(Bloomberg) —

Bitcoin gained for the first time in almost a week even with the Federal Reserve raising interest rates, helping to push the coin toward the higher end of the range it’s been trading in for much of the year.

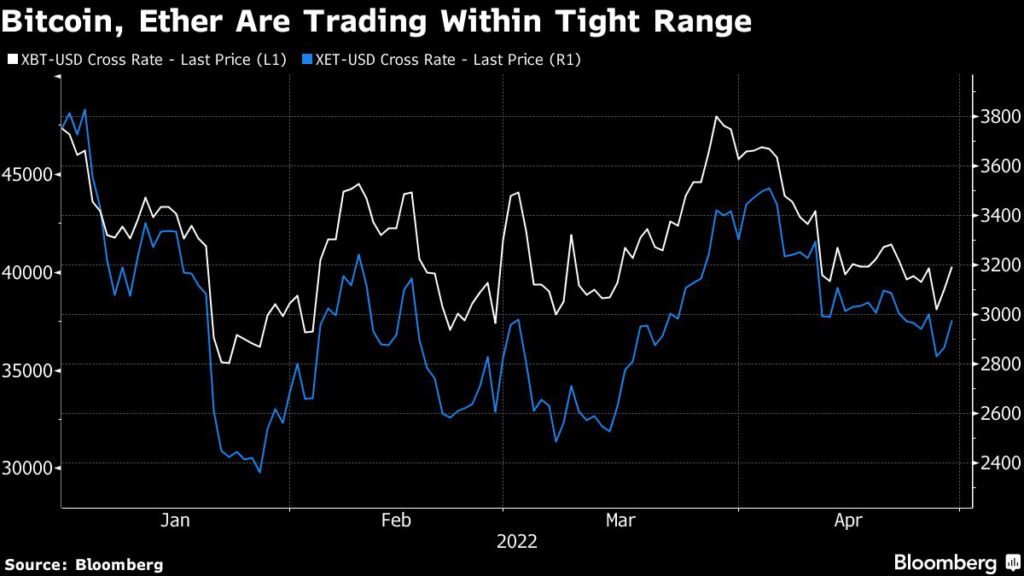

The world’s largest cryptocurrency rose as much as 4.4% to $39,439 in New York trading, a percentage move that passes for excitement for the token these days. The digital currency has swung within a 5% band for eight trading sessions in a prolonged calm not seen since the start of the year.

“Everything in crypto, I think, is more muted right now,” said Antonio Juliano, founder and chief executive of dYdX, a decentralized trading platform that focuses on perpetual swaps.

Crypto assets, just like other riskier areas of the market, have all been weighed down as the Fed and other global central banks raise interest rates to fight red-hot inflation. The U.S. central bank’s policy-making Federal Open Market Committee on Wednesday voted unanimously to increase the benchmark rate by a half percentage point and will begin allowing its holdings of Treasuries and mortgage-backed securities to roll off in June.

In this environment, Bitcoin hasn’t been able to break out in any meaningful way beyond the highs it came into the year with.

“Right now, the market is basically stuck in a range for the most part,” Dan Gunsberg, co-founder of Hxro Network, said by phone.

Money has been flowing out of the sector amid the malaise. Investors yanked roughly $120 million from crypto products last week, bringing total outflows over the past four weeks to $339 million, according to data tracked by fund provider CoinShares. Bitcoin last week accounted for the majority of the flows in what was its largest single week of outflows since June 2021.

Elsewhere, data from CoinGecko shows that the price of ApeCoin, the native crypto token of Yuga Labs’ APE ecosystem, rallied 17% intraday Wednesday after Elon Musk changed his Twitter display picture to that of a collage of Bored Apes.

Yuga Labs, creators of the Bored Ape Yacht Club collection of NFTs, had recently auctioned virtual land on ‘Otherside’, its metaverse project. The sale raised netted Yuga $320 million but also led to huge congestion and high transaction fee on the Ethereum network over the past weekend.

The token price of ApeCoin fell from its Sunday highs of $22 to $14.50 per token on Wednesday before jumping to $17.16 after the Tesla CEO changed his profile picture.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.