The JSE continued its losing streak on Monday, giving up 1.78%, which sees the bourse close in the red for the fifth consecutive trading day. The local bourse tracked global markets as inflation, monetary tightening, Covid-19 lockdowns in China, and the war in Ukraine continue to weigh heavily on markets.

The All Share Index is at 66,769 points with the Top 40 at 60,161 points after losing 1.84%

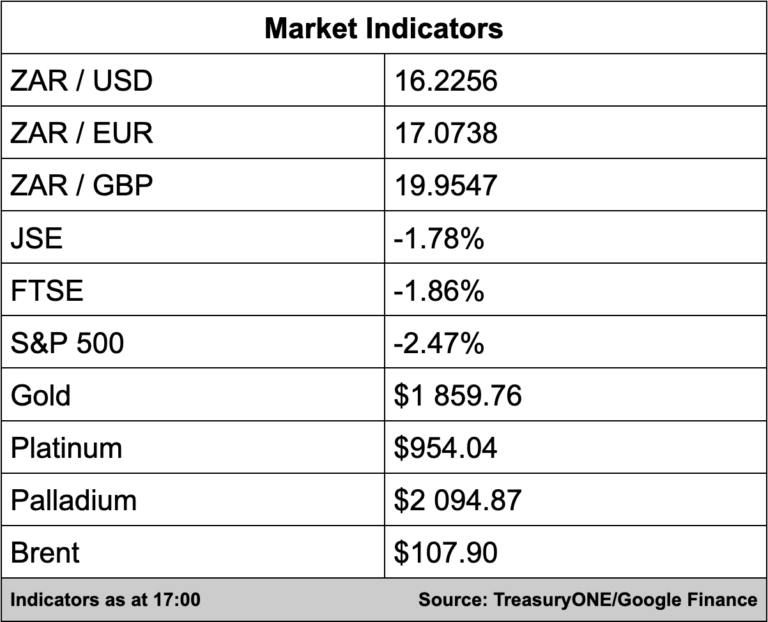

In the currency markets, riskier assets were on the back foot today as emerging market stock exchanges fell due to the pressure placed on them by the hawkish US Fed.

“The Rand did trade at its highest point for the year, touching the R16.27/$ level briefly and is currently down 1.4% for the day. The sustained strength we see in the Dollar is still the key driver with prolonged tensions in eastern Europe and a slowdown in the Chinese economy both adding fuel to the fire,” comments TreasuryONE.

On the commodity front, the slowdown in the Chinese economy seeped over into the commodity markets. Gold is down 1.2% for the day and is currently trading at $1,860, platinum is down 1.4%, while palladium is the only shining star in the metal sector, currently trading at 2% up for the day.

Brent crude is trading 3.5% lower at $107 a barrel.

Back on the JSE, gold counters Harmony and AngloGold Ashanti bled 4.45% and 6.06% respectively after the former reported four of its employees had died at its Kusasalethu mine while the latter reported production for the first quarter was flat.

Harmony said six of its miners were working on cleaning an underground mud dam and repairing a mud pipe on Saturday when the mud wall fell onto the workers. Two miners managed to escape while the others lost their lives.

AngloGold said in a trading update while production was flat for the quarter to the end of March, it still expected a double-digit increase for its full year. The group said adjusted core profit fell by 2% to $438m (R7bn) in the three months to end-March year on year, while inflationary pressure is expected to persist for the rest of the year, said the miner.