Markets are focusing on the US Federal Reserves’ FOMC interest rate decision due tomorrow with the JSE trading weaker on Tuesday while its global peers were mixed.

Stock markets around the world remain under pressure amid inflation jitters, tighter monetary policy and China Covid-19 lockdown concerns. The US Fed is expected to announce the largest interest rate hike since 2000 on Wednesday with a 25-50 basis point increase expected.

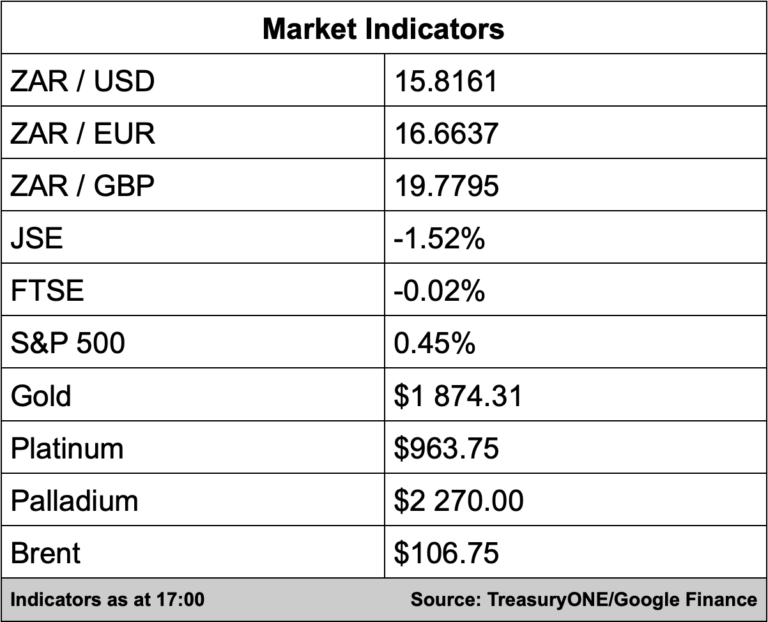

The local bourse lost 1.52% with the All Share Index closing on 71,338 points while the Top 40 is at 64,401 points, losing 1.64%.

Impala platinum released a production report for the three months ended March 31 with the mining company saying concentrate production fell by 2% while tonnes milled fell by 4%. The news adds to the recent slew of disappointments from mining companies with production levels taking knocks from supply chain issues and Covid-related disruptions, despite this, the group’s share price added 2.54%.

In the currency markets, the Rand reached R16.20/$ yesterday on thin liquidity and a drop in commodity prices but the local unit has traded back to the R15.78/$ level today, “retracing back to the levels where it opened yesterday morning,” comments TreasuryONE.

“We have also seen the US Dollar losing ground, and commodities have rebounded slightly. Other EM currencies have joined the Rand and the Brazilian Real in the stronger move against the US Dollar.”

The Rand and Real are more than 2% stronger on the day. The next few days will be crucial to see if the Rand will find a new direction with the Fed and non-farm payrolls coming up.

On the commodity front, platinum is the star performer, adding 3% and currently trading at $968 per ounce. Palladium is trading at $2,267 while gold is moving back to the $1,900 and is currently trading at $1,875.

Brent crude lost some ground today and is currently trading at $107 a barrel.