The JSE fell further on Wednesday to close a second consecutive day in the red as investors weighed up the US Federal Reserve FOMC meeting announcement expected later today.

The bourse traded 1.38% lower with the All Share Index at 70,357 points and the Top 40 at 63,573 points having lost 1.28%.

Sanlam and German financial giant Allianz said they would merge their respective African operations outside of South Africa to create a new company worth R33 billion. The new venture will be 60% owned by Sanlam while Allianz will have the balance of the ownership.

Sanlam said it would be contributing all of its African assets – excluding South Africa, Continental Re and its Namibian subsidiaries – while Allianz will contribute all of its African assets to the new Pan-African business.

Sanlam shares traded almost a per cent higher on Wednesday but ultimately closed 0.06% down at R64.46 while subsidiary Santam traded 2.11% higher.

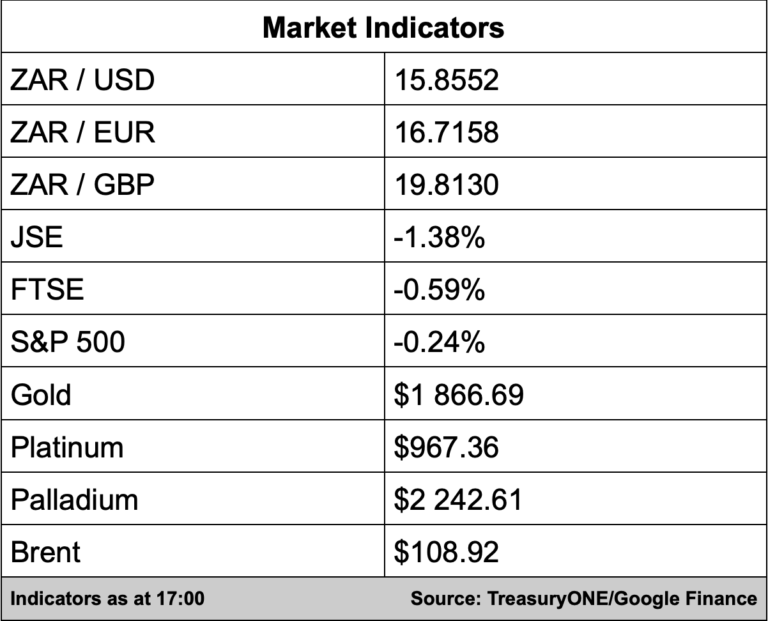

In the currency markets, the Rand stayed within a tight 10-cent range today after some big moves over the preceding two days.

“The likelihood of the Rand staying in this tight range is very low as we expect that the tight range has to do with the FOMC meeting later on tonight and market players sitting on their hands until after the rate decision. Should the FOMC continue with their hawkish stance, we could see the Rand coming under pressure, but should the tides of hawkishness turn; it could be beneficial for Rand’s strength,” comments TreasuryONE.

On the commodity front, there was sideways trade today leading up to the FOMC decision with none of the important metals showing any significant move today.

“Gold is trading at $1,864, platinum at $968, and palladium at $2,240 per ounce. However, we have seen an uptick in the Brent crude oil price, with Brent crude testing the $110 per barrel level at $108.76.”