Stock markets rose on Thursday as investors digested a slew of company results and shrugged off a worse-than-expected US economic contraction.

In foreign exchange, the dollar traded around 20-year peaks versus the yen and at the highest level in more than five years against the euro as the Federal Reserve prepares to aggressively hike US interest rates.

European and Asian markets closed higher and Wall Street saw major gains despite the US government reporting a surprise 1.4 percent GDP contraction in the first quarter of 2022 driven by a spike in imports and low inventories, though spending remained strong.

“Everyone on Wall Street knew to expect enhanced volatility in the first quarter given the war in Ukraine, the impact of the Omicron wave, and as the economy grappled with inflation,” Edward Moya of Oanda said.

“Today’s economic data does not change anything for the Fed and markets should continue to think they are on a clear path to raise rates rapidly over the next couple of policy meetings.”

The Dow won nearly two percent, and the Nasdaq climbed more than three percent, two days after indices suffered grievous losses on fears of tighter Fed policy.

Trading has been volatile across major assets as investors remain on high alert over a range of crises including the Ukraine war, surging inflation, higher interest rates and Chinese Covid lockdowns.

Investors are also paying close attention to the ongoing earnings season, which has seen a mixed bag of results that have weighed on tech firms.

Facebook parent Meta posted a forecast-beating reading on Wednesday, which analysts said could provide some relief to the sector.

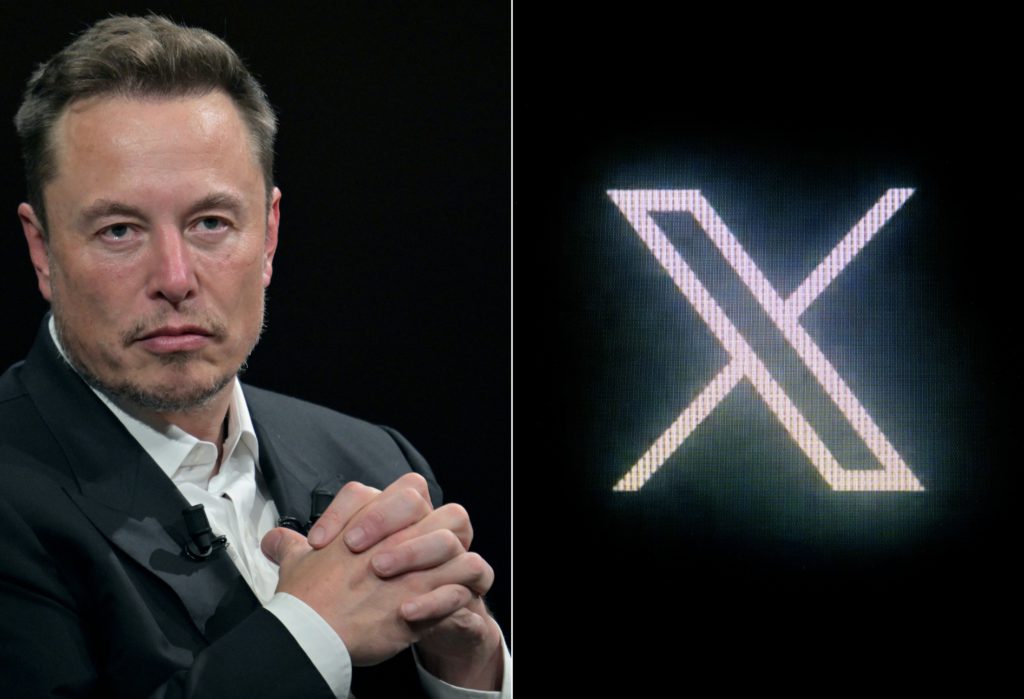

Twitter released mixed first-quarter results on Thursday, with revenues missing estimates but active users rising, three days after agreeing to be acquired by Tesla boss Elon Musk.

After markets closed, Apple reported slower growth but results that topped estimates, while Amazon reported a rare loss due in part to a stake in electric truck maker Rivian, while warning of continued challenges.

– Inflation fight –

Central banks worldwide are hiking rates to fight spiking inflation, and data released Thursday showed German consumer prices rose at their fastest pace in four decades in April, climbing to 7.4 percent.

Sweden’s central bank on Thursday became the latest to lift rates, from zero to 0.25 percent.

The Federal Reserve is next week expected to lift US interest rates by half a point and signal further big increases through the year.

But the Bank of Japan decided to keep its ultra-loose monetary policy unchanged on Thursday, prompting the Tokyo stock market to close higher.

For its part, the European Central Bank has refused to tighten borrowing costs and on Thursday ECB vice-president Luis de Guindos said a surge in eurozone consumer prices is “very close” to reaching its peak.

Soaring prices are impacting consumers and businesses everywhere.

British consumer goods giant Unilever announced a jump in revenue after it passed on higher costs to customers.

McDonald’s also reported rising first-quarter sales on price hikes, though profits tumbled due to an unspecified tax issue.

– Key figures at around 2030 GMT –

New York – Dow: UP 1.9 percent at 33,916.39 (close)

New York – S&P 500: UP 2.5 percent at 4,287.50 (close)

New York – Nasdaq: UP 3.1 percent at 12,871.53 (close)

London – FTSE 100: UP 1.1 percent at 7,509.19 (close)

Paris – CAC 40: UP 1.0 percent at 6,508.14 (close)

Frankfurt – DAX: UP 1.4 percent at 13,979.84 (close)

EURO STOXX 50: UP 1.1 percent at 3,777.02 (close)

Tokyo – Nikkei 225: UP 1.8 percent at 26,847.90 (close)

Hong Kong – Hang Seng Index: UP 1.7 percent at 20,276.17 (close)

Shanghai – Composite: UP 0.6 percent at 2,975.48 (close)

Euro/dollar: DOWN at $1.0509 from $1.0557 late Wednesday

Pound/dollar: DOWN at $1.2468 from $1.2545

Euro/pound: UP at 84.25 pence from 84.15 pence

Dollar/yen: UP at 130.79 yen from 128.43 yen

Brent North Sea crude: UP 2.2 percent at $107.59 per barrel

West Texas Intermediate: UP 3.3 percent at $103.36 per barrel

burs-jmb/cs/bfm