(Bloomberg) — Relying on a specific sector such as tech to build an ESG portfolio has exposed investors to unnecessary losses, according to Luke Barrs of Goldman Sachs Asset Management.

The focus on tech has been a “kind of lazy approach” in environmental, social and governance investing, said Barrs, GSAM’s head of fundamental equity client portfolio management in EMEA and Asia ex-Japan, in an interview.

“It just became an easy trade where you got exposure to these high growth businesses that were doing very well and you can mask them as kind of ESG,” he said. “Where actually, when we think about ESG, ESG should not be a sector specific determination.”

Instead, Barrs said GSAM is looking for “solution providers to environmental issues,” which includes areas like supply chains of electric vehicle makers, environmentally friendly farming and power usage for buildings. “Those are areas that I think are incredibly attractive long-term,” he said, declining to name specific stocks.

Read More: Amazon Defeats Drive to Unionize Second New York Facility

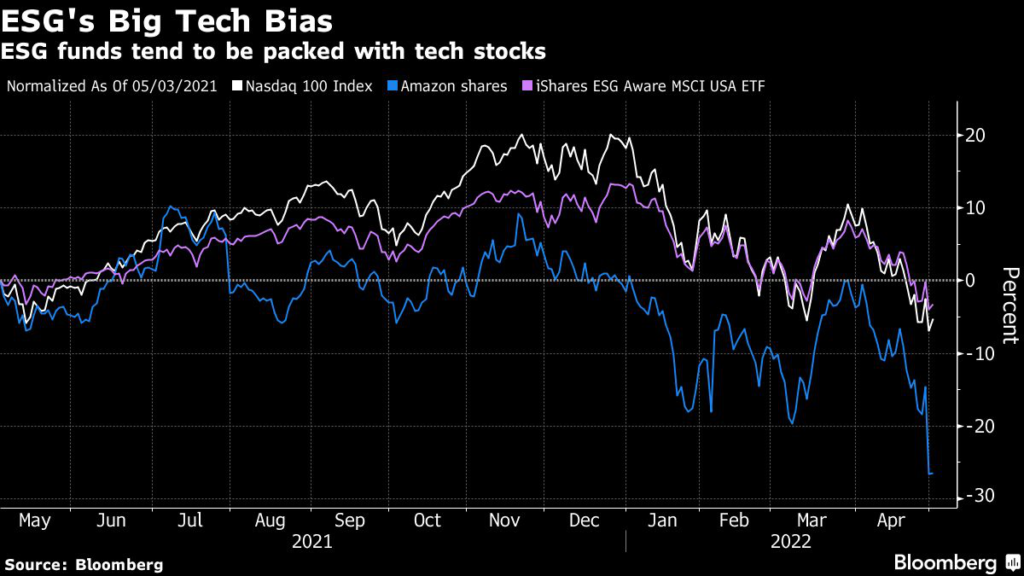

ESG investors who are overweight technology stocks have had a sobering start to the year, thanks in large part to a more hawkish Federal Reserve. The Nasdaq 100 Index is down by roughly a fifth of its value, with heavyweights like Amazon.com Inc. losing even more than that.

And yet, a lot of ESG funds continue to rely heavily on tech. BlackRock Inc.’s iShares ESG Aware MSCI USA ETF, the world’s biggest ESG exchange-traded fund, counts Amazon among its three biggest holdings, along with Apple Inc. and Microsoft Corp. It’s down about 15% this year.

Much of the appeal of tech has been tied to its “quite limited carbon intensity profile,” Barrs said. And despite obvious social concerns associated with some tech giants, “for the most part these are technologies and businesses that can help solve some social issues,” he said. “And so there’s an easy way of framing that.”

Meanwhile, there are signs that ESG investing clients may be growing dissatisfied with some of the poor returns they’re seeing. Jean-Xavier Hecker, JPMorgan Chase & Co.’s co-head of ESG equity research, said in March that some ESG investors have started to worry about a “potential missed opportunity.” That’s as non-ESG assets such as defense stocks and commodity prices have soared.

At the same time, there are indications of a broader sense of indifference to ESG among regular savers. A recent survey by Charles Schwab found that 66% of U.K. retail investors don’t care whether their allocations are sustainable, and instead only focus on maximizing returns.

“Part of the reason you’ve seen material underperformance of some passive ESG solutions is they put deliberate screens and exclusionary frameworks in place to reduce exposure to, especially, carbon assets,” Barrs said. “There’s more flexibility or discretion an active manager can have to try and still build balance in a portfolio against the changing backdrop.”

Many investors are “very fee conscious and sensitive,” Barrs said, which favors passive strategies. But at some point, “people recognize the opportunity cost,” because a passive strategy may overlook risks, he said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.