(Bloomberg) — Bitcoin is falling toward levels last seen in July 2021, part of a wider retreat in cryptocurrencies amid a global flight from riskier investments.

The world’s largest digital token dropped as much as 2.7% on Monday and was trading at $33,568 as of 8:44 a.m. in London. The second biggest, Ether, shed as much 4.6%. Most of the major virtual coins were under pressure over the weekend and the downbeat mood carried over into Monday. Equities in and Europe also dropped, with Hong Kong’s benchmark index slumping 3.8%.

Tightening monetary policy to combat runaway inflation and ebbing liquidity are turning investors away from speculative assets across global markets. Adding to the caution around digital assets, the value of TerraUSD or UST, an algorithmic stablecoin that aims to maintain a one-to-one peg to the dollar, slid below $1 over the weekend before recovering.

“In light of fears of rising inflation, most investors have taken a risk-off approach — selling stocks and cryptos alike in order to cut down risk,” said Darshan Bathija, chief executive of Singapore-based crypto exchange Vauld.

Bitcoin Breaches Key Level; Do Kwon-Backed Stablecoin Slips

Rising interest rates are giving individual and institutional investors pause for thought about the crypto market outlook, according to Edul Patel, chief executive officer of Mudrex, an algorithm-based crypto investment platform.

“The downward trend is likely to continue for the next few days,” he said, adding Bitcoin could test the $30,000 level.

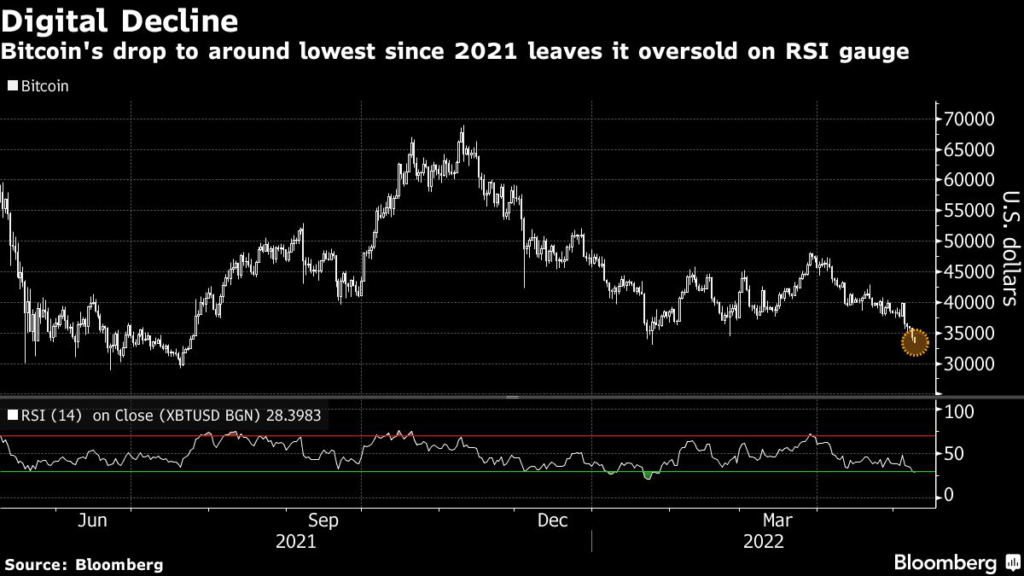

The token would hit its lowest level since July 2021 if it weakens below $32,970. Bitcoin’s 27% decline in 2022 compares with a retreat of more than 10% in global bonds and shares, and a 2.5% advance in gold.

Bitcoin’s recent decline puts it at risk of firmly dropping out of the range where it’s been trading in 2022, completely reversing the bull run that drove the token to a record of almost $69,000 in November. With its 40-day correlation with the S&P 500 stock benchmark at a record 0.82, according to data compiled by Bloomberg, any further hit to equities sentiment would risk dragging Bitcoin down as well.

A correlation of 1 means two assets move in perfect lockstep; a reading of -1 means they move in opposite directions.

(Updates with comment from exchange CEO in fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.