Wall Street stocks rallied and the dollar retreated Wednesday after the Federal Reserve announced a large 50 basis points interest rate increase but ruled out an even bigger hike for the foreseeable future.

The decision — which follows weeks of anticipation and speculation as Fed officials have vowed a tough response to inflation — came as European officials proposed a gradual ban on Russian crude, lifting oil prices.

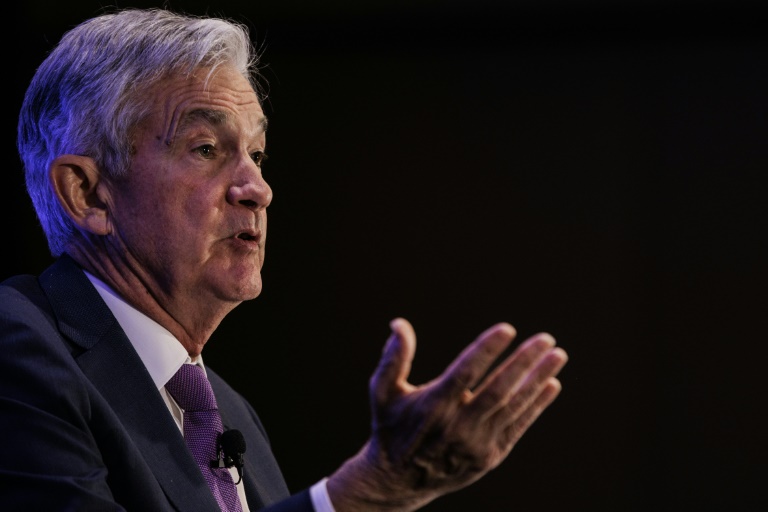

With inflation at the highest rate in four decades, Federal Reserve Chair Jerome Powell sent a message directly to the American people, expressing concern for the pain caused by rising prices, and pledging to use all available tools to bring them down.

Wednesday’s interest rate hike, the biggest since 2000, was coupled with a move to begin reducing the central bank’s bond holdings from June 1, marking the Fed’s most aggressive steps so far to counter inflation.

Powell said half-percentage point increases “should be on the table at the next couple of meetings,” but added that a three-quarter point increase “is not something the committee is actively considering.”

Stocks rallied off the remarks as Powell also expressed confidence the US central bank could engineer a “soft landing” that tames inflation without sending the economy into a recession.

Major US indices powered about three percent higher, while the dollar retreated against the euro and other currencies.

Art Hogan, strategist at National Securities, said the Fed’s decision met expectations but contained “no hawkish surprise,” adding that stocks could push higher in the coming sessions.

Some analysts have viewed the stock market as positioned for a potential rally after suffering deep losses in April amid worries over the Fed.

The central bank’s announcement followed data showing slowing growth in the US services sector and lackluster private-sector hiring that reflected limited labor capacity. The report comes ahead of Friday’s closely-watched government jobs data.

In earlier trading, European stocks closed down, after a broadly downbeat session in Asia, although key bourses including Shanghai and Tokyo remained shut.

Oil prices rebounded sharply after the European Commission proposed a gradual ban on Russian crude over Moscow’s invasion of Ukraine.

The Fed announcement is due one day before the Bank of England is also predicted to deliver a hike.

India’s central bank unexpectedly ramped up its key rate by 40 basis points to 4.4 percent on Wednesday.

Policymakers are seeking to tackle runaway prices but risk damaging global economic recovery from the pandemic.

Investor sentiment also remains dogged by the fallout from Russia’s ongoing Ukraine invasion, which has fueled bumper gains for many raw materials including crude.

– Key figures at around 2100 GMT –

New York – Dow: UP 2.8 percent at 34,061.06 (close)

New York – S&P 500: UP 3.0 percent at 4,300.17 (close)

New York – Nasdaq: UP 3.2 percent at 12,964.86 (close)

London – FTSE 100: DOWN 0.9 percent at 7,493.45 (close)

Frankfurt – DAX: DOWN 0.5 percent at 13,970.82 (close)

Paris – CAC 40: DOWN 1.2 percent at 6,395.68 (close)

EURO STOXX 50: DOWN 1.0 percent at 3,724.99 (close)

Hong Kong – Hang Seng Index: DOWN 1.1 percent at 20,869.52 (close)

Tokyo – Nikkei 225: Closed for a holiday

Shanghai – Composite: Closed for a holiday

Brent North Sea crude: UP 4.9 percent at $110.14 per barrel

West Texas Intermediate: UP 5.3 percent at $107.81 per barrel

Euro/dollar: UP at $1.0625 from $1.0521 on Tuesday

Pound/dollar: UP at $1.2632 from $1.2499

Euro/pound: DOWN at 84.06 pence from 84.18 pence

Dollar/yen: DOWN at 129.05 yen from 130.14 yen