The JSE has not been spared from the global meltdown following a rout on Wall Street that saw a massive tech selloff on Thursday against the backdrop of rising interest rates and inflation concerns. The local bourse tumbled 2.45% on Friday and has now lost around 10% since the beginning of April.

The All Share Index closed at 67,978 points while the Top 40 lost 2.56% and closed for the weekend at 61,290 points.

“Global markets have been battered this year by a series of crises including surging inflation, rising interest rates, China’s economic slowdown and the war in Ukraine,” reports AFP.

The tech-heavy Nasdaq lost 5% on Thursday and the selloff filtered through to the Asian markets with Hong Kong taking more than 3% and losses began to affect tech firms.

JSE heavyweights, Naspers and Prosus, which have exposure to the Asian market through a shareholding in Tencent, lost 0.07% and 0.22% respectively.

Tencent lost 4.69% on Friday on the stock exchange in Hong Kong.

Telecoms giant MTN saw its share price drop over 3% on Friday after it said profits from its Rwandan operations had fallen by more than a third. Rwanda accounts for just over 2% of the group’s total subscriber base with profits falling 39.6% for the quarter to the end of March.

Despite this end of week headache for MTN, the group’s share price is up some 4% for the week following the release of earnings reports for some of its African operations this week, including Nigeria – the group’s most lucrative market.

Telecoms peers Vodacom (-1.39%), Telkom (-2.19%), and Blue Label Telecoms (-4.71%) all lost.

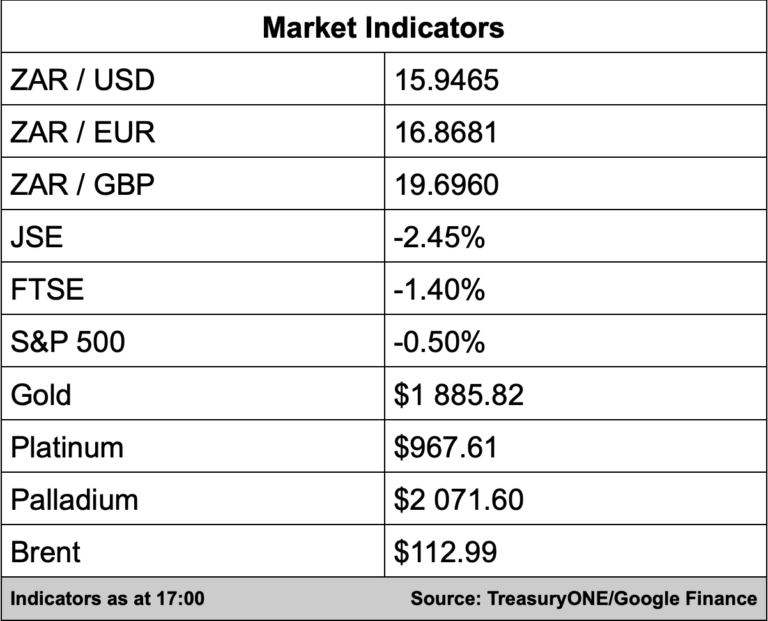

In the currency markets, after losing close to 4% yesterday, the Rand fought back somewhat today to close the week trading around the R15.97/$ level.

“The sideways movement of the Rand and most of the EM’s also coincided with the US Dollar taking a little breather after breaking below 1.05 against the Euro earlier,” comments TreasuryONE.

Commodities were a mixed bag today with palladium the largest loser after it gave up around 5% and is currently trading at $2,068. Platinum is trading at $967 and gold at $1,883 per ounce. Brent crude is edging higher and presently trading at $112.11 per barrel.