make it a space for completely unfettered free speech and has asked his “worst critics” to remain on the platform.

One of his rivals on the world’s wealthiest person ladder, Jeff Bezos, took a shot at Musk after the deal was announced and tried to push the narrative that Twitter might be in for possible undue influence from a foreign government given Tesla’s ties to China.

Twitter co-founder and former CEO Jack Dorsey said in a thread on the platform, “Twitter as a company has always been my sole issue and my biggest regret,” writing that he trusted the takeover by Tesla and SpaceX CEO Musk. “Solving for the problem of it being a company however, Elon is the singular solution I trust.”

Meanwhile, Tesla shares fell on Monday following the news Musk had agreed to buy Twitter and take the company private. Tesla shares were down 0.7% by the close of trade.

And if you’re still trying to make sense of all of this back and forth, from Musk announcing he had a large shareholding in Twitter, to accepting a seat on the board and then declining it, to finally clinching a deal to buy the whole thing, then Bloomberg has put together a nifty timeline to help you out.

On the local front, Covid-19 infections are on the rise with scientists predicting the start of the fifth wave of infections. Health minister Joe Phaahla said last week there were “worrying signs” the country was entering the fifth wave, but health experts don’t expect tighter restrictions to be enforced as was the case during previous waves.

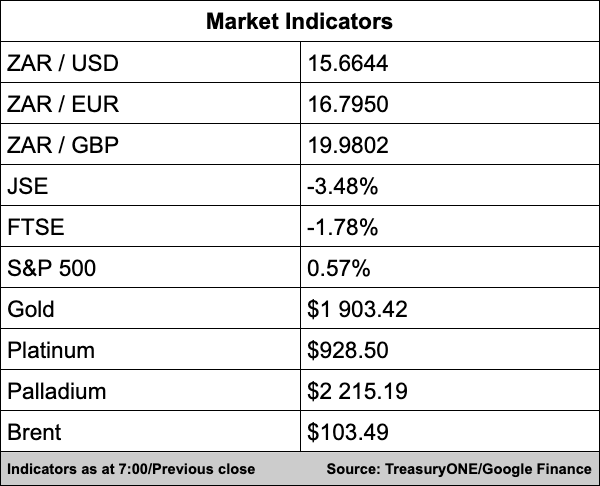

In the currency markets, concerns over the impact of Covid-19 lockdowns in China have seen investors run towards the US dollar with the greenback remaining dominant. “The hawkish Fed rhetoric and the prospect of larger and faster rate hikes add to the Dollar’s attractiveness,” comments TreasuryONE.

The rand remains on the backfoot after taking a beating last week and moved nearly as high as R15.80/$ at one point before closing at R15.67/$. This morning, the local unit is trading relatively flat at R15.69/$.

Commodities were sold off heavily yesterday with palladium losing 9.4% while gold was down 1.7% and there were losses for both platinum and copper. This morning, there is some relief and recovery with gold up 0.3% at $1,903, platinum up 0.8% at $926 and palladium up 3% at $2,210.

Brent crude dropped below the $100 mark at one point yesterday against the backdrop of demand concerns before it closed at $102.30 a barrel. This morning, Brent is trading at $103.06 a barrel.

Here’s a round-up of what we’re reading:

SA Business

South Africa’s biggest fuel producer to accelerate green hydrogen plans – BusinessTech

KZN floods: Nine passenger railway sections severely damaged – Fin24

Eskom board’s Busisiwe Mavuso defends her decision to walk out of Scopa meeting – EWN

Global Business

What other CEOs can learn from Elon Musk’s aggressive, unorthodox Twitter takeover – Business Insider

Will Ford’s new truck finally make Americans buy electric? – BBC

Britain to cut Ukraine tariffs to zero to help its economy – Reuters

Markets

Oil Up as China Fuel Demand Concerns Mount – Investing.com

Asian markets mixed but China, Fed keep confidence in check – AFP

Tech Leads China Stocks Rebound as Beijing Renews Policy Support – Bloomberg

Tech

HAVE A LOOK | Inside Facebook’s first ever physical retail store – Business Insider

Pentagon Taps Former Lyft Executive for New Data and AI Post – Bloomberg

Trump says he won’t leave Truth Social, despite Musk’s Twitter takeover – The Verge