(Bloomberg) — Intel Corp., the world’s biggest maker of computer processors, gave a disappointing second-quarter sales and profit forecast, indicating weaker demand for its chips across the board. Shares slipped in late trading.

Profit in the second quarter will be 70 cents a share, excluding some items, Intel said Thursday. Revenue will be about $18 billion. Those targets fell below average analysts’ estimates of 82 cents on $18.5 billion in sales, according to data compiled by Bloomberg. Gross margin, a measure of profitability that represents the percentage of sales left after deducting production costs, will be 51%.

PC chip revenue dropped in the first quarter as some customers cut orders to reduce unsold inventory and consumers bought fewer devices for education purposes, Intel said. The report comes amid escalating concern that overall demand for consumer PCs — Intel’s largest source of revenue — is sputtering following a boom that was fueled by pandemic-related working and studying from home.

That threatens to shake investors’ faith in assurances by Chief Executive Officer Pat Gelsinger that Intel will gain market share and resume faster revenue gains, reversing the trends that plagued the company under his predecessors.

In light of an overall first-quarter sales decline and the lackluster forecast for the current period, Gelsinger and Chief Financial Officer Dave Zinsner faced numerous questions on why the company is sticking to full-year forecasts that imply growth will accelerate over the second half of the year.

While some of the “inventory burn” by customers will continue into the second quarter, Intel will have a set of better products to offer in the third and fourth quarters of 2022, Gelsinger said on a conference call. Seasonal demand will pick up and orders from corporations and owners of cloud data centers will gain momentum, he said.

“We have a tremendous growth story over the next several years,” Gelsinger said. “We remain intensely focused on rebuilding our execution machine.”

Read more about Gelsinger’s big bet on U.S. chip manufacturing

In the first quarter, the Santa Clara, California-based company said sales fell to $18.4 billion, compared with the average $18.3 billion analysts had predicted. Profit was $8.11 billion, or $1.98 a share, compared with $3.36 billion, or 82 cents, in the same period a year earlier.

The return of Covid-related lockdowns in parts of China has hurt the supply of some components needed to complete devices, stalling some orders, Intel said. The company is assuming that those disruptions will be confined to the Shanghai region and will dissipate in the current quarter. Other chipmakers, such as Texas Instruments Inc., have also said these disruptions were hurting their earnings projections.

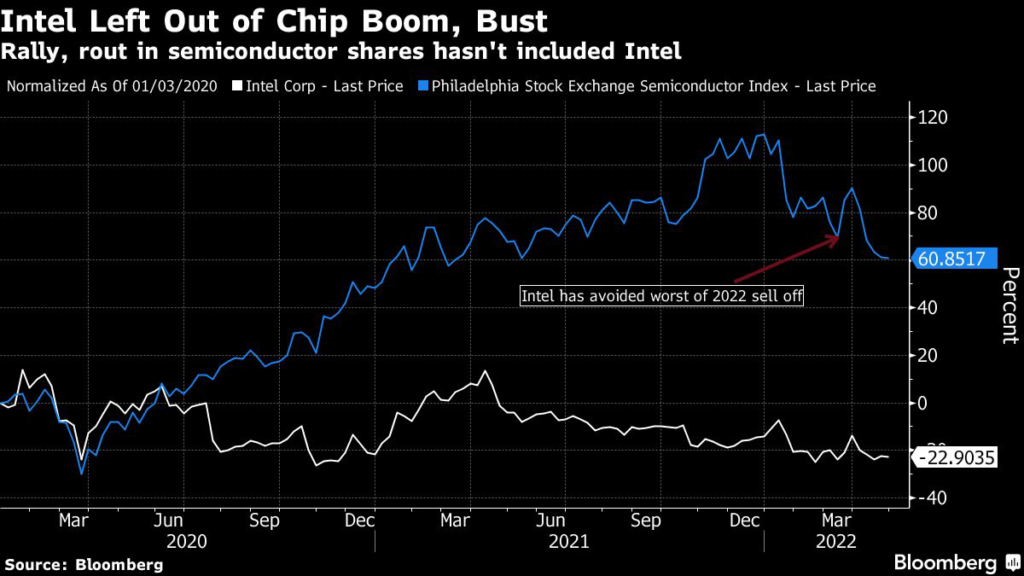

Intel shares dropped about 4% in extended trading, after closing at $46.84 in New York trading. The stock has fallen 9% this year, losing less ground than semiconductor stocks in general after two years of lagging the market.

Sales in the data center division rose 22% to $6 billion in the recent quarter, but missed the average analyst estimate of $6.91 billion. Client computing, Intel’s PC chip unit, posted revenue of $9.3 billion, below the $9.39 billion projection and declining 13% from a year earlier.

The company maintained its prediction for annual sales of $76 billion, which would be an increase of 2% from 2021. Its target for gross margin for the whole of 2022 is 52%, and earnings per share will be $3.60.

Gelsinger, who took over as Intel’s top executive in the first quarter of last year, has outlined an ambitious plan to restore the company’s leadership of the semiconductor industry and branch out into new areas. His makeover will cost billions, including new plants in the U.S. and Europe that he will open to manufacture chips for other companies, even rivals. The company is planning to spend a record $27 billion on new plants and equipment, Intel said on Thursday.

Read more: Intel’s Gelsinger promises the return of growth to once-dominant chipmaker

Gelsinger and Zinsner have been asked repeatedly about what the heavy investment will do to the company’s profit margins, which were once the envy of the industry. Zinsner has promised that gross margin will stay in the 51% to 53% range. Part of Intel’s spending will be offset by government subsidies aimed at fostering a return of chip manufacturing to the U.S. and Europe, he said. Gelsinger has said that within five years those margins will return to historic levels, which were typically above 60%.

Investors have welcomed Gelsinger’s aggressive plans to make Intel’s products and manufacturing technology competitive again after delays and poor decisions under past CEOs allowed rivals to catch up and overtake it. The significant costs of his makeover have many waiting for the first signs of gains against Advanced Micro Devices Inc., Nvidia Corp. and Taiwan Semiconductor Manufacturing Co. before they return to investing in Intel shares.

AMD, which has revamped its product lineup and won back some of the market share it lost to Intel, will report its first-quarter results next week. Under Chief Executive Officer Lisa Su, AMD has grown much more quickly.

(Updates with CEO comments from fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.