(Bloomberg) — Lyft Inc. shares plunged after a weaker-than-expected outlook sparked investor concerns that a planned increase in spend on driver incentives could weigh on profits.

The San Francisco-based company sees earnings before interest, tax, depreciation and amortization of $10 million to $20 million in the current period, substantially missing the $81 million Wall Street projected. The shares were down 26% in pre-market trading.

The disappointing outlook underscores Lyft’s struggle to claw its way out of the pandemic without eroding profitability. Though the ride-hailing giant and its rival Uber Technologies Inc. have found resurgent customer demand, attracting drivers has been a persistent challenge and companies have spent millions in bonuses and other incentives to lure drivers back. The imbalance has led to longer wait times and high fares for riders.

Meanwhile, a dramatic spike in gas prices in March squeezed workers’ take-home earnings, further casting doubt on rideshare platforms’ ability to retain them. Lyft and Uber have already introduced a gas surcharge to rides in a bid to help drivers. Though Lyft recorded a 40% increase in the number of drivers in the first quarter from the previous year, the company plans to invest more to boost driver supply in the second quarter, Chief Financial Officer Elaine Paul said on an analyst call the company. Paul said Lyft “remains committed” to being profitable on an adjusted basis for the year.

The outlook suggests “that the company’s investments to boost driver supply coupled with higher gas prices may keep dragging on ride frequency through the year,” Bloomberg Intelligence analyst Mandeep Singh wrote. The decline in both active riders and revenue per active rider was “unexpected,” Singh said. “This could be a signal that Lyft is ceding market share to Uber.”

Wait Times

The average rideshare trip in the U.S. cost approximately $20 in the first quarter, up approximately 45% versus the same period in 2019, according to market research firm YipitData. Lyft President John Zimmer said in an interview the company “has room to improve” service levels, or wait times, which came down by about 30% in the first quarter.

Lyft reported first-quarter revenue of $875.6 million on Tuesday, up 44% from a year earlier. That was more than the $844.5 million analysts were expecting, according to data compiled by Bloomberg. Lyft’s adjusted earnings before interest, tax, depreciation and amortization were $54.8 million in the quarter, far surpassing the $14.4 million analysts were expecting.

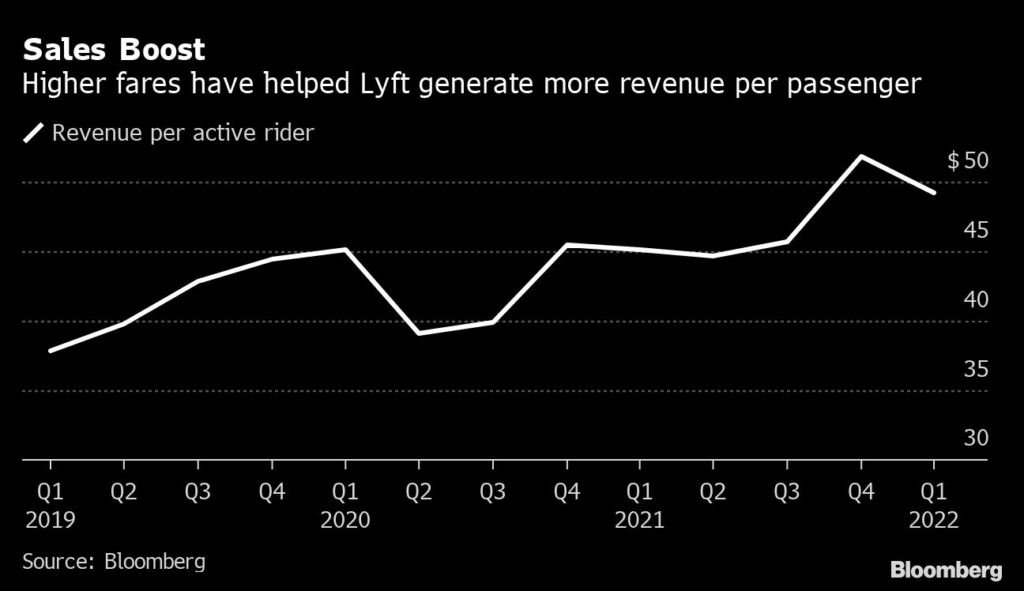

The boost in profits is attributed to strong ride volumes but also from the increase in revenue Lyft extracted from each passenger. Lyft generated $49.18 per active rider in the first quarter, the second-highest on record and 9% higher than the same period last year, partly due to higher fares.

“The first quarter had a lot of disruptive factors,” CFRA Research analyst Angelo Zino said before the numbers were released. “While a high revenue per rider helps profitability, longer-term we want to see that figure come down to reflect a sustainable rideshare pricing model. Maintaining a growing rider base is key.”

Unlike Uber, which pivoted into food delivery during the pandemic with Uber Eats, Lyft’s core business is ride sharing. The company has expanded into other forms of transportation like bikes and scooters in some of its biggest markets such as New York City, San Francisco and Chicago. Still, Lyft’s ability to grow its rider base could be challenged by Uber’s partnerships with New York City and San Francisco taxi-hailing apps that would migrate cabbies to Uber’s platform. Lyft has no plans to pursue a similar deal, Chief Executive Officer Logan Green said on Tuesday.

Lyft projected revenue of as much as $1 billion in the second quarter. Green said bringing back shared rides, which are only in effect in Miami and Philadelphia, will accelerate Lyft’s recovery and expects a broader rollout by the end of the year.

Lyft reported a net loss of $196.9 million, or 57 cents a share, narrower than the loss of $198.4 million, or 60 cents a share, analysts forecast.

(Adds pre-market trading in the second paragraph, TOUT on Street Wrap)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.