South Africa’s unemployment rate is at a record high of 35.3% of adults unemployed in the country, according to the latest available data from Stats SA, but could this be an inaccurate depiction of SA’s unemployment rate?

Several economists have raised the alarm and called the accuracy of the unemployment rate into question while the chairperson of the Statistics Council, the advisory board to Statistics SA, has called for an urgent meeting after indicating the poor response rate on the employment survey has distorted the figures.

News24 reports, that of the 30,000 households that were sampled only 44.6% responded, amounting to a record low response rate. The low response rate led to a delay in publishing the Q4 2021 statistics and some of the results, like those from the metropolitan areas, were excluded from the publication.

Two possible indications for the outcome of the figures include a switch to telephonic surveys following the outbreak of Covid-19 in the country while there is also a public breakdown in trust between citizens and government with many indicating they did not want to speak with Stats SA staff.

Having accurate unemployment figures is vital to a country’s policy planning and economic outlook. The next publication of unemployment figures, which will account for Q1 of 2022 is due out at the end of the month. The survey was also mostly conducted by telephone.

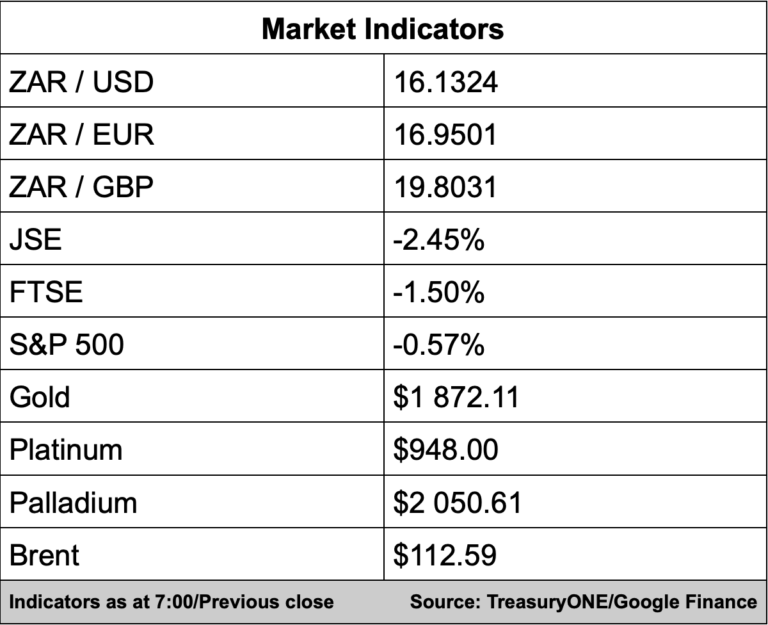

In the currency markets, the Rand starts the week on the back foot and is currently trading 0.75% lower this morning at R16.13/$.

“A break above the R16.20/$ level could see further weakness in the short term with a possible move to R16.50/$ possible. Surging US bond yields and stricter Covid lockdowns in China have raised global growth concerns and strengthened the Dollar,” comments forex trading house TreasuryONE.

On the commodity front, after gold closed last week slightly firmer it’s down 0.5% this morning at $1,872, platinum is down 1.6% at $947, and palladium is flat at $2,048 with the strength of the Dollar impacting the prices.

Brent crude is currently trading at $112.50 a barrel with supply constraints eased by the falling demand from China.

Here’s a round-up of what we’re reading:

SA Business

Banks vow to make Bounce Back Scheme a success after Mboweni’s rebuke – here’s who opted in – Fin24

Distrust in South African State Puts Charity at Relief Forefront – Bloomberg

Standard Bank says all services have been restored after earlier outage – Business Insider

Global Business

EU edges towards oil sanctions on Russia, no deal yet – Reuters

US unveils new sanctions on Russia, targeting services, media and defense industry – The Guardian

Beijing District Shuts Gyms, Cinemas to Halt Covid Spread – Bloomberg

Tech

Joe Rogan lost the top spot on Spotify to a Batman podcast – Mashable

The EU could start enforcing rules to regulate Big Tech in spring 2023 – The Verge

Bitcoin value drops by 50% since November peak – BBC

Markets

JSE faces continued Asian market pressure on Monday – Business Day

Asian stocks tumble on global anxieties over inflation – AFP

Dow Futures Trade Lower after Volatile Week – Investing.com