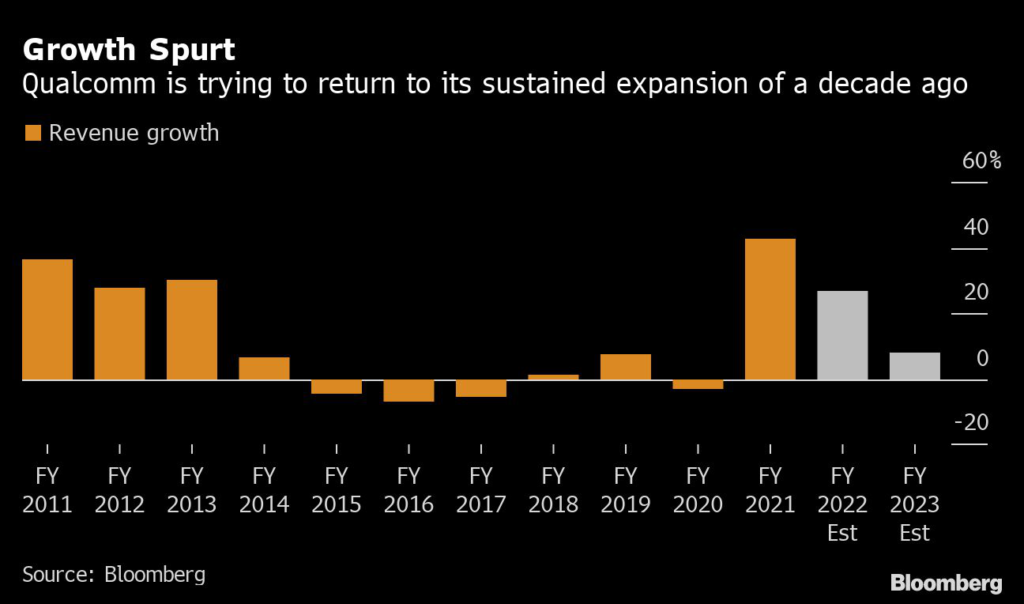

(Bloomberg) — Qualcomm Inc., the biggest maker of chips that run smartphones, surged as much as 8.8% on Thursday after giving a strong sales forecast for the current quarter, bolstered by its expansion into new markets.

Revenue will be $10.5 billion to $11.3 billion in the fiscal third quarter, Qualcomm said on Wednesday. That compares with an average analyst estimate of $9.97 billion. Profit will be $2.75 to $2.95 a share, well above the $2.60 average projection.

The outlook helped dispel fears that chip demand is slowing after a pandemic-fueled surge the past two years — and showed that Chief Executive Officer Cristiano Amon’s long-touted plan to diversity the business is paying off.

Qualcomm’s main product is the processor that runs many of the world’s smartphones, and another of its chips connects Apple Inc.’s iPhone to high-speed data networks. That makes it particularly vulnerable to swings in demand for such devices. But under Amon, the company is trying to parlay that skill set into a growing presence in cars, networking and computers.

“We can no longer be defined just as a communications company serving just one industry,” he said on a call with analysts.

Qualcomm shares, which had slid this year in line with a general decline in chip stocks, rose to a high of $147, posting the biggest intraday increase since November.

Analysts have pointed to slowing demand for Android phones in China, the largest market, as a threat to growth. But sales of Qualcomm’s phone-related chips were higher than expected last quarter. They came in at $6.33 billion, compared with an estimate of $5.99 billion.

The company predicted its handset division will grow more than 50% in its current fiscal year, bolstered by Samsung Electronics Co.’s flagship Galaxy phone and gains at some Chinese smartphone makers. Previous versions of the Galaxy line had used a larger proportion of Samsung’s own chips, rather than Qualcomm’s.

Executives said that there’s some evidence of weakness in demand for cheaper phones, but it won’t hurt Qualcomm’s revenue because that’s not a big part of its business.

Revenue from the Internet of Things — efforts to add computing power to a wider range of devices and appliances — was $1.7 billion. That compared with an average projection of $1.6 billion.

Increasing use of its chips in industrial machinery is driving growth as well, Qualcomm said. The company’s automotive unit, which posted sales of $339 million, was up 41% from a year earlier. It has a “design-win pipeline” that will amount to more than $16 billion of sales, Qualcomm said.

Excluding certain items, profit in the fiscal second quarter was $3.21 a share, compared with Wall Street’s average estimate of $2.93. The company generated $11.2 billion in revenue, topping the $10.6 billion projection.

Like many other chipmakers, Qualcomm outsources its production and has struggled to get enough supply from its Asian subcontractors over the last two years. The company’s leaders have promised it will be able to strike a better balance between supply and demand as 2022 progresses.

In prior quarters, Qualcomm has focused on providing the most expensive smartphone parts — at the expense of orders from makers of cheaper smartphones. But Amon’s longer-term strategy is betting on new markets. He has said that his tenure should be judged by Qualcomm’s progress in higher-growth areas.

Qualcomm had set aggressive growth goals. Revenue has the potential to top $46 billion by fiscal 2024, Chief Financial Officer Akash Palkhiwala said at a company event late last year.

The company is unusual in the chip industry because a large chunk of its profit comes from technology licensing. Makers of phones pay to use Qualcomm’s technology, regardless of whether they buy its chips, because the company owns patents that cover some of the fundamentals of mobile communications.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.