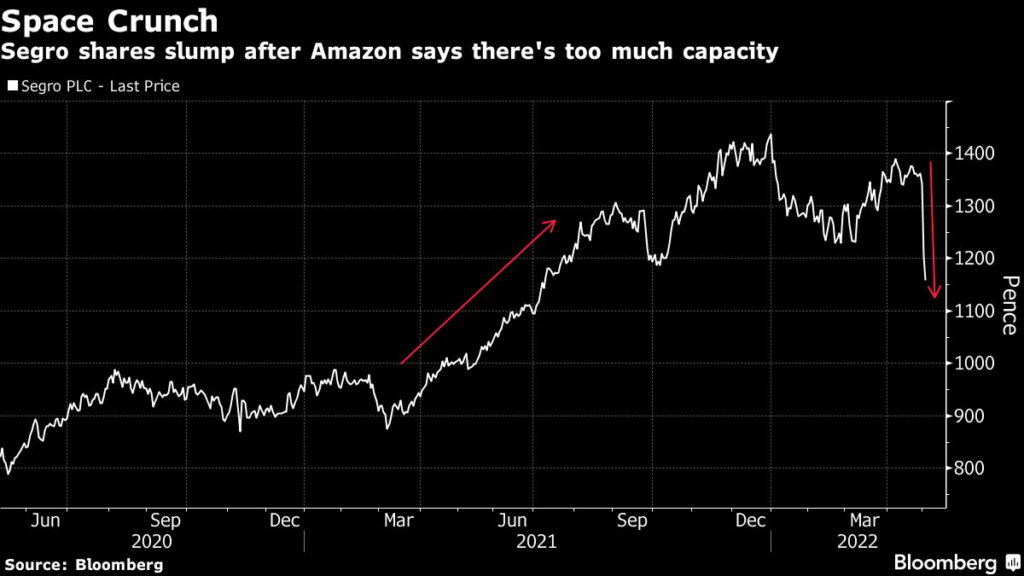

(Bloomberg) — Shares of U.K. warehouse companies are among the latest pandemic-era winners to head south. Analysts are blaming Amazon.com Inc.

Segro Plc, Europe’s biggest warehouse landlord, has fallen 14% in the last two sessions after Amazon flagged last week that there was “too much space right now.” That view from the U.S. e-commerce giant was a blow to Segro and its peers, who added warehouse capacity as the pandemic fueled online shopping.

“This kind of comment may add some jitters to the logistics market,” wrote Kepler Cheuvreux analyst Frederic Renard, adding that Amazon was Segro’s largest tenant, accounting for 7% of headline rent. Renard downgraded his rating on the stock to reduce from hold on Tuesday.

Shares in Tritax Big Box Plc, LondonMetric Property Plc and Urban Logistics REIT Plc have all been sliding this week.

Roughly 20% of the U.K.’s logistics space was taken up by Amazon in the past two years, according to Bloomberg Intelligence analyst Susan Munden.

Segro owns or manages 9.6 million square metres of space valued at 21.3 billion pounds ($26.7 billion), according to its website. It has properties in the U.K. and seven European countries.

“At a time when speculative developments are rising and with a pile of money being deployed at aggressive yields to bet on future rental growth, we argue that only one domino has to fall to put the whole chain at risk,” said Renard.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.