(Bloomberg) — Cathie Wood’s famous faith in Elon Musk doesn’t appear to extend to his potential leadership of Twitter Inc.

Funds managed by Wood’s Ark Investment Management had already been selling the social-media platform this year even before the Tesla Inc. co-founder struck a deal to take Twitter private. On Thursday, when Twitter was one of the few stocks that gained amid a vicious rout, the funds sold a further 875,000 shares, nearly eliminating all of their remaining Twitter holdings.

The Ark Next Generation Internet ETF (ticker ARKW), which had about 5% in Twitter at the end of last year, cut its stake to about 2% by this week and then almost entirely disposed of it on Thursday, according to data compiled by Bloomberg.

The Fintech Innovation ETF (ARKF), which has maintained Twitter at about 1% this year, also trimmed its stake Thursday to 0.7%. The flagship Innovation ETF (ARKK) had already eliminated its Twitter holdings by mid-February.

Wood had expressed concerns about the platform that were similar to Musk’s, saying her firm’s confidence in Twitter “was nicked a bit as we saw some of the censorship issues and controversies.” After his deal was announced, she thanked Musk in a tweet.

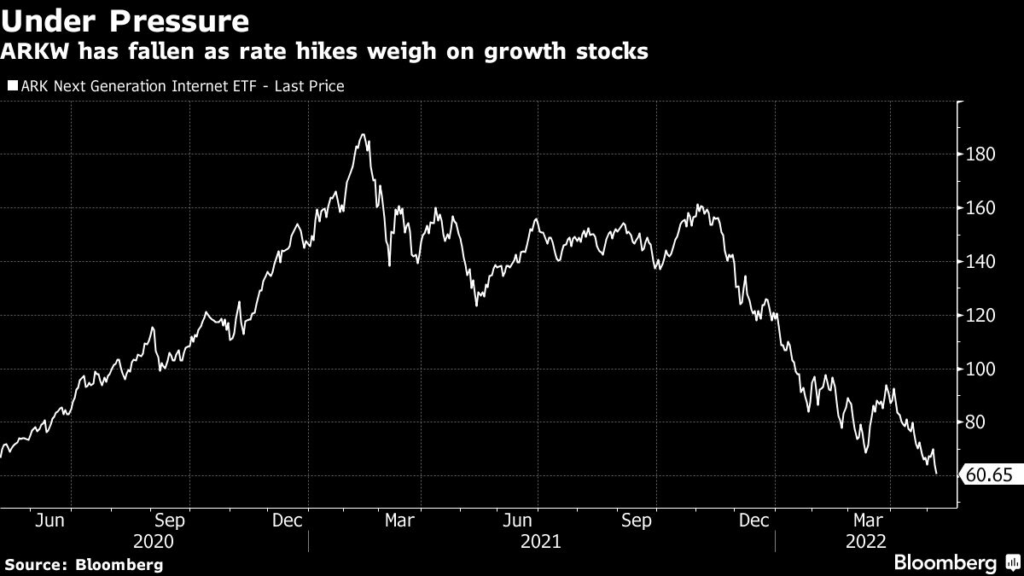

Ark’s exchange-traded funds have been under pressure from rising interest rates, which have weighed particularly hard on the valuations of growth stocks. Since the ETFs had been cutting their Twitter holdings this year, they also missed out on some of the gains in Twitter after Musk disclosed that he’d become Twitter’s biggest shareholder in April.

Meanwhile, Wood has stuck with Tesla, which is the biggest holding in ARKK and the second-biggest holding in ARKW. It’s also kept former lockdown-era favorites, like Zoom Video Communications Inc. and Teladoc Health Inc., which have tumbled 46% and 63%, respectively, this year.

ARKK experienced its worst month ever in April and its shares are down 51% in 2022, while ARKW has dropped 48% and ARKF has fallen 51%.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.